The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Foreign trade zones (FTZ) are areas located within U.S. boundaries, but outside of its customs territory. Foreign goods can be imported duty-free into an FTZ and then either re-exported without duties or formally imported into the U.S. market accompanied by payment of U.S. import duty. The original intent of FTZs was to encourage exports and related activities. Until recently, FTZ growth was minimal because most of the export-enhancing features merely duplicated other tariff-reducing vehicles on re-exported goods.

The use of FTZs has grown significantly over the last decade as U.S. firms, especially auto assembly plants, have started using FTZs to reduce their tariff rate by importing intermediate goods into FTZs duty-free and incorporating them as components of finished goods destined for the U.S. market. FTZ growth may be slowed, however, by proposed regulations making FTZ status more difficult to obtain. This Chicago Fed Letter describes the many uses of FTZs and assesses the economic issues surrounding this latest development in the institution.

The basics

Foreign trade zones consist of two types of zones: general-purpose zones and subzones. In practice, general-purpose zones and subzones are used for different activities. The general-purpose zone is created before any of its subzones and is normally located at a port of entry such as a shipping port, border crossing, or airport. A general-purpose zone usually consists of a distribution facility or industrial park.

Space is leased in a manner similar to any other industrial park or shared warehousing facility. Activities in general purpose zones typically consist of inspecting, storing, repackaging, and distributing merchandise, and destroying defective merchandise, prior to re-export. For example, the Miami FTZ acts as a distribution center for European and Asian companies exporting into South America and the Caribbean. Manufacturing activities take place in only a few general-purpose zones.

Subzones are areas that are physically separate from the general-purpose zone but are legally and administratively attached. Subzones allow new or existing facilities that are located outside of the general-purpose zone to take advantage of FTZ benefits. For example, subzones allow space-intensive facilities, such as assembly plants, to become part of an FTZ without using expensive port space. A subzone is used by a single company and is typically created around a manufacturing plant.

Benefits

FTZs potentially provide firms with a wide array of benefits. Firms can repackage or assemble imported merchandise along with domestic components for re-export without having to pay a customs duty on the imported components. This benefit makes it competitive for exporters to operate within U.S. boundaries and was the original goal of the FTZs.1 However, many firms have found it to be more convenient and cost-effective to avoid duties on re-exported goods by alternative means such as bonded warehouses or duty drawback programs, which return tariffs on re-exported goods.

Another benefit of FTZs is that custom duties and taxes on goods for domestic consumption are not paid until the merchandise leaves a foreign trade zone and enters U.S. customs territory. In fact, while in a zone, merchandise is not subject to taxes of any kind. Furthermore, defective imports can be discarded before tariffs are paid, so that tariffs are not paid on unusable products. In practice, the deferral of both tariffs and domestic taxes until the imported merchandise leaves the trade zone is the major benefit enjoyed by current users of general-purpose zones. Most of these establishments are repackaging and distribution centers.

A third benefit of FTZs is that firms may keep merchandise in a zone indefinitely. This allows firms to weather periods of poor sales without paying import duties and to defer import quotas. If import quotas have been met for the year, the merchandise can be stored in the FTZ until the next year so that it will not be included in the current year’s quota.

In addition to the financial benefits provided by FTZs, there are two often-cited logistical advantages. First, for the foreign suppliers of manufacturers that practice just-in-time manufacturing, FTZs provide a local storage site for components, allowing for better timing of deliveries. Second, FTZs provide a form of guarantee for foreign producers’ ability to deliver goods in a timely fashion. The foreign company can store its goods in an FTZ tax free until the goods are sold. Meanwhile, the purchaser has greater assurance that the supplier can deliver the merchandise on schedule.

While these benefits can be substantial, they stimulated only tepid growth in FTZs from their inception in 1934 through the 1970s. However, FTZ use increased dramatically in the 1980s as new regulations made it more feasible for firms to use FTZs to circumvent inverted tariffs.

