The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

In February of 1991, at the request of Mexico’s President Salinas, the United States, Mexico, and Canada agreed to begin negotiations for a free trade agreement. An agreement between the three countries is expected to benefit all three, although not equally, by allowing each trading partner more open access to the others’ markets. Formal negotiations for the North American Free Trade Agreement (NAFTA) began in June of l991 and an agreement was announced on August 12, 1992.

The potential benefits to the three nations of forming a regional trading bloc are enormous. The combined GDP of the three countries in 1990 was $6.2 trillion, $221.3 billion larger than the European Economic Community’s. All three countries would benefit from reduced costs, more competitive prices, and greater global trading power. Although the benefits at the regional level within the U.S. are difficult to determine at this time, the Seventh District, which covers most of Illinois, Indiana, Michigan, and Wisconsin, and all of Iowa, should benefit from NAFTA through increased exports to Mexico. As a region, the five states have increased their manufacturing exports to Mexico 90% over the 1987-1991 period; U.S. manufacturing exports have increased 130% over the same period. As Mexico develops, so will the demand for the types of goods produced in the Seventh District, namely machinery and transportation equipment.

This Chicago Fed Letter discusses the current trade relationship between the U.S. and Mexico, the potential benefits to the U.S. of future trade with Mexico, and two issues of special concern to the Seventh District states: U.S. jobs and worker retraining, and rules of origin.

Trade between the U.S. and Mexico

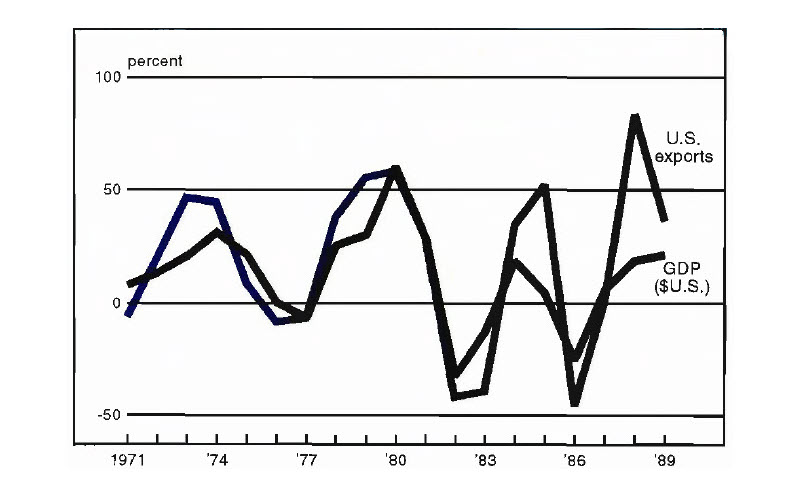

Because the U.S. is Mexico’s largest trading partner, Mexico’s economic ups and downs are felt by many U.S. industries. The five largest U.S. exporting industries to Mexico in 1991 were electrical machinery, nonelectrical machinery, transportation equipment, chemicals, and primary metals, totaling slightly less than two-thirds of manufacturing exports to Mexico that year. And the interdependence between the two countries is growing. In 1971, the U.S. provided 61% of Mexico’s imports and received 62% of its exports. By 1989, both numbers had grown to 70%. As seen in figure 1, U.S. exports to Mexico rise and fall with the Mexican economy, closely paralleling the economy in the 1970s, but with more pronounced impacts occurring in the latter half of the 1980s, suggesting that as the Mexican economy continues to grow, their need for U.S. goods also grows.

1. Mexican GDP and U.S. exports

Of particular significance to the U.S. and the Seventh District has been the growth of U.S. manufacturing exports to Mexico. Total U.S. manufacturing exports grew $161.9 billion, or 75%, to $377.9 billion over the 1987-1991 period, with exports to Mexico contributing $17.7 billion of the increase. Over this period, roughly half of all manufacturing exports to Mexico were in the capital goods-producing industries, i.e., machinery and transportation equipment.

These two categories of capital goods exports comprised 68% of the District’s manufacturing exports to Mexico in 1991. Mexican imports of machinery and transportation equipment1 have comprised anywhere from 30% to 55% of total commodities imports over the last 20 years. It would be safe to assume that this trend will likely continue, particularly in the short run, with or without NAFTA.

