Over the past two decades, guarantees that protect variable annuities’ balances when their underlying investments perform poorly have become quite popular. Collectively, these guarantees can pose a sizable risk to life insurers. This article explores the different types of variable annuity guarantees, the extent of the risk they pose to insurers, and the practices used by insurers to mitigate against such risk.

A variable annuity is a savings policy that is sold by life insurers. The policyholder contributes funds to the annuity’s balance, and the balance is invested in subaccounts made up of mutual funds and other investments.1 Any gains or losses from the subaccounts are passed back to the balance. After a certain number of years, the policyholder can start cashing out of the annuity by making withdrawals from or annuitizing the balance.2 Because stock investments are the largest component of variable annuities, variable annuity returns are strongly correlated with the performance of stock markets.3

Although variable annuities were first introduced by life insurers in the 1950s, they only became a popular vehicle for retirement in the past two decades.4 At least two factors have contributed to this. First, tax reforms in the mid-1980s reduced the tax advantages of alternative retirement products.5 This made variable annuities, by comparison, more appealing.6 Second, in the late 1990s and early 2000s, insurers began to package variable annuities with optional guarantees.7 While the guarantees come in different forms, their general purpose is to ensure that the annuity balance is protected when its investments perform poorly.8 These guarantees have proven attractive to policyholders who are willing to pay a fee to limit potential losses to their savings. In the fourth quarter of 2016, 76% of policyholders elected to purchase a guarantee when it was available with their variable annuities.9

The popularity of variable annuity guarantees has introduced new risks for life insurers. In “traditional” life insurance products such as term insurance, the main source of risk for insurers is policyholder mortality. This risk can be managed via diversification: By issuing a large number of policies, insurers can predict the mortality rate of their policyholders (using the law of large numbers) and then price the policies appropriately. However, variable annuity guarantees introduce risks that are not as diversifiable. Namely, they expose insurers to the risk that financial markets deteriorate, causing policy balances to decline and guarantees to kick in across the board. This risk cannot be mitigated by issuing a large number of policies because most policies are subject to a similar risk (i.e., the risk is systematic rather than idiosyncratic). Therefore, issuing more policies is likely to increase, rather than decrease, the amount of risk being absorbed by insurers.

Because variable annuity guarantees can be sizable, concerns have been raised about how these guarantees might amplify the consequences of financial crises for insurers. Indeed, the risk associated with variable annuity guarantees may be large enough to cause some insurers distress during a market downturn. To preempt this possibility, many insurers manage the systematic risk by entering into derivative contracts that transfer risk to other counterparties. Generally, the derivative counterparties for insurers are very large banks, which have more capital than the variable annuity issuers. Thus, using derivatives may transfer the systematic risk to institutions that are better able to bear it, thereby improving the overall allocation of risk.

In this Chicago Fed Letter, we explore the risk posed by variable annuity guarantees to life insurers. We proceed by providing an overview of the different types of variable annuity guarantees. Then, we gauge the size of these guarantees and discuss it in the context of stock market and interest rate shocks. Finally, we briefly assess how insurers use derivatives hedging and other strategies to mitigate the risk associated with variable annuity guarantees.

Types of variable annuity guarantees

Backed by strong stock market returns, variable annuity sales increased over sixfold from 1991 to 2000. However, the severe stock market disruption in the early 2000s caused sales to drop by almost 20%, as savers transitioned to alternative products offering more-stable returns.10 In response to this drop in sales, insurers began to develop and market purchasable guarantees to go with their variable annuities. Between 2003 and 2007, these guarantees were sold in large quantities, and the benefits they delivered to policyholders became increasingly generous.

There are two broad types of guarantees—death benefits and living benefits. Death benefits have been around since the 1990s; they are the older and simpler guarantee. The death benefit stipulates that if the policyholder dies before cashing out of the annuity, the policy’s beneficiaries will receive at least the funds that were deposited into the account. Therefore, this guarantee kicks in if investment returns are negative at the time the policyholder dies.11 Today, it is common for most variable annuities to contain a death benefit.