Inverted tariffs

Tariffs in the U.S. are usually implemented to protect U.S. producers from foreign competitors. Tariff schedules are normally structured so that foreign components and raw materials are taxed at a lower rate than foreign finished goods in order to encourage U.S. manufacture of high value-added goods. Sometimes, due to the broad and multi-lateral nature of trade negotiations, unintended consequences may occur. For example, the duty rate on a final good may be lower than the rate of its components. This is called an inverted tariff. Its effect is that U.S. firms that import components must pay a higher tax on those components than foreign firms who export finished products into the U.S., thereby reducing the tariff protection on the finished goods industry.

In the case of inverted tariffs, FTZs allow firms to avoid the tariff on intermediate goods and instead utilize the lower tariff on domestic finished goods. Firms can import foreign components into FTZs for use in domestic finished goods without paying tariffs. The tax rate and the value of the merchandise may change as a result of processing or manufacture in the zone. The firm can then choose to pay the duty and taxes at either the tax rate of the foreign component or at the finished good rate. In the case of inverted tariffs, foreign components can be imported and then manufactured into the final product, and the tariff can be subsequently paid on the imported components at the lower final product rate. This restores the tariff protection for domestic producers of final goods. For example, suppose that tariffs on imported automobile components range from 4% to 10%, while the tariff on completed automobiles is 2.5%. An auto manufacturer who imports the components can assemble a car in an FTZ and pay a 2.5% tariff on the imported components included in the car, rather than the 4% to 10% tariff.

Allowing manufacturers to avoid inverted tariffs has become the dominant financial benefit of FTZs. In 1987, the International Trade Commission conducted a survey of establishments operating in subzones. Of the 55 firms responding, just over two-thirds established FTZ status to avoid inverted tariffs. Additional firms, particularly in the sugar processing and petroleum refining industries, would have liked to have avoided inverted tariffs through the use of FTZs but were allowed to operate in the zones only under strict constraints placed on them by the FTZ Board. The FTZ Board, which approves all FTZ applications, imposed these constraints in response to objections by competitors and suppliers. Only 16 firms took advantage of intended FTZ benefits such as deferring or avoiding duties on goods destined for re-export. Six firms used privileged foreign status, which allows imports to be valued for customs purposes before being combined with domestic components.

The increased use of FTZs to avoid inverted tariffs during the early 1980s was due to two regulatory changes that increased the inverted tariff savings available to manufacturers in the zones. In 1980, the Treasury Department excluded domestic value-added from the dutiable value of finished goods entering the U.S. from FTZs. In 1982, the Customs Service further excluded overhead costs (such as transportation and insurance) from the dutiable value of goods leaving the FTZs. These changes enhanced the FTZ value of avoiding inverted tariff structures. Not only is the high tariff on intermediate components avoided, but the alternative tariff on final products is now paid on only its “foreign” content, and not on a larger base that would negate the savings from a lower tax rate.

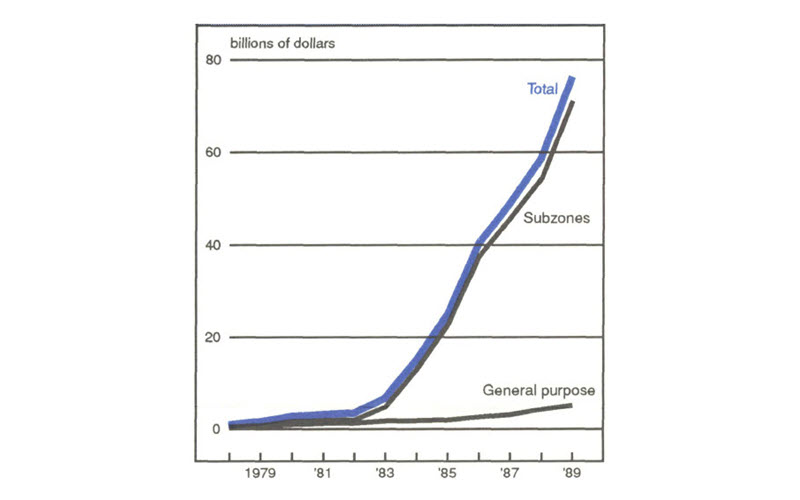

Growth in the amount of merchandise moving through the zones has been astonishing (see figure 1). In 1980, total merchandise received in FTZs was $2.6 billion. By 1985, this figure had grown to $24.8 billion, an increase of 57% per year. Over the next four years volume increased at an annual rate of 32%, reaching $76.3 billion in 1989. This rapid growth does not appear to be slackening. For example, Detroit’s zone increased its shipment from $9.7 billion in fiscal 1987 to more than $18 billion in 1989. Furthermore, activity in subzones, where manufacturing to avoid tariffs takes place, has come to dominate general purpose zones. In 1970, subzones accounted for 9% of all merchandise received in FTZs. In 1986, the share of merchandise entering FTZs received by subzones peaked at 94%, and is currently at 93%.

