The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

The strong growth of the immigrant population in recent years, coupled with their lower average income and educational levels, makes financial access an issue of broad concern. A national conference in April 2004 aims to encourage policy-oriented research and to identify public–private partnerships that can help bring the foreign born into U.S. financial markets.

Between 1990 and 2000, the foreign-born population in the United States grew by 57% to 31 million people. Immigrants represent about 11.1% of the total population and 12% of the total civilian labor force.1 Despite the increasing economic importance of immigrants, the foreign-born are less likely than their U.S. counterparts to use a wide variety of financial services.2 Their financial integration may be hampered by lower household incomes, language and cultural differences, and inexperience with domestic financial institutions.

Ensuring fair and equal access to transaction accounts, consumer-related credit, business financing, and other bank products or services is central to the mission of the Federal Reserve System. Laws such as the Community Reinvestment Act, the Equal Credit Opportunity Act, and the Fair Housing Act aim to encourage the provision of mainstream financial products and services to all sectors of society. The benefits of banking relationships are far-reaching. Transaction account ownership provides individuals with useful tools for effectively managing personal finances and contributes to asset building (e.g., savings accounts) and wealth creation (e.g., homeownership). From a community perspective, greater participation in housing and credit markets can help promote neighborhood stabilization and revitalization. While an extensive literature has examined immigrant labor market and homeownership assimilation, there has been little academic research on access to financial markets for immigrants.

In April 2004, a national conference, Financial Access for Immigrants: Learning from Diverse Perspectives, is being cosponsored by the Federal Reserve Bank of Chicago’s Center for the Study of Financial Access for Immigrants and the Brookings Institution’s Center on Urban and Metropolitan Policy.3 The conference will draw on the expertise of national researchers, community development professionals, financial institutions, and government agencies to discuss immigrant access to financial services. It is designed to encourage future policy-oriented research and to identify public–private partnerships to help bring immigrant communities into the financial mainstream.

In anticipation of the conference, this Chicago Fed Letter provides an overview of key topics related to immigrant participation in financial markets.

Characteristics of the immigrant population

The strong growth of the immigrant population in recent years, coupled with their lower average income and educational levels, makes financial access an issue of broad concern. Compared with the U.S.-born, about 20% fewer of the foreign-born population aged 25 or older had completed high school as of 2000. In addition, foreign-born households have lower incomes on average than U.S.-born households, even taking into account differences in household size and the number of earners. A greater proportion of the foreign-born have fewer years of residence in the U.S., a higher rate of noncitizenship, and potentially less experience with the U.S. financial system. The fraction of the foreign-born population residing in the U.S. for 20 years or more dropped from 50% in 1970 to 32% in 2000. In addition, 37% of the foreign-born were naturalized citizens in 2000, down from 64% in 1970. An immigrant’s banking decisions are likely to be substantially influenced by their age, educational attainment, income level, years of U.S. residence, or citizenship status.

The location decisions of many of the foreign-born population in the U.S. have made their integration into local economies a concern at the national level. Although the destinations for the majority of the foreign-born population included the largest metropolitan areas in six states (California, New York, Florida, Texas, New Jersey, and Illinois), there was also substantial population growth in the Southeast, Midwest, and Rocky Mountain regions.4 Areas such as Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Nebraska, and North Carolina that experienced little if any international migration for most of the twentieth century now host concentrated pockets of immigrants in small rural towns.5

Transaction account ownership

A growing body of research has investigated how changes in the financial services sector affect the banking relationships of lower-income and minority populations. Focusing on the determinants of “banked” versus “unbanked” status, researchers have found that the unbanked (i.e., those without a transactions account at a mainstream financial institution) tend to be more heavily represented among families with lower incomes, a smaller amount of net worth, or less education. Families are also more likely to be unbanked if they are unemployed, a member of a minority group, headed by a single female, or a resident of the South.6 Studies asking why the unbanked in the general population do not have checking accounts have found a variety of answers, including not having enough money, not trusting banks, the potentially high costs of maintaining a bank account, and the concurrent decision to patronize check cashers.7