Living benefits, in contrast, can be exercised while the policyholder is still alive. Although living benefits are highly sophisticated and take several forms (see figure 1), they generally utilize a feature called the benefit base. The benefit base is a minimum amount that is available for withdrawal from the annuity, regardless of the performance of the investments. The benefit base is commonly calculated by applying a prespecified growth rate to the funds deposited into the policy; hence, it gets larger the longer the annuity is held. Furthermore, many policies include high-water marks or “step-ups” that increase the benefit base value to the level of the account value whenever the latter is larger than the former. Living benefits kick in if the benefit base exceeds the annuity’s balance at the time the policyholder is ready to make withdrawals from the annuity.

1. Common types of guaranteed living benefits

Although insurers take on risk by issuing both types of guarantees, two factors make living benefits riskier for insurers than death benefits. First, living benefits tend to create larger future obligations for insurers. Whereas death benefits typically return only the funds that the policyholder contributed to the annuity, living benefits usually return the funds plus guaranteed accumulated growth. Second, living benefits afford policyholders some discretion regarding utilization. Whereas death benefits can only be claimed when the policyholder has died, living benefits can be claimed strategically—for instance, if the benefit base (less any fees for early withdrawals) is significantly larger than the account balance. This can be particularly problematic for insurers after major market disruptions, during which benefit bases might exceed annuity balances across the board. Indeed, as we will show in the next section, life insurers’ liabilities for variable annuity guarantees increased significantly during the 2008 financial crisis.

How large are liabilities associated with guarantees?

As a safeguard for policyholders, insurers are required to set aside funds to back future payouts on all their issued policies, including variable annuity guarantees. These funds are called reserves and constitute the main liability on insurers’ balance sheets. Reserves need not be static. For example, if an unexpected event changes the expected value of future payouts to policyholders, then insurers may be required to make corresponding changes to reserves. In an extreme scenario, if these reserve additions are so substantial that they exceed available funds, insurers will experience financial distress and may even be rendered insolvent.

The risk of having to add reserves differs across insurance products. Reserves for variable annuity guarantees strongly depend on market conditions, making these guarantees more prone to reserve volatility compared with other insurance products. When stock markets perform well, guarantees are unlikely to kick in, so the required reserves for guarantees are generally small. If market conditions deteriorate, low investment returns could trigger a spike in reserves for many policies. In general, this scenario is likely to affect reserves for living benefits more than death benefits because living benefits tend to be more generous and can be exercised by the policyholders with some discretion. For this reason, living benefit reserves are typically orders of magnitude higher than death benefit reserves and drive most of the volatility in overall reserves for guarantees.12

Reserves for variable annuity guarantees are sensitive to stock market conditions because annuity balances are primarily invested in mutual funds and other stock-related investments. Reserves are also subject to interest rate risk. When insurers set aside reserves, they estimate the present value of future payouts to policyholders—a value that changes with interest rates because of discounting and changes in policyholder behavior. When interest rates increase, insurers will decrease reserves for guarantees to reflect that the time value of today’s dollar has increased. Policyholders may also claim their benefits earlier (because their guarantees are worth less to them as interest rates increase), further reducing reserves. Conversely, insurers will increase reserves as interest rates drop, and the effect will generally be most severe when guarantees have already kicked in because of a stock market downturn. Thus, a combination of decreasing stock markets and interest rates will lead to large increases in reserves.