1. FTZ merchandise received

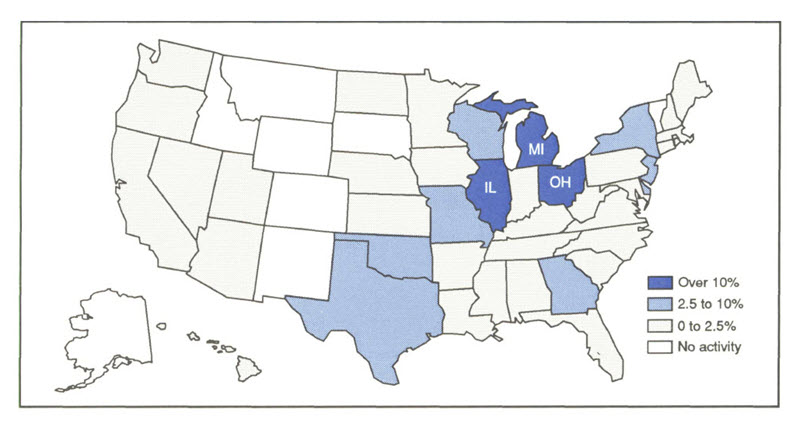

Most of this growth is in automobile manufacturing in subzones, which accounts for the strong Midwestern concentration of FTZ activity (see figure 2). In 1981 there was one automobile assembly plant located in a subzone, accounting for 28% of all goods received in FTZs. By 1986, there were 24 automobile assembly plants located in subzones, accounting for 85% of all goods received in FTZs. Furthermore, through February 1990, another 16 subzones for automobile assembly and 15 subzones for automobile components have been approved.

2. Share of shipments received by FTZs, 1989

The FTZ controversy

The use of FTZs to circumvent inverted tariffs was certainly not the original or primary intention of the FTZ legislation, and the continued use of FTZs as a tool to circumvent import tariffs on intermediate goods remains an area of public debate. In those circumstances where inverted tariffs work against the public interest, this use of FTZs serves to correct ill-conceived trade policies and the undesired results of tariff negotiations. For example, the tin plate in containers in which imported pineapple enters the United States carries no tariff. Prior to acquiring FTZ status, Hawaiian-based Dole Pineapple Co. paid a 3.9% ad valorem rate of duty on tin plate imports that are used to make cans to package pineapple, putting the firm at a competitive disadvantage with respect to canned pineapple importers. In order to give Dole equal treatment on the tin plate it uses to can its domestic pineapple, the FTZ Board approved Dole’s use of the trade zone to eliminate this disparity.

However, some national tariff policies are intended to protect domestic producers of intermediate goods regardless of the interests of final goods producers. In such situations, the use of FTZs to avoid inverted tariffs circumvents the intended tariff protection of industries and regions.

Although FTZs have provided significant benefits to industries such as automobiles, steel pipe, and typewriters, there are often complaints about FTZ use from other domestic industries. The use of FTZs to reduce tariffs on goods brought into the U.S. and to avoid other trade restraints (such as quotas) has quickly become apparent to competitors and suppliers of firms operating in the zones. Steel companies accuse ship builders and automobile manufacturers of circumventing trade agreements. Auto parts suppliers complain that auto manufacturers take advantage of FTZs to import their components. Similar complaints have been made about bicycles and television components.