The primary benefit of free trade is the nearly complete elimination of tariffs between free trade partners. Therefore, NAFTA will, on net, benefit2 each nation. The U.S. will benefit through expanded trade with a large and growing market, increased competitiveness in world markets, and more investment opportunities for U.S. firms. Mexico will benefit from more open and secure access to its largest market, the U.S.; increased confidence on the part of foreign firms to invest in Mexico; a more stable economic environment; and the return of Mexican-owned capital. Canada’s benefits are mostly in the form of safeguards: maintaining its status in international trade; no loss of its current free trade preferences in the U.S. market; and equal access to Mexico’s market. However, free trade is not without problems. An agreement must deal with such issues as worker displacement and rules of origin, and the potential impact of free trade on the environment (i.e., air and water quality).

Labor issues

Among those voicing the strongest reservations about free trade with Mexico are U.S. factory workers, mainly because they fear that U.S. companies, seeking lower labor costs, will transfer factory type operations to Mexico where average wages are far lower than their U.S. counterparts (see figure 2). While studies have shown that wages are not necessarily the driving factor in location decisions, it must be recognized that they represent a large share of manufacturing costs. For example, wages of production workers alone, excluding white collar jobs, accounted for 20.5% of value added by U.S. manufacturers in 1990.

2. Hourly manufacturing compensation costs for production workers

| 1985 | 1986 | 1987 | 1988 | 1989 | 1990 | 1991 | |

|---|---|---|---|---|---|---|---|

| (U.S. dollar costs) | |||||||

| U.S. | $13.01 | $13.25 | $13.52 | $13.91 | $14.31 | $14.88 | $15.45 |

| Canada | $10.80 | $11.00 | $11.94 | $13.51 | $14.81 | $16.02 | $17.31 |

| Mexico | $1.60 | $1.10 | $1.06 | $1.32 | $1.59 | $1.80 | $2.17 |

| 1985-1988 | 1989 | 1990 | 1991 | |

|---|---|---|---|---|

| (Annual % change in U.S. dollar costs) | ||||

| U.S. | 2.3 | 2.9 | 4.0 | 3.8 |

| Canada | 7.7 | 9.6 | 8.2 | 8.1 |

| Mexico | –6.2 | 20.5 | 13.2 | 20.6 |

U.S. workers’ fears are not unfounded. U.S. companies with foreign affiliates in Mexico increased employment from 1977 to 1989 by 146,000 workers (or 39.4%) at the same time that employment in U.S. foreign affiliates worldwide declined by 8% (see figure 3). In particular, employment has grown rapidly in the electronics and transportation industries. The increase in transportation employment can be attributed to the fact that the Detroit Three each have auto or truck assembly operations in Mexico. Transportation and electronics industries accounted for 47% of employment of U.S. affiliates in Mexico in 1989.

