In this Chicago Fed Letter, we illustrate how regulators have used rule-based and principle-based approaches to set the minimum level of reserves and capital for insurers. We use examples to show the trend toward more principle-based regulation.

Life insurance is valuable only if insurers are able to pay their commitments to policyholders. While it is not possible to guarantee insurers will pay in all events, solvency regulation is meant to foster a high likelihood that insurers will make good on their promises. People purchase life insurance products to receive payment for events that may not occur until many years in the future. As a result, life insurance firms often receive premiums for 20 or 30 years before making payments to policyholders. In the process, they accumulate a large amount of assets. Thus, a significant part of the life insurance business model involves purchasing assets with an eye toward judiciously matching them with future policyholder needs. To meet policyholders’ needs, insurers are required to keep a minimum amount of funds. For regulatory purposes, these funds are divided into reserves and capital. Under a rule-based approach, the methodologies and parameters set by the regulator to estimate reserves and capital are defined with little room for interpretation and are common to all insurance companies. Alternatively, under a principle-based approach, the regulator sets broad objectives while allowing insurers to rely on their own methodologies and parameters.

Standardized rules offer certainty in the regulation process and allow for an easy comparison of regulatory requirements across firms. Once rules are settled, the role of enforcement is straightforward and compliance verification can be mechanized (this is useful when there are a large number of small firms to be regulated). On the other hand, when insurance products and asset management strategies are complex and rapidly changing, it can be difficult for a regulator to revise its rules often enough to keep up with the changes. Because of their rigidity, rules are subject to regulatory arbitrage; this is where firms can reduce their reserves and/or capital requirements through changes in their operations that do not reduce their risk exposure. The evolution of regulation over time is explained in part as an effort to reduce regulatory arbitrage.1

The principle-based approach is characterized by more flexibility, since firms can use their own assumptions and models, but this may make it more difficult for outsiders (including regulators) to compare financial health across firms. With a principle-based approach, an insurer is able to customize the implementation—within limits set by the regulator—to better fit its operations and risk exposures. The limits are necessary since, if left entirely to their own devices, insurers would have a natural tendency to lower capital and reserves because that would allow them to report higher earnings. The learning curve is steeper for regulators to be effective in a principle-based environment (for example, getting up to speed on a complex internal model) and requires more active involvement of the regulator.

Both approaches have advantages and disadvantages, and as a practical matter most regulation frameworks contain both rule-based and principle-based aspects.

Reserves and capital

Reserves are a liability representing the value of expected future payments to policyholders. Reserves are by far the largest liability on life insurance firms’ balance sheets and the funds associated with this liability are invested in assets, primarily fixed-income assets such as corporate bonds. The idea is that interest and principal payments on the assets will be timed to allow the insurer to pay policyholder claims.

Because of the long time horizon over which life insurance payments are made, estimating reserves is very difficult, both for insurers and regulators. For example, payments on life insurance policies depend on future mortality rates that can vary depending on factors such as medical developments and epidemics. Calculating reserves also requires estimating current and future interest rates to discount (find the present value of) future insurance payments. When setting reserves, a key question is how to account for the uncertainty. One way is to set reserves equal to the best guess of the expected amount of assets necessary to cover payments to policyholders (call this a “best estimate” reserve). But regulators tend to be more conservative. When they set the minimum level of reserves for an insurer, their goal is to have reserves cover expected payments plus an additional margin of safety.

Capital provides another line of defense. It can be used to cover policyholder payments when reserves are insufficient, such as might result from unexpected decreases in the value of assets or unexpected increases in claims.

Evolution of life insurance regulation

Rule-based reserve requirements for life insurance firms were first introduced in the state of Massachusetts in the mid-1800s.2 The Massachusetts regulations specified a mortality table for calculating reserves. Due to the long time horizon over which life insurance payments are made, the reserve rule also prescribed the interest rate that should be used to calculate the present value of future payments. Prior to this, insurers in the United States were not required to hold reserves and were at risk of becoming insolvent if the reserves they held on a discretionary basis underestimated mortality or overestimated the interest rate they could earn.