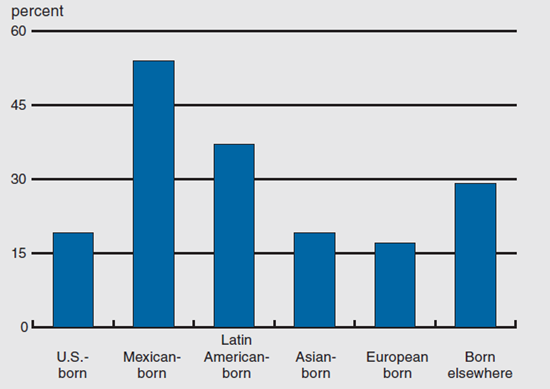

The paucity of studies on the foreign-born population has been due in part to a lack of suitable data. Using 1999 data from the U.S. Census Survey of Income and Program Participation, our analysis indicates that about 32% of foreign-born households in the U.S. do not hold transaction accounts, compared to roughly 18% of the U.S.-born. As shown in figure 1, the rate of unbanked status is highest for Mexican immigrants at 54%. By comparison, 17% of European immigrants and 19% of Asian immigrants are unbanked. The unbanked foreign-born share many of the same characteristics as the unbanked in the general population: lower incomes, lower net worth, fewer years of education, and single marital status.

1. Unbanked population

To the extent that immigrants are less likely than their U.S.-born counterparts to have a transaction account, it is of interest to determine whether barriers such as legal status, language proficiency, or source-country cultural differences influence an immigrant’s decision to use the financial mainstream. Many immigrants arrive in this country with a distrust of formal financial institutions.8 The absence of universally accepted documentation among banking institutions for foreign nationals has also resulted in inconsistent identification requirements and confusion within certain ethnic communities about what is required to open a bank account.9

Homeownership

An important milestone in the assimilation process for immigrants is homeownership.10 Homeownership represents a major household investment and wealth creation opportunity. Immigrants accounted for 20% of the overall increase in homeownership during the 1990s, up from a 10% share during the 1980s. Even so, wide disparities in homeownership rates persist between the U.S.-born and immigrants, further motivating the study of immigrant homeownership.

According to the U.S. Census, the homeownership rate for the U.S.-born approached 70% by 2000. By comparison, the homeownership rate for Latin American immigrants was roughly 41%, for European immigrants the rate was 63%, while for Asians the rate was 52%. A number of studies have suggested that a portion of the gap in homeownership rates can be explained by differences in socioeconomic, demographic, or location characteristics.11 For example, relatively lower educational levels, younger age, immigrant status, and residential location have contributed to the lower homeownership rate for Hispanics. Although these socioeconomic, demographic, and residential characteristics are important determinants of homeownership, they do not fully explain the variation in homeownership rates. Other factors, possibly behavioral or cultural in nature, are likely to influence the decision to own a home.

Business

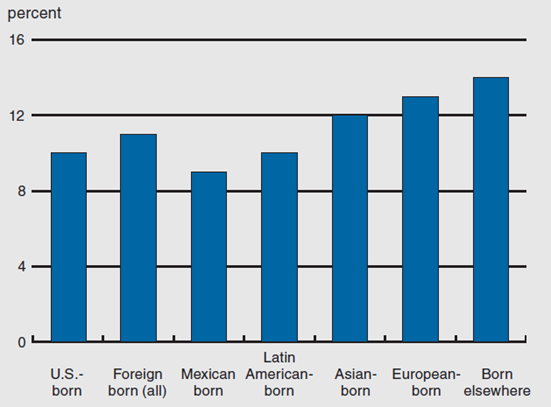

Access to credit and other financing for immigrant business owners is another measure of financial integration. Historically, self-employment has been an important avenue of economic progress for immigrants.12 As traditional opportunity structures change for low-skilled workers, entrepreneurship has been viewed as both a viable route up the socioeconomic ladder and as a mechanism for survival in an economically uncertain environment. Figure 2 displays the percentage of business ownership in the U.S. by country of origin. In every decennial census since 1880, immigrants were more likely to be self-employed than natives.13

