The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Although the fair lending laws and the Community Reinvestment Act (CRA) were enacted in the 1960s and 1970s, the 1990s have seen the most rigorous enforcement.1 There are a number of reasons for the recent increase in regulatory aggressiveness, including the availability of detailed lending data, public disclosure of said data and ratings, and a new commitment by the Justice Department to seriously pursue potential violations of lending guidelines. In addition, the Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac), two large purchasers of mortgages in the secondary market, have been encouraged to increase their purchase of low-income loans. Thus, the regulatory environment in the 1990s is typically thought to be more effective at channeling mortgage credit toward targeted markets, including low-income individuals, or areas, and minority groups or neighborhoods.

In a recent study, we discussed the evolution of fair lending regulations, reviewed the economic literature that serves as a basis for this regulation, and analyzed recent mortgage lending trends by depository institutions and their affiliates in response to recent enforcement of the regulation.2 In this Chicago Fed Letter, we summarize the findings from that study and expand upon them by looking at more detailed lending patterns for selected metropolitan statistical areas (MSAs) in the Seventh Federal Reserve District.

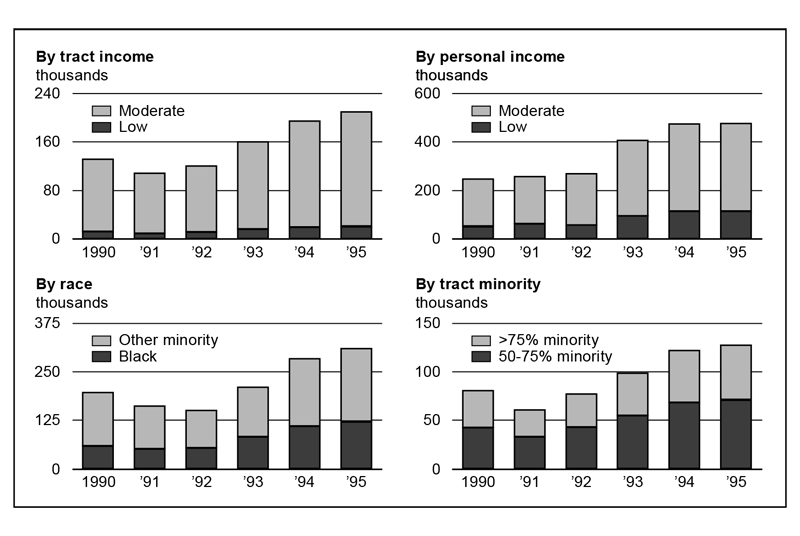

There has been much written recently in the popular press concerning surges in mortgage lending to targeted groups.3 This is typically attributed to stricter enforcement of the CRA and fair lending laws and is measured as increased lending to low-income individuals, low-income neighborhoods, and/or minority groups. For example, data presented in figure 1 suggest that the annual number of mortgage originations to these targeted groups increased significantly between 1990 and 1995.4 Originations to both low- and moderate-income neighborhoods or individuals approximately doubled between 1991 and 1995 (the most recent year for which we had data). However, there is significant disagreement in the industry about the effectiveness of the CRA and fair lending regulations and whether recent trends can actually be attributed to regulation.

1. Mortgage originations by depository institutions, 1-4 family

A full assessment of the success of the CRA and the fair lending programs would require a comprehensive cost–benefit analysis. Data limitations preclude this. We can, however, evaluate lending patterns and check for trends that appear consistent with the goals of the regulations. To do this, we compared aggregate lending trends before and after the recent changes in regulatory enforcement, changes in homeownership rates across minority groups over time, and the degree of lending to targeted versus nontargeted groups.

To analyze the effect on the aggregate level of mortgage activity, we estimated the relationship between the quarterly growth rate of the dollar value of mortgage originations and variables thought to explain this trend (e.g., gross domestic product growth, changes in mortgage rates, the growth rate of the Consumer Price Index, and variables to capture intrayear seasonal effects) from 1970 to 1995. We found no evidence to support the contention that mortgage originations were stronger following the CRA and fair lending regulatory changes in the 1990s.