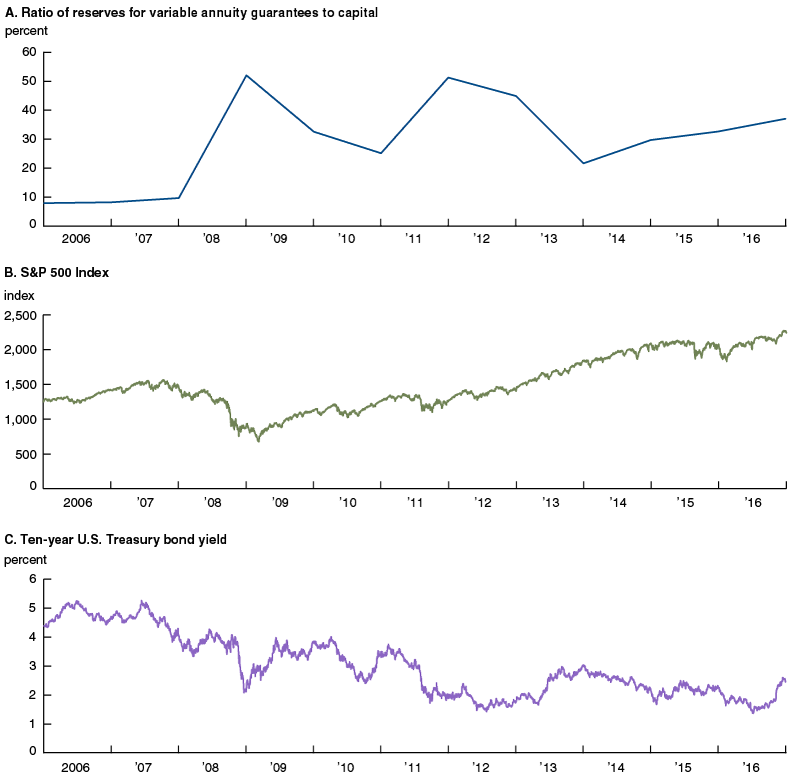

Figure 2 shows the evolution of reserves for variable annuity guarantees for the ten largest issuers of these guarantees.13 In line with what we’ve discussed thus far, reserve additions (and consequently, capital reductions) are driven by bearish stock markets and declining interest rates—conditions that accompany most recessions. Crucially, this relationship may be harmful to insurers because it increases their need for funding in periods of widespread financial distress.14

2. Reserves for variable annuity guarantees versus selected market factors

Note: Reserves are plotted for the domestic life insurance subsidiaries of the ten largest variable annuity issuers, based on average reserve size from year-end 2005 through year-end 2016.

Sources: Authors’ calculations based on data from SNL Financial and Haver Analytics.

In particular, reserves for variable annuity guarantees (relative to insurers’ capital) have spiked twice in the past ten years (see figure 2, panel A). The financial crisis caused the Standard & Poor’s (S&P) 500, a broad U.S. stock index, to drop nearly 40% from year-end 2007 through year-end 2008 (see figure 2, panel B). Over the same period, the yield on ten-year U.S. Treasury bonds dropped 179 basis points as the Federal Reserve lowered the federal funds rate to near zero and investors, seeking safety from the stock market, piled money into less risky government bonds (see figure 2, panel C). As a result of these events, a large number of guarantees suddenly became more valuable, which required substantial additions to reserves.

By the start of 2011, the stock market had not fully recovered to pre-crisis levels (see figure 2, panel B). As a result, 65% of policies had a benefit base above the account value. Because the stock market was flat year over year, annuity balances flatlined while benefit bases continued to grow, raising the fraction of exercisable guarantees to 84% by year-end.15 Furthermore, concerns about the quality of European countries’ government bonds triggered a decrease of 141 basis points in the ten-year U.S. Treasury bond yield (see figure 2, panel C), which further increased the economic value of existing guarantees. The combination of these events led to another spike in reserves for guarantees (see figure 2, panel A).

Consistent with our preceding analysis, reserves for variable annuity guarantees have shown to be large and volatile. For the ten largest issuers of guarantees as a group, reserves have ranged from less than 10% of capital before the financial crisis to about 50% at the ends of 2008 and 2011.16 The increase from year-end 2007 to year-end 2008 was over 40 percentage points (from 10% to 52%). This level of volatility is much higher than is usual for more traditional insurance policy reserves. Clearly, variable annuity guarantees pose a unique, market-based risk to insurers, one that has led them to adopt market-based hedging practices.

How do insurers manage the risk associated with guarantees?

Because reserves for variable annuity guarantees can be large and volatile relative to capital, many insurers use risk hedges. Insurers can hedge by purchasing derivatives that gain value when adverse stock market or interest rate changes occur. When such shocks occur, insurers can fund required additions to reserves using the gains they receive on their derivatives. In other words, derivatives are used to counteract reserve volatility and thus stabilize insurers’ funding needs.17

All of the ten largest issuers of variable annuity guarantees purchase derivatives.18 The most common types of derivatives used to hedge guarantees are equity futures and options and interest rate swaps and swaptions. Different insurers will purchase various combinations of these and other derivatives to offset a desired fraction of their reserve volatility.