2. Business ownership

Factors that influence the business participation rates of various ethnic groups include the prevalence of self-employment within the origin country, tenure in the United States, English proficiency, and education.14 Some studies have determined that ethnic enclaves promote the proliferation of immigrant enterprises, while others suggest that enclaves inhibit the development of economic opportunities.

Both national and case-study data demonstrate that access to start-up capital is a primary determinant of business ownership, and that capital, labor, and business know-how, more so than social capital, enable immigrants to establish small businesses in the U.S. Studies of particular immigrant groups have also found a positive relationship between start-up capital and the longevity of businesses and a positive relationship between business profitability and start-up capital.

Whether immigrants are credit constrained at start-up because of institutional barriers is uncertain. Many studies find evidence that start-up funding is lower for immigrants than for comparable U.S.-born entrepreneurs.15 Several of these studies have also pointed out that the informal financial sector can play an important role. What is unclear from the literature is whether small business owners have made a decision not to seek formal sector funding because they do not understand credit markets, do not want to incur debt, or have experienced real or perceived barriers to financial access.

International remittances

Based on data collected in 2002, primarily on the Latin American market, over $30 billion flowed from immigrants in the U.S. to family and friends in their home country.16 Many studies have focused on the behavioral motivators for remittances, which include altruism or the desire to care for those left behind, financing the emigration of additional family members, investment in the human capital of family back home, insuring family against regional shocks, or the purchase of physical assets in home communities.17

Other studies have focused on strategies for increasing the efficiency and welfare of remitters. An insufficient supply of consumer transfer services by banking institutions has contributed to the usage of nonbank money transfer services, and by most accounts, the costs to individual remitters have been relatively high. Particular characteristics have been found to significantly influence the decision to use banking institutions to remit funds. For example, Mexican migrants are less likely to use banks when remitting money to rural areas that lack a sound banking infrastructure.18 Migrants are also less likely to use banks when the remitters lack legal documents. Conversely, banks were more likely to be used by immigrants who were more highly educated or skilled, had family and friends residing in the U.S., or who were remitting a relatively large percentage of their earnings.

Emerging financial services

Emerging financial products and services refer to a range of offerings that are intended to supplement traditional transaction accounts or loan products. They are often complemented by financial education programs aimed at helping consumers make sound financial decisions. Typically, studies have used a “best practices” approach to highlight the more successful or innovative examples. These include specialized bank cards, low-cost transactions accounts aimed at facilitating money transfers abroad, secured credit cards, secured term loans for building a credit history, and loan products that rely on rent and utility payments to demonstrate creditworthiness for large asset purchases.

Growing numbers of financial institutions are adapting their application procedures to accept alternative forms of identification (consular identification card or individual taxpayer identification number) for opening accounts. Some large investment firms have also hired financial advisors with expertise in asset management for particular immigrant markets.

National conference

While the topics of immigrant bank account ownership, homeownership, business credit, and other uses of the financial mainstream have been studied to varying degrees, rarely has there been an opportunity to explore the common question of financial access across related subjects. The upcoming conference is intended to identify the basic questions that unify this area of study and give a clearer definition to the concept of financial access among the foreign-born. The sessions will treat broad themes such as how the financial practices of immigrants compare to those of the U.S.-born, as well as more focused topics such as the techniques used to inform immigrants about financial products.

From both an empirical and a practical perspective, much remains to be understood about the choices confronting the foreign-born population in their participation in the financial system. Building on the diverse perspectives presented at the upcoming conference, the Chicago Fed aims to encourage additional policy-oriented research that takes into account the experiences of financial institutions, service providers, and government agencies to address these unanswered questions.