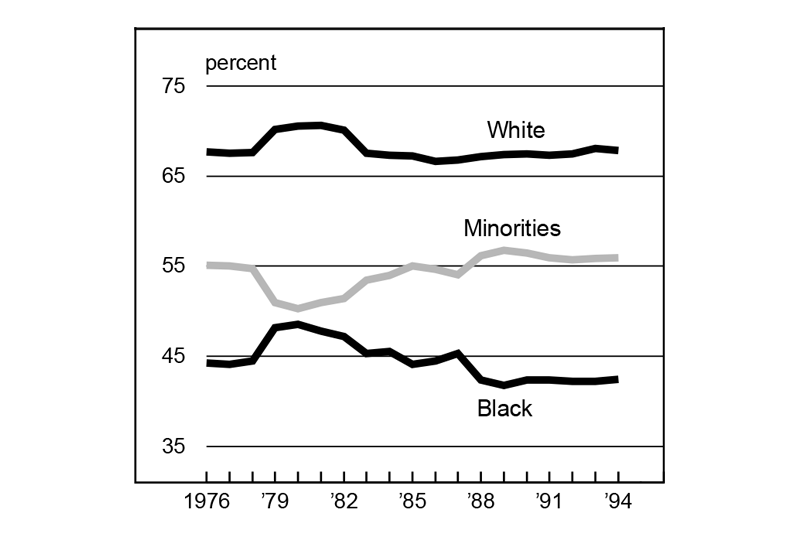

To assess the extent to which the supply of mortgage credit to minority borrowers increased in the 1990s, we examined homeownership rates over time. The potential relaxation of credit constraints induced by the new regulatory environment should have caused minority mortgage originations and the minority home ownership rate to increase. Figure 2 displays homeownership rates from 1976 to 1994. While there are slight fluctuations, there are no large changes. The homeownership rates for minority groups for the 1990s are similar to (or lower than) those observed in the mid- to late-1980s. Although Black borrowers have experienced the largest growth in mortgage originations during the 1990s, this apparently has had little effect on home ownership rates.

2. Home ownership rates

Although we found no significant evidence of a shift in the aggregate lending trend or in homeownership rates, the new regulatory environment could still have significantly affected lending behavior toward the targeted groups. If the targeted groups constitute a relatively small share of total mortgage activity, lending increases may have a minor influence on aggregate activity. There may also have been a redistribution of lending activity toward these groups that wo not be observable in the aggregate data. Yet, this shift would be consistent with the intent of the regulation.

To check for such changes, we analyzed growth rates in mortgage originations by neighborhood income. During the 1980s we found growth rates in low- and moderate-income neighborhoods were typically lower than in high-income areas. Although at times during the decade the growth in originations to low-income areas was quite high (even exceeding that in the 1990s), it consistently lagged the growth in more affluent neighborhoods.

After 1991, mortgage origination growth was relatively high in low- and moderate-income neighborhoods. This is consistent with the contention that financial institutions responded to the more vigorous enforcement of the CRA and fair lending regulations. We found similar patterns in mortgage application data. This is important because, in addition to being criticized for not extending credit in lower-income areas, banks were accused of discouraging (or not encouraging) applications from individuals in these neighborhoods. However, the evidence is also consistent with a strong economy and low interest rates having a more than proportional impact on lending to the targeted groups. At issue, then, is whether the regulatory changes caused the increased lending.

In addition to evaluating trends by income groups, we analyzed recent mortgage activity based on the race of the applicant. Although neither the CRA nor the fair lending laws explicitly require lenders to change underwriting criteria and actively pursue minority mortgage business, bankers may believe such efforts help avoid charges of discrimination and would be viewed favorably during regulatory examinations. We found relatively high growth of minority applications and originations after 1991, particularly among borrowers.