For these reasons, the FTZ Board’s policy has been to act more judiciously in expanding the use of FTZs as a means of circumventing inverted tariffs. For example, concern about sugar processors avoiding the high tariffs on sugar has resulted in severe limitations being placed upon the activities of sugar processors within zones. Proposed regulations drafted in 1983 require proof of a public economic benefit for FTZ approval. However, in practice, verifying the extent of the public benefit is expensive and time consuming. The FTZ Board does not have the resources to do this. Consequently, in practice it is FTZ Board policy that if inverted tariffs occur because of a congressional policy, as with bicycle or television manufacturers, then FTZs cannot be used to avoid inverted tariffs. However, if the inverted tariffs were not part of a conscious policy but a byproduct of trade negotiations, as in the auto industry, then FTZs can be used to avoid inverted tariffs. When opposition to an FTZ application is extensive, the FTZ Board makes a decision by balancing the competing interests involved, in some cases placing severe restrictions on the use of the zone or discouraging the subzone application.

Conclusion

Early FTZ legislation was drafted without consideration of the use of FTZs to circumvent inverted tariffs and provides few guidelines for approving or disapproving proposed subzones. Because of the difficulty in measuring the public economic benefits of proposed subzones, it is not surprising that the FTZ Board developed and continues to use its own criteria rather than the proposed regulations. The proposed regulations have the advantage of clarifying approval criteria. However, if the proposed regulations were adopted, the FTZ Board would no longer approve FTZ status by taking into account competing interests. This may not be an improvement because, as mentioned above, due to their general nature, trade negotiations have unforeseen consequences. FTZs provide a means to selectively correct errors and reverse the unintended consequences of trade policy. Use of foreign trade zones as a vehicle for correcting trade policy errors was not the original intent of FTZ legislation, but it may yet provide a strong reason for their existence.

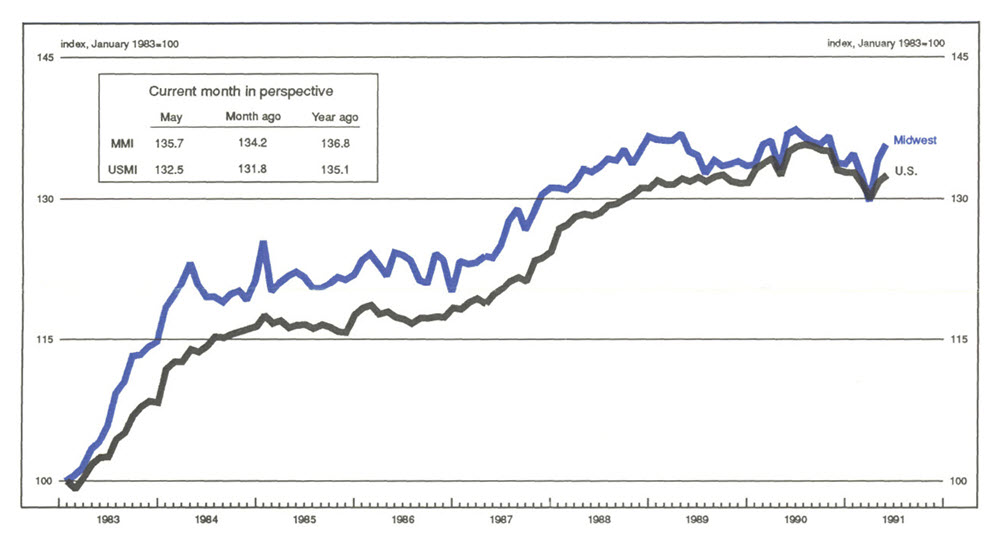

MMI-Midwest Manufacturing Index: Current expansion

Manufacturing activity in the nation continued to recover in May, with the Midwest once again outpacing the rest of the nation. The MMI registered a 1.2% gain in May, compared to a 0.4% gain in the USMI. Neither index has reached its previous peak. However, the MMI is back to its average level for the second half of last year, while the nation is still well below that mark.

The transportation sector continued to lead the recovery, but most sectors showed improvement in May. For the Midwest, the transportation sector not only has the largest gain, but that gain was double the national rate. Machinery, which tends to lag the economy, declined nationally, but posted a modest gain in the Midwest.

Notes

1 See, for example, The implications of foreign-trade zones for U.S. competitive conditions between U.S. and foreign firms, United States International Trade Commission, February 1988.