The Massachusetts regulations, like most early insurance regulations, were a one-size-fits-all approach. Regulators could adjust their rules over time as conditions such as interest rates and mortality changed. However, they did not account for differences across firms. For a long time, the need to differentiate across firms was somewhat limited, as insurance products and assets were relatively simple and the introduction of new products was infrequent. As a result, rule-based requirements prevailed, almost exclusively, from the time they were first introduced up to the 1970s.

In the early 1980s, things began to change. Insurance firms began to offer more complex products. They also started purchasing more complex assets, including new products such as collateralized mortgage obligations, and using derivatives, such as swaps and options, to manage interest rate risk.

While the use of rule-based assumptions and methodology to estimate reserves and capital continues to be part of solvency regulation to this day, principle-based aspects have increasingly been incorporated as insurance products and assets have become more complex. Next, we use some examples to illustrate how insurance regulation has evolved.

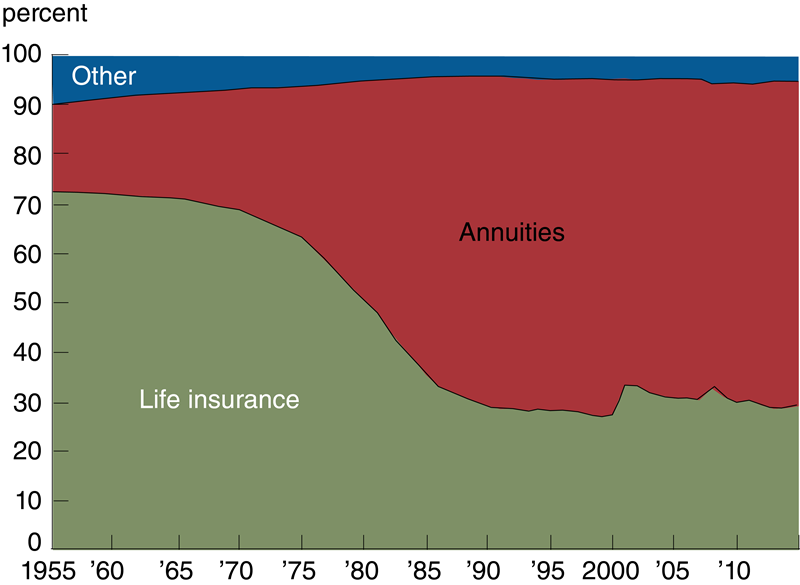

1. Life insurance product shares: 1955-2014

Sources: American Council of Life Insurers, 2015 Life Insurers Fact Book, and authors’ calculations.

Example 1: Annuities

During the early 1980s, interest rates on ten-year government securities were in the mid-teens. Savers had limited opportunities to take advantage of the high interest rates, however, as there was a ceiling set by regulation on the interest rate that could be earned on bank deposits. These caps were not completely lifted until 1986. This period of high rates and restrictions on bank savings rates increased the popularity of annuities.3 Annuities had been a core product for life insurers for a long time, but it was during the high interest rate period in the early 1980s that they became a much larger share of what life insurance companies did (see figure 1). In part, this growth came about because insurers offered generous interest rate guarantees on annuities. In some cases, in order to earn enough to fund these guarantees, insurers invested in assets that had high default risk or that had significant call or prepayment features.

As interest rates decreased from their peak in the early 1980s, there were growing concerns about whether insurers had assets that could support the generous guarantees in policies issued during that time frame. To address this issue, in 1986 New York State began requiring insurers to test the capacity of their assets to meet liability commitments under stress scenarios. In particular, this approach introduced principle-based elements into life insurance solvency regulation. For example, firms used internal models to estimate asset prepayment and policyholder behavior. By the early 1990s, regulations that required insurers to test whether their reserves were sufficient to cover policyholder payments under moderately adverse scenarios were adopted on a broad basis (these tests are known as asset adequacy analysis requirements).4

The early 1990s saw several large life insurance failures, in which the insolvent insurers had written a large amount of annuity business backed by risky assets, such as junk bonds and commercial real estate.5 Up to this point, state regulators had mandated that life insurers hold a fixed amount of capital no matter their size and financial condition.6 When insurers started to fail because of risky investments, regulators decided to make capital requirements a function of risk. In 1992, state regulators began the process of implementing risk-based capital (RBC) requirements.