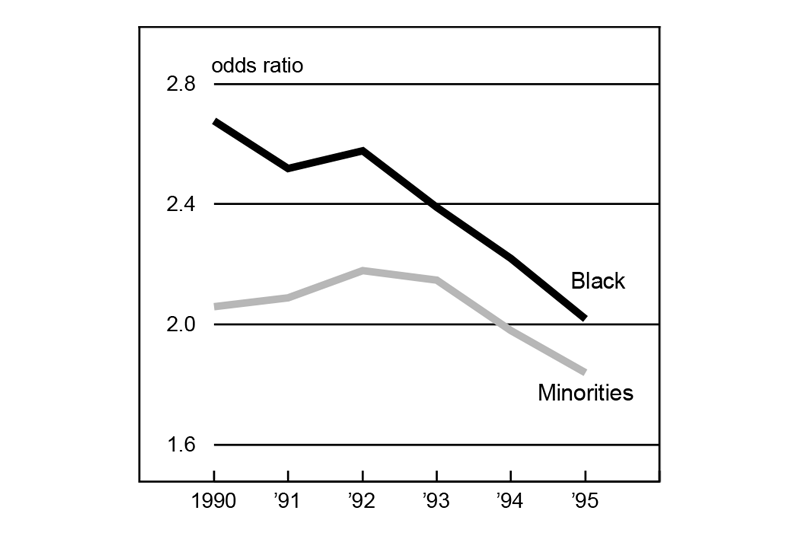

We also evaluated denial rates for ethnic groups. A common question raised in the literature and popular press is why minorities typically have higher denial rates than other applicants. Is it driven by economic differences or lender discrimination? Has this difference changed over time, particularly in the new regulatory environment? Based on the loan decision, after accounting for income and loan value, we derived the odds of a minority applicant being denied a loan relative to those of a nonminority applicant.5 An “odds ratio” with a value greater than one corresponds to a higher denial rate for minorities. The odds ratios for the 1990s, presented in figure 3, suggest that the odds of a minority applicant being denied a mortgage are about twice those of a nonminority applicant. The declining trend in the ratio suggests a change in the relative treatment of minority applicants from 1990 to 1995, i.e., lenders became more accommodative to minority applicants. These results are consistent with more stringent regulations producing a change in lender behavior. We should be careful, however, about attributing the change entirely to such adjustments in lender behavior. There may be additional factors which need to be considered.

3. Mortgage denial odds ratio

Given these findings, an obvious question is whether or not the new regulatory environment has been effective at channeling credit to underserved areas. Based on growth rates to targeted groups, one could argue that the findings appear to be consistent with a deliberate effort by banks to alter lending behavior. The absolute numbers, however, are less impressive. For example, looking at the year for which loan growth to low- and moderate-income neighborhoods was greatest (1993), even if we ignore economic forces and attribute the entire growth in depository institution mortgage activity for the year to the new regulations, it translates to just over 100 loans and approximately $8 million per MSA. Similarly, looking at homeownership rates, during the 1990s approximately 113,000 new loans would have been required to move the Black ownership rate a single percentage point. In 1993 mortgage originations among Black borrowers increased by approximately 23,000. Again, when viewed in absolute terms, the changes are less impressive.

One criticism of our earlier analysis was that the averages we presented may have obscured significant lending changes in individual markets. For example, in response to the statement that loan growth during a particularly large growth year represented, on average, 100 loans and $8 million per MSA, it was argued that this level of activity would be a welcome addition in certain smaller markets.6 To provide more detailed information, we further analyzed the mortgage origination data for selected MSAs in the Seventh Federal Reserve District (see figure 4). It suggests that for the MSAs selected (which are large relative to the national average), growth rates varied significantly across markets and, in certain markets, exceeded the national average of 31%. Whether this change should be considered significant is difficult to say. In Chicago, for example, the 1,600 “new” loans must be put in perspective. Those loans were made to a total market of over 6 million people with a low- to moderate-income market of nearly 2 million people and 600,000 households. Smaller markets showed significantly smaller absolute gains. It should be emphasized, however, that this analysis attributes the entire growth in mortgage activity to regulatory-induced changes in lender behavior and ignores any influence from the business cycle.

4. Changes in mortgage lending: Selected Seventh District MSAs (1992-93)

| To low- and moderate-income neighborhoods | To low- and moderate-income individuals | |||

| MSA | Number | Million dollars | Number | Million dollars |

| Chicago, IL | 1,602 (38.7%) | 162.4 (46.7%) | 3,370 (31.4%) | 268.4 (38.2%) |

| Indianapolis, IN | 704 (45.4%) | 36.0 (44.8%) | 2,367 (69.1%) | 155.1 (89.0%) |

| Detroit, MI | 611 (27.8%) | 26.2 (27.0%) | 2,833 (32.9%) | 145.3 (34.5%) |

| Milwaukee, WI | 392 (29.1%) | 19.5 (32.1%) | 1,165 (41.1%) | 71.7 (51.9%) |

| Grand Rapids, MI | 299 (57.6%) | 9.0 (37.7%) | 1,759 (109.1%) | 68.7 (100.1%) |

| Des Moines, IA | 155 (82.9%) | 6.6 (99.2%) | 393 (42.7%) | 18.8 (48.2%) |

| Springfield, IL | 103 (43.6%) | 2.0 (26.7%) | 620 (97.6%) | 27.2 (107.7%) |

| District average per MSA | 138 (33.2%) | 9.1 (38.3%) | 504 (44.2%) | 30.0 (52.0%) |

Conclusion

Overall, our results are rather mixed. We found some evidence of changes in lending patterns that were consistent with changes in bank lending behavior encouraged by the new regulatory environment. However, when viewed in absolute terms of number or dollar value of loans instead of growth rates, the changes appear less impressive. It should be emphasized that we have also said nothing about the cost of implementing the regulations relative to the benefits. Ideally, we would quantify both the benefits and costs of regulatory changes. Data limitations do not allow for such a detailed analysis. Future analysis should monitor trends in targeted markets and attempt to distinguish between market-driven and regulatory-induced mortgage activity.