For eight of the ten largest issuers of variable annuity guarantees, reserves for guarantees are strongly correlated with the value of their derivatives holdings, suggesting that a large portion of these derivatives are used for hedging guarantees.19 However, given the complexity of guarantee products, it is difficult for insurers to remove all risk associated with reserve volatility.20 Furthermore, data limitations make it difficult to evaluate the extent to which insurers offset this risk through the use of derivatives. Specifically, the accounting rules insurers use to report reserves for variable annuity guarantees allow them to report reserves net of some of their hedges, but the total amount of hedges deducted from reported reserves is not publicly available.21 This means that reported reserves for variable annuity guarantees might not fully reflect the funding needs associated with guaranteed payments to policyholders.

When insurers use derivatives to hedge variable annuity guarantees, market risk gets transferred to other counterparties that have bought or sold the derivatives. Derivatives should improve the overall allocation of market risk if counterparties are more capable of absorbing the risk compared with insurers. It turns out that banks—specifically, the world’s largest banks—are the leading derivatives counterparties for insurers. For example, when reserves for guarantees peaked in 2011, 75% of insurers’ derivatives counterparties were banks, 8% were other insurers, 1% were other entities, and 16% were unidentifiable entities.22 Overall, the banking industry is three times larger than the insurance industry in terms of assets. Furthermore, the banks acting as counterparties in derivatives transactions are, on average, four to five times larger than the insurers issuing the guarantees.23 Given their size, it is likely that large banks have more capacity to absorb market risk than insurers.

Insurers can try to employ other strategies for managing the risk associated with variable annuity guarantees. An alternative to derivatives hedging could be seeking funds from capital markets—e.g., issuing new equity or debt—whenever large reserve additions are required. A problem with this alternative is that often, large reserve additions are required precisely when financial markets are under distress, making it expensive for insurers to raise funds.

Another approach observed since the financial crisis is the modification of provisions in newly sold guarantees.24 For example, after the crisis, some insurers introduced “rebalancing” clauses that shift investments in variable annuity accounts from stocks to bonds as stock markets decrease, thereby lowering the exposure of insurers to stock market risk. Additionally, benefits have become less generous, and fees have increased. These product modification strategies may reduce risk for insurers at the cost of making variable annuities less appealing to potential new policyholders.

Conclusion

Variable annuities with guarantees are attractive retirement savings vehicles for individuals who want to benefit from market increases but who also want to establish a limit on potential losses. Insurers that issue large quantities of variable annuity guarantees absorb high levels of market risk. In the past decade, reserves held by insurers to back such guarantees have spiked on two different occasions, driven by poor stock market performance and low interest rates. On both occasions, these spikes constituted about 50% of capital, on average, among the ten largest issuers of such guarantees. There is evidence that suggests that insurers, recognizing this issue, are using derivatives as a hedge against risk created by variable annuity guarantees.

1 The policyholder usually has some discretion regarding what type of securities can be selected for investment, including fixed-income and other investments. The degree of discretion varies across insurers and products.

2 Annuitizing means converting the balance into a perpetual series of cash flows to be paid by the issuing insurance company. Fees, known as surrender charges, are paid to the insurer if the policyholder elects to withdraw money before a predefined waiting period.

3 According to data from SNL Financial, 77% of variable annuity balances are invested in stocks.

4 Annuity products (led by variable annuities) have become so popular that the liabilities for these products exceed those of traditional life insurance products.

5 http://www.naic.org/cipr_topics/topic_variable_annuities.htm.

6 Taxes on variable annuity investment gains are deferred until the money is withdrawn, allowing for the returns to accumulate tax free.

7 http://www.mckinsey.com/business-functions/risk/our-insights/responding-to-the-variable-annuity-crisis.