3. Employment of U.S. nonbank foreign affiliates

| Year | Mexico | Canada | All countries | NonMexico | Asia/Pacific |

|---|---|---|---|---|---|

| (Thousands of workers) | |||||

| 1977 | 370.1 | 1,064.5 | 7,196.7 | 6,826.6 | 1,208.3 |

| 1982 | 470.3 | 913.8 | 6,640.2 | 6,169.9 | 1,159.7 |

| 1983 | 442.9 | 900.6 | 6,383.1 | 5,940.2 | 1,170.0 |

| 1984 | 430.0 | 897.9 | 6,417.5 | 5,987.5 | 1,182.0 |

| 1985 | 465.9 | 900.6 | 6,419.3 | 5,953.4 | 1,155.5 |

| 1986 | 441.9 | 905.1 | 6,250.2 | 5,808.3 | 1,210.8 |

| 1987 | 438.1 | 907.8 | 6,296.6 | 5,858.5 | 1,214.7 |

| 1988 | 460.1 | 965.5 | 6,403.5 | 5,943.4 | 1,283.9 |

| 1989 | 515.8 | 945.4 | 6,621.4 | 6,105.6 | 1,416.2 |

| Change 1977–89 | 145.7 | –119.1 | –575.3 | –721.0 | 207.9 |

| % change 1977-89 | 39.4 | –11.2 | –8.0 | –10.6 | 17.2 |

While these figures document the job flight to Mexico, it is important to take note of the myriad forces that are dislocating American workers, including the movement of production to other low-wage countries (Taiwan, Singapore, etc.) by both domestic and foreign companies. That is, U.S. jobs that might be lost due to U.S. affiliate job growth in Mexico might be moved to some other low-wage country if not Mexico. In fact, there are some business and labor representatives who believe that open borders with Mexico have, so far, helped preserve jobs in the U.S. that would otherwise have been lost overseas. Under the maquiladora program,3 parts and components can cross the border from the U.S. to Mexico duty free, where further assembly or fabrication takes place. On completion, the products are mostly re-exported to the U.S., and only the products’ value added in Mexico is subject to U.S. import tariffs. It is argued that, in some instances, access to low-wage labor in Mexico has allowed U.S. firms to maintain their share of such production, rather than losing entire operations to foreign competition located in other countries.

Also, Mexico’s growing economy, together with NAFTA, may have a more significant and positive affect on the U.S. economy. A recent Commerce Department report indicates that in 1990, exports to Mexico supported 538,000 U.S. jobs and that for every 10 jobs directly supported (for example, manufacturing jobs), 19 more jobs (such as supplier jobs) are indirectly supported.4

Worker retraining and other assistance

To compensate for individual job displacement that may come about as a result of NAFTA, U.S. labor unions have been lobbying hard to have worker displacement and job retraining programs and assistance included in any NAFTA negotiations. While the Bush Administration recognizes that job displacement is likely to occur and acknowledges the need for job retraining, no formal program was included in the August 12 agreement.5

In November of 1991, a House bill (HR 3878), titled the American Jobs Protection Act, was introduced which, if enacted, will supplement current federal programs that provide relief for workers whose jobs have been eliminated, such as the Worker Adjustment and Retraining Notification Act of 1988 (WARN) and the Trade Adjustment Assistance program. In addition to direct employee benefits such as severance pay and health care benefits, the American Jobs Protection Act introduced by the House would prevent employers from closing a plant or initiating a mass layoff if the employer has or will transfer work from the plant to another country without prior notice.

Rules of origin

The second major issue facing NAFTA concerns “rules of origin.” This is a trade term defining a minimum percentage of a country’s exported product that must be produced or substantially transformed within the border of the exporting country (also known as “local content”). The term “substantially transformed” means that products that use foreign inputs must go through considerable change (for example, a raw input being processed into a finished good) in order to be used in an export to a free trade partner. The reason for this rule is to limit a country involved in a free trade agreement from using cheaper, foreign parts in its exports while using its favorable tariff arrangements to avoid higher tariffs.

While all industries are concerned with this issue, the Detroit Three automakers, headquartered in the Seventh District, proposed that a strong rule of origin apply to the automotive industry. In addition to a lengthy phase-in period designed to protect companies with existing operations in Mexico, the Detroit Three suggested that the rules of origin be more stringent in an agreement with Mexico. In the U.S.-Canada free trade act, auto-related rules of origin are applied to each individual plant, with a current minimum of 50% local content required. For NAFTA, the Detroit Three automakers suggested each company, rather than each individual plant, be allowed to average the local content requirement across all plants, with GM suggesting a 60% requirement, and Ford and Chrysler proposing 70%.6 According to the August 12 agreement, the North American content percentage will be 62.5% for passenger vehicles and 60% for other vehicles and auto parts, based on net cost (total cost less royalties, sales promotions, and packing and shipping).

Conclusion

The potential for the U.S., Canada, and Mexico to become the world’s largest regional trading bloc will enhance all three countries’ ability to prosper and compete. Mexico will possibly benefit the most from its new standing as a North American trading partner. Its recent moves toward international market liberalization and economic reform have already begun to change the world’s view of Mexico in terms of trade and investment; NAFTA will solidify it. And the U.S. will benefit not only in terms of increased exports, but also from better and more open relations with Mexico in areas such as drug enforcement and illegal immigration.

Although the trade negotiators from Canada, the U.S., and Mexico have reached an agreement, NAFTA must still be ratified by the governments in the three countries. In the U.S., widespread support for NAFTA will depend on the extent to which the agreement protects the wide array of U.S. interests, particularly as they relate to rules of origin, worker retraining and dislocation programs, and the environment. If it is to receive broad-based support, the costs and benefits of NAFTA must accrue to the larger share of those affected, and not unfairly burden or protect the few.