At the time it was introduced, RBC was a rule-based approach that used asset and liability characteristics to estimate the minimum amount of capital an insurer was required to hold. RBC was calculated by applying factors to asset and reserve balances.7 Similar to the risk-weighting approach initially used in bank capital requirements, with RBC the required capital increased as firm risk increased. For example, more capital was required from insurers with large junk bond holdings or firms that sold products with generous guarantees.

As time progressed and insurers changed both their products and their risk-management practices (the two were often correlated), it became apparent that the simple rule-based RBC model was not sufficient to capture the full extent of insurers’ risk exposure. For example, the model did not adequately measure how well a company was hedged against interest rate risk (e.g., by using asset liability management techniques like duration matching or by using derivatives). In response, starting in 2000, regulators changed the estimation of the interest rate risk component of RBC from a rule-based factor approach to a principle-based approach. The new regulation specified that insurers should use the same (internal) modeling framework that they used for asset adequacy analysis to calculate the RBC held against interest rate risk.

Example 2: Variable annuities

Life insurance firms typically invest premiums they receive in conservative fixed-income instruments, such as corporate bonds. However, life insurers also sell products that allow policyholders to decide how funds will be invested. Variable annuities (VAs)—the predominant product in this category—are a pass-through investment product, in which the policyholder chooses the investment strategy and the insurer passes through the gains and losses (minus fees). Many policyholders like the ability to have an unlimited upside on their investments but do not like the potential for large losses. To cushion that risk, insurers often offer VA policyholders guarantees (riders in insurance jargon) that, for an additional fee, offer a minimum return even if the investments perform poorly. This shifts some of the risk from the policyholder to the insurer. The risk to insurers is amplified by the flexibility that many policyholders have to adjust their investments over time and withdraw the value of their account when they want. After the tech crash in 2001, there was a large increase in demand for stock-market-based investment vehicles that offered guaranteed returns, and sales of VAs took off.

Hedging the risk introduced by VA guarantees is complicated at best. Absent the flexibility afforded policyholders to change investments or withdraw funds, the VA guarantee is similar to an equity put option—it increases in value during stock market sell-offs. This risk can be hedged with sophisticated capital market techniques using derivatives, such as options and swaps. However, the flexibility for policyholders that is a feature of many VAs makes complete hedging—even with derivatives—difficult and costly.

The 2008 financial crisis led to a stock market sell-off accompanied by a significant decline in interest rates: a worst-case scenario for sellers of VA guarantees. Several life insurers found themselves in financial difficulty as a result of losses on VA policies with guarantees, raising questions about whether these companies were adequately hedged.

Over the period from 2005 through 2009, regulators began to require that insurers hold additional reserves and capital against the risk introduced by VA guarantees. Because of the complex nature of VA guarantees, these new regulatory standards involved principle-based reserve and capital regulations that rely on firms’ internal models.

Example 3: Principle-based reserves for life insurance

We have discussed regulatory changes that came about as annuities became popular. Variable annuities, in particular, were the first life insurance products subject to principle-based reserves. Generally speaking, these changes had less impact on traditional life insurance products.

However, over time insurers found ways around the rule-based reserve requirements on traditional life insurance products that they viewed as excessive (this regulatory arbitrage, sometimes referred to as “shadow insurance,” was accomplished by moving this business to jurisdictions with more favorable regulatory conditions).8 Rigid rules did not give room for regulators to adjust their policies to address this strategic behavior, causing many (but not all) states to favor principle-based reserve (PBR) requirements for life insurance policies. These regulations became operative in January 2017 (subject to a three-year phase-in and applicable to new business only). PBR will allow firms to use assumptions, such as mortality rates, that are more reflective of their own experience. Regulators hope that this will reduce the incentive for insurers to conduct regulatory arbitrage.

State regulators faced considerable pressure to address the perceived issues with reserve requirements that led to regulatory arbitrage. The pressure came both from state jurisdictions that maintained high reserve requirements and from the broader scrutiny that came about after the 2008 financial crisis.

Response to the 2008 financial crisis

The financial crisis and the regulatory response to it have led to important changes for the whole financial sector, including insurance. The insurance group AIG played a significant role in the 2008 financial crisis and ultimately required government support. AIG’s problems were due to risky activities conducted by subsidiaries that were not insurance operating firms. The specific activities that played the largest role were credit default swaps and securities lending activities (although the latter were conducted on behalf of AIG’s insurance operating firms).9 AIG was able to take on this risk in part because state insurance regulators did not have authority over AIG’s noninsurance subsidiaries.