8 The precise nature of the guarantees varies by product.

9 Data from Teodor Radu, 2017, “Glimpse: Variable annuity guaranteed living benefit election tracking (2016, 4th quarter),” LIMRA, report, March 30, available by subscription at http://www.limra.com/research/abstracts/2017/variable_annuity_guaranteed_living_benefit_election_tracking_(2016,_4th_quarter).aspx.

10 Authors’ calculations based on data from Todd Giesing, 2016, U.S. Individual Annuity Yearbook—2015, LIMRA, report, with contributions from Joe Montminy and Steve Simonds, August 11, available by subscription at http://www.limra.com/research/abstracts/2016/u_s__individual_annuity_yearbook_-_2015.aspx. According to this LIMRA publication, annual variable annuity sales increased from $22 billion in 1991 to $137 billion in 2000. However, the bursting of the “tech bubble” in 2000 had caused sales to plunge to $111 billion by 2001. In contrast, sales of fixed annuities, which offer a fixed return, nearly doubled between 2000 and 2002.

11 Sometimes, guaranteed death benefits include a provision that applies a prespecified rate of growth to the policy balance. However, this is not very common.

12 Analysis based on data from Jimmy S. Bhullar and Pablo S. Singzon, 2016, “Variable annuity market trends,” J.P. Morgan Markets, report, November 22, available by subscription at https://markets.jpmorgan.com/research/ArticleServlet?doc=GPS-2189884-0&referrerPortlet=search_company.

13 The ten largest issuers are selected based on average size of reserves for variable annuity guarantees from year-end 2005 through year-end 2016. These issuers held 47% of the life insurance industry’s total assets in 2005 and 44% in 2016. They held 85% of the industry’s total reserves for variable annuity guarantees in 2016.

14 Although we witness large additions to reserves for guarantees when financial markets are in distress, smaller reserve increases may be required when markets are stable but growing slowly. For example, reserves have grown steadily during the past three years on the back of slow stock market growth and a slight drop in interest rates. In general, this reserve growth happens because the low investment returns in annuity balances (minus the management fees) are overtaken by relatively higher growth in benefit bases.

15 Authors’ calculations based on data from Matthew Drinkwater, Jafor Iqbal, and Joseph E. Montminy, 2014, Variable Annuity Guaranteed Living Benefits Utilization—2011 Experience, Society of Actuaries and LIMRA, report, January 6, available by subscription at http://www.limra.com/Research/Abstracts/2014/Variable_Annuity_Guaranteed_Living_Benefits_Utilization_–_2011_Experience_(2014).aspx.

16 Authors’ calculations based on data from SNL Financial. Figures pertain to the domestic life insurance subsidiaries of the ten largest variable annuity issuers.

17 http://www.nber.org/papers/w23365.pdf.

18 According to insurance statutory data from SNL Financial, the fair value of derivatives held by the ten largest issuers of variable annuity guarantees was 57% of the life insurance industry’s derivatives holdings in 2016.

19 Authors’ calculations based on data from SNL Financial. The average correlation for the top ten issuers is 50%; however, this number is driven down by one company that has a large negative correlation between its reserves for variable annuity guarantees and derivatives. The average correlation for the remaining nine issuers is 63%. Because of data availability limitations, these calculations are based on data from 2010 through the present.

20 For example, hedging volatility in reserves for variable annuity guarantees exposes insurers to other risks, such as basis risk (i.e., the risk that the value of a hedging instrument will not move in line with that of the underlying exposure) and counterparty risk. See https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2972295.

21 Insurers report variable annuity reserves using statutory accounting principles (SAP). Under SAP, reported reserves can be true reserves minus up to 70% of the derivatives used to hedge variable annuity guarantees. See http://us.milliman.com/uploadedFiles/insight/research/life-rr/discussion-actuarial-guideline-43-RR04-01-09.pdf.

22 Authors’ calculations based on data from SNL Financial. These calculations are based on the absolute value of the fair value of the derivatives contracts. Because of the limitations in the insurers’ derivatives data, we cannot provide numbers for 2008, when the financial crisis hit. Also, we cannot identify counterparties for 16% of derivatives transactions because they were performed using an exchange or over-the-counter market.

23 Authors’ calculations based on data from SNL Financial.

24 For a more detailed discussion of how guarantees were changed, see the reference in note 20.