Tracking Midwest manufacturing activity

Manufacturing output index (1987=100)

| June | Month ago | Year ago | |

|---|---|---|---|

| MMI | 110.0 | 111.4 | 109.1 |

| IP | 109.3 | 109.6 | 107.5 |

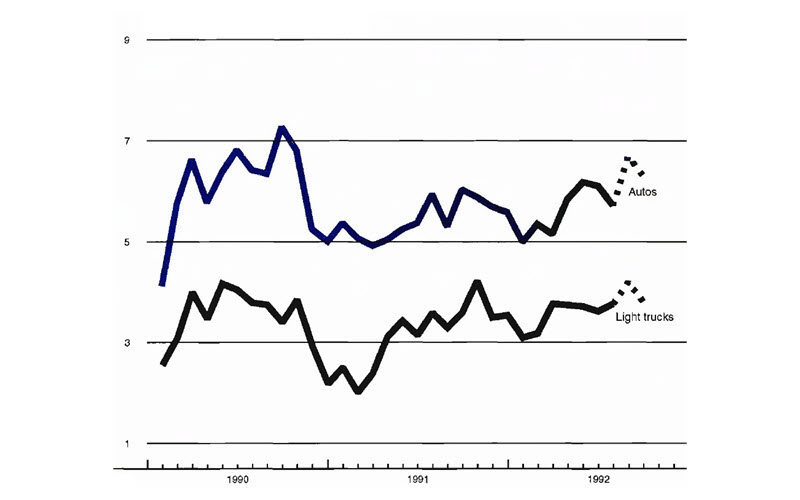

Motor vehicle production (millions, saar)

| July | Month ago | Year ago | |

|---|---|---|---|

| Autos | 5.7 | 6.1 | 6.0 |

| Light trucks | 3.8 | 3.6 | 3.6 |

Purchasing manager’s association: production index

| July | Month ago | Year ago | |

|---|---|---|---|

| MW | 62.7 | 62.1 | 58.1 |

| U.S. | 57.6 | 56.4 | 57.6 |

Motor vehicle production, millions (saar)

Note: Dotted lines are estimated production for August and September.

Sources: The Midwest Manufacturing Index (MMI) is a composite index of 17 industries based on month hours worked and kilowatt hours. IP represents the FRBB industrial production index for the U.S. manufacturing sector. Autos and light trucks are measured in annualized physical units, using seasonal adjustments developed by the Federal Reserve Board. The PMA survey for the U.S. is the production components of the NPMA survey and for the Midwest is a weighted average of the production components of the Chicago, Detroit, and Milwaukee PMA survey, with assistance from Bishop Associates and Comerica.

Motor vehicle production edged downward for the second consecutive month in July. Auto assemblies dropped to a seasonally adjusted annual rate of 5.7 million units (from 6.1 million units in June), while light truck production rose from 3.6 million units to 3.8 million units over the same interval.

Slowing auto production contributed to a slight decline in the MMI in June. However, current production plans call for increased motor vehicle production in August and September, which bodes well for overall manufacturing activity in the District in the third quarter. Purchasing managers’ surveys indicated further expansion in many District manufacturing businesses in recent months.

Notes

1 Because of the use of different data sources, the term “capital goods” as it relates to exports from the U.S. and imports by Mexico is not totally comparable.

2 Benefits to each of the three trading partners are credited to “North American free trade: issues and recommendations,” by Gary Clyde Hufbauer and Jeffrey J. Schott, Institute for International Trade, March 1992.

3 The maquiladora program, initiated in the 1960s, allows foreign-owned (mainly U.S.) plants to bring unfinished parts and components into Mexico tariff free for final processing and assembly prior to reexport to the U.S. Tariffs are levied only on the value added in Mexico.

4 Davis, Lester A., U.S. Jobs Supported by Merchandise Exports, U.S. Department of Commerce, April 1992, p. 2.

5 The U.S. government currently spends around $7,000 per worker in trade-related training. The AFL-CIO wants additional retraining and income maintenance provided to all workers who lose their jobs because of trade.

6 Position paper: Chrysler, Ford, and General Motors; submitted to U.S. trade representative, September 1991.