The Dodd–Frank Act (DFA), passed in response to the financial crisis, altered many aspects of financial regulation. In particular, the DFA instituted special regulation of financial institutions designated as systemically important (that is, a firm whose material financial distress “could pose a threat to the financial stability of the United States”). These systemically important financial institutions (SIFIs) could—and indeed do—include insurers. The DFA made the Federal Reserve responsible for the regulation of systemic risk at SIFIs; state regulators are still in charge of setting capital and reserve levels for U.S. insurance operating companies owned by SIFIs to ensure policyholder protection. SIFI regulation is at the group or consolidated level (noninsurance and foreign business activities are also covered). This reduces the opportunity for a firm to arbitrage gaps in regulatory coverage.

In addition to AIG, several large insurance groups received capital support from the federal government during the crisis (via the Troubled Asset Relief Program, or TARP). In some cases, the need for capital support may have been related to the losses on VA guarantees sold by these firms.

The implementation of regulations for insurers based on the DFA is in progress.10

Conclusion

Changes in regulation often occur in reaction to crisis. Asset adequacy testing was adopted after large changes in interest rates raised questions about the ability of some insurance firms to fulfill their guarantees. Risk-based capital requirements were imposed after the junk-bond-fueled failures of several large life insurers in 1991. Principle-based reserve and capital requirements were implemented to deal with the complexity of variable annuity guarantees. After the 2008 financial crisis, the DFA was enacted to reduce the potential contagion from a large financial institution’s failure. Most recently, PBR requirements for life insurance policies have been adopted to address “shadow” insurance. As we look ahead, the trend toward more principle-based regulation may continue as the life insurance industry faces new challenges.

1 This is an example of what Kane calls the regulatory dialectic. See Edward J. Kane, 1988, “Interaction of financial and regulatory innovation,” American Economic Review: Papers and Proceedings, Vol. 78, No. 2, May, pp. 328–334.

2 The reserve rules were due to the efforts of Elizur Wright, commissioner of insurance for the state of Massachusetts during that period. Wright was also responsible for instituting the first nonforfeiture laws in the United States.

3 In this article, we use the word annuity to represent a broad set of life insurance products for which policyholders contribute funds to accumulate investment income and then withdraw the money at a later date. Withdrawals may take many forms, including lump sums and lifetime annuities. In a lifetime annuity, the policyholder receives (monthly) level payments while they are alive. See http://www.investopedia.com/terms/a/annuity.asp.

4 Note that in this case the principle-based aspect works in combination with the existing rule-based reserves. The rule-based reserves continue to serve as a floor, and asset adequacy testing can lead to additional reserves being held above this minimum level.

5 Executive Life, Mutual Benefit, and First Capital all failed in 1991. When capital levels declined as junk bonds were written down, annuity policyholders rushed to redeem funds as in a bank run. This caused a death spiral, as the insurers had to sell assets at a loss to meet redemptions. See Harry DeAngelo, Linda DeAngelo, and Stuart C. Gilson, 1994, “The collapse of First Executive Corporation: Junk bonds, adverse publicity, and the ‘run on the bank’ phenomenon,” Journal of Financial Economics, Vol. 36, No. 3, December, pp. 287–336, and Moody’s, 1999, “Life after death—Moody’s examines life insurance insolvency,” April, https://www.moodys.com/sites/products/defaultresearch/2007000000459611.pdf(registration required).

6 The requirements varied from $500,000 to $6 million, depending on the insurance firm’s home state and line of business.

7 RBC was the sum of asset, insurance, interest rate, market, and operational risk components, with an overall offset for correlation among these risks.

8 Benjamin M. Lawsky, 2013, “Shining a light on shadow insurance: A little-known loophole that puts insurance policyholders and taxpayers at greater risk,” New York State Department of Financial Services, report, June.

9 Robert McDonald and Anna Paulson, 2015, “AIG in hindsight,”Journal of Economic Perspectives, Vol. 29, No. 2, Spring, pp. 81–106.

10 As mandated by the DFA, as of this writing the Federal Reserve is in the process of developing capital rules and other regulations for insurers designated as SIFIs.