Tracking Midwest manufacturing activity

Manufacturing output indexes (1992=100)

| February | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 125.3 | 124.0 | 119.4 |

| IP | 119.8 | 118.9 | 114.8 |

Motor vehicle production (millions, seasonally adj. annual rate)

| February | Month ago | Year ago | |

|---|---|---|---|

| Cars | 6.1 | 6.0 | 6.1 |

| Light trucks | 6.0 | 6.1 | 5.6 |

Purchasing managers' surveys: net % reporting production growth

| March | Month ago | Year ago | |

|---|---|---|---|

| MW | 64.3 | 30.1 | 50.5 |

| U.S. | 56.8 | 59.5 | 47.2 |

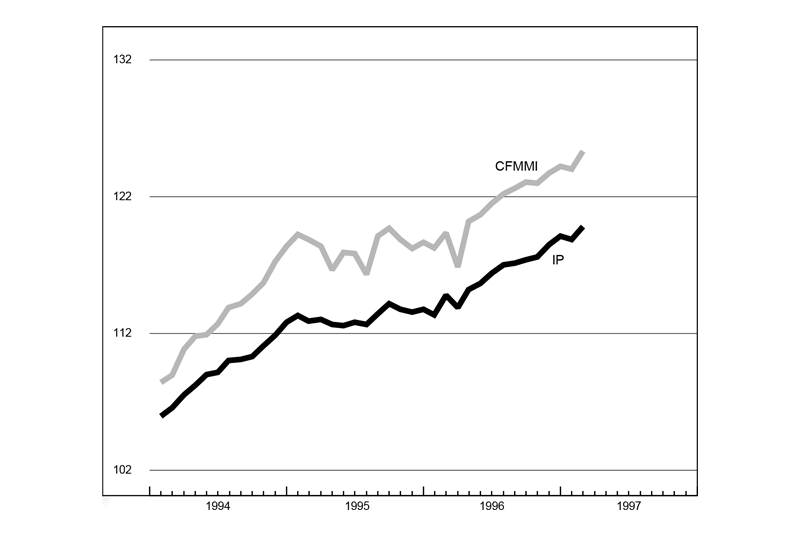

Manufacturing output indexes, 1992=100

The Chicago Midwest Manufacturing Index (CFMMI) rose 1.1% in February to a record level, rebounding from January’s 0.2% decline. The Federal Reserve Board’s Industrial Production Index for manufacturing increased by a slightly slower 0.8% for the same period.

For the first time since June 1996, all sectors of the CFMMI posted positive monthly growth. In addition, with the exception of the machinery sector, all other sectors in the region’s index outperformed the nation’s index. The growth in the region’s machinery sector has lagged that of the nation for the past six months. The industrial machinery and equipment component, in particular, has underperformed its national counterpart for a year.

Notes:

1 See Government Accounting Office, Community Reinvestment Act: Challenges Remain to Successfully Implement CRA (1995), and J. Macey and G. Miller, “The Community Reinvestment Act: Economic analysis,” Virginia Law Review (March 1993).

2 D. Evanoff and L. Segal, “CRA and fair lending regulations: Resulting trends in mortgage lending,” Economic Perspectives, Federal Reserve Bank of Chicago, Vol. 20, No. 6 (November/December 1996), pp. 19–46.

3 See, for example, L. Lindsey, “Home ownership opportunities in a deregulatory environment,” Marketwise, Federal Reserve Bank of Richmond (1996).

4 The data are for loans on one- to four-family owner-occupied residences in MSAs by depository institutions or their affiliates. Details concerning the data are in Evanoff and Segal (1996), particularly notes 33 and 40.

5 There could obviously be additional factors beyond income and loan amount that drive the underwriter’s decision.

6 See Dean Anason, “Was CRA really behind minority lending gains?” American Banker (January 7, 1997), p. 2.