Notes

1 See Census 2000 website and U.S. Department of Commerce, U.S. Census Bureau, 2001, “Profile of the foreign-born population in the United States: 2000,” Current Population Reports, Special Studies, December.

2 See Sherrie L.W. Rhine and William H. Greene, 2003, “Immigrant participation in the financial mainstream: Taking that first step,” unpublished manuscript; and Una Okonkwo Osili and Anna Paulson, 2003, “The financial assimilation of immigrants in the U.S.,” unpublished manuscript.

3 For more details, go to www.chicagofed.org/community_development/index.cfm.

4 See Audrey Singer, 2004, “The rise of new immigrant gateways: Historical flows and recent settlement trends,” Washington, DC: The Brookings Institution, forthcoming.

5 See Andrew Schoenholtz and Kristin Stanton, 2001, “Reaching the immigrant market: Creating Homeownership Opportunities for New Americans,” Georgetown University and Fannie Mae Foundation.

6 See Jeanne M. Hogarth and Kevin H. O’Donnell, 1997, “Being accountable: A descriptive study of unbanked households in the U.S.,” Proceedings of Association for Financial Counseling and Planning Education; U.S. Department of the Treasury, 1997, Mandatory EFT Demographic Study, Washington, DC, Financial Management Center, OMB No. 15100-00-68.

7 For example, see William H. Greene, Sherrie L. W. Rhine, and Maude Toussaint-Comeau, 2003, “Who uses check-cashing businesses and why: A look at racial/ethnic differences,” Federal Reserve Bank of Chicago, working paper, No. 2003-10.

8 See Schoenholtz and Stanton, 2001.

9 See Sheila C. Bair, 2002, “Remarks by the Honorable Sheila C. Bair, Assistant Secretary for Financial Institutions before the Multi-Lateral Investment/Inter-American Development Bank,” Second Regional Conference on Impact of Remittances as a Development Tool.

10 See R. D. Alba and J. R. Logan, 1992, “Assimilation and stratification in the homeownership patterns of racial and ethnic groups,” International Migration Review, Vol. 26, No. 4, Winter, pp. 1314–1341.

11 For example, see D. Myers, I. Megbolube, and S. W. Lee, 1998, “Cohort estimation of homeownership attainment among native-born and immigrant populations,” Journal of Housing Research, Vol. 9, pp. 237–269.

12 See Jimy Sanders and Victor Nee, 1996 “Immigrant self-employment: The family as social capital and the value of human capital,” American Sociological Review, Vol. 61, No. 2, April, pp. 231–249; and I. Light, P. Bhachu, and S. Karageorgies, 1993, “Immigrant networks and entrepreneurship,” in Immigration and Entrepreneurship, Ivan Light and Parminder Bhachu (eds.), New Brunswick, NJ.

13 See “Immigrant entrepreneurs” in Research Perspectives on Migration: A Joint Project of the International Migration Policy Program of the Carnegie Endowment for International Peace and the Urban Institute, January/ February 1997, Vol. 1, No. 2.

14 For example, see Borjas 1986; Fairlie and Meyer, 1996; and Andrew Yuengert,1995, “Testing hypotheses of immigrant self-employment,” Journal of Human Resources, Vol. 30, No. 1.

15 For example, see Timothy Bates, 1990, “Self employment trends among Mexican Americans,” U.S. Census, Economic Studies, No. 90-9.

16 See Manuel Oroczo, 2003, “Worker remittances: Issues and best practices,” Inter-American Dialogue, Washington, DC.

17 For example, see Robert Lucas and Oded Stark, 1985, “Motivations to remit: Evidence from Botswana,” Journal of Political Economy, Vol. 93, No. 5, pp. 901–918.

18 See Catalina Amuedo-Dorantes and Susan Pozo, 2002, “On the use of differing money transmission methods by Mexican immigrants,” mimeo.