The sudden rise in inflation that started in 2021 was the largest in 40 years for the United States. The rapidity, size, and persistence of this increase took most observers by surprise. In this article, we conduct a retrospective analysis and compare the accuracy of inflation projections made before, during, and after the Covid-19 pandemic by three groups of people: individual households, professional forecasters, and policymakers on the Federal Open Market Committee (FOMC) of the Federal Reserve System.

We document three main facts. First, each of these three groups made large forecast errors in the pandemic era and its aftermath (the 2020–24 period). Relative to the pre-pandemic period, the average forecast error is about three times larger in the 2020–24 period. This is true both for near-term forecasts (i.e., forecasting what inflation will be in the current year) and for medium-term forecasts (i.e., forecasting what inflation will be one or two years from now).

Second, the short-run and medium-run inflation projections made by professional forecasters and by FOMC participants remained closely aligned throughout the 2020–24 period. Hence, while the Federal Reserve inflation projections were inaccurate during this period, they were no more inaccurate than those of private sector forecasters.

Third, and perhaps surprisingly, households’ inflation predictions were more accurate than those of professional forecasters (and, by implication, the FOMC) in the 2020–24 period. This contrasts sharply with the pattern in the pre-pandemic period, when households’ inflation projections were significantly less accurate. This outperformance holds even after we take into account that households have systematically higher inflation expectations than professional forecasters.

For data reasons, mainly concerning differences in the timing and forecast horizon of the forecasts made by the three groups, we first discuss the projections of the FOMC and compare them with those of professional forecasters and we then compare the projections of professional forecasters with those of households.

An important caveat to keep in mind is that we are looking back at all these projections with 20/20 hindsight. We evaluate forecasts by whether they were successful in the end (or ex post). It is possible that some well-founded forecasts turned out to be wrong because of unexpected events, such as the invasion of Ukraine.

The FOMC’s Summary of Economic Projections

Each quarter, the Federal Open Market Committee publishes the Summary of Economic Projections (SEP), which reports the individual projections made by FOMC participants.1 Each participant provides their individual projection of the most likely paths of inflation, real gross domestic product (GDP) growth, and the unemployment rate for the current year and the next two or three years (as well as the longer run) under what each participant deems “appropriate monetary policy.”2 These projections help the public and financial markets understand Fed policymakers’ views regarding the current economic situation, the outlook, and future monetary policy. We will focus here on the projection for core inflation (which measures the rate of change in the price of a consumption basket that excludes food and energy components) according to the Price Index for Personal Consumption Expenditures (PCE) from the U.S. Bureau of Economic Analysis (BEA), and we will use the median value of the inflation projections (across the 19 participants who attend FOMC meetings, as explained in note 1). It is important for our purpose to understand the exact timing of these inflation projections. At the FOMC meeting closest to the end of each quarter (typically around the middle of March, June, September, and December), participants provide projections for inflation in the current year, the next year, and the year after next; at the September and December meetings, they further project inflation in the year after the next two. For instance, at the December 2024 meeting, FOMC participants gave their projections for inflation in 2024 (which was almost over), 2025, 2026, and 2027. (Inflation is measured from the end of one year to the end of the next one; e.g., for 2024 it is the growth rate of prices from the fourth quarter of 2023 through the fourth quarter of 2024.)

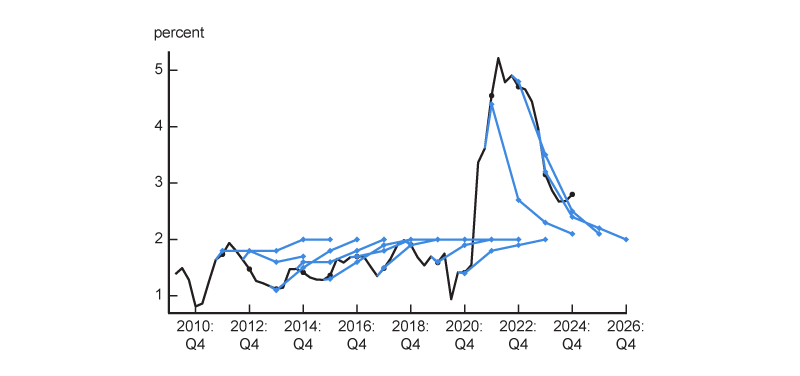

Figure 1 compares the paths of SEP projections made in December of each year, shown as blue diamonds connected by blue lines, with realized core PCE inflation, shown as a black line.3 (In this figure, we omit the projections made in March, June, and September in the interest of visual clarity.) Each blue line represents the path of the median of projections released in a December SEP for core PCE inflation over the current year and the next three years. The black dots (along the black line) highlight the fourth quarter-to-fourth quarter values, which are the measure of inflation the SEP tries to project.

1. December SEP projections for core PCE inflation versus realized core PCE inflation

Sources: Federal Reserve and the U.S. Bureau of Economic Analysis from Haver Analytics.

Figure 1 shows that over the period 2011–20, core PCE inflation remained largely confined to a narrow range of about 1% to 2%, before accelerating suddenly and reaching over 5% in 2022.4 The figure also provides a visualization of the accuracy of projections at different horizons. Forecasts where the blue diamonds overlap with the black dots are the most accurate. More generally, the vertical distance between the blue diamond and the black dot directly above or below measures the accuracy of the projection (i.e., the shorter the distance, the more accurate the projection).

We can distinguish two periods in figure 1. The first period is before the pandemic: From 2011 through 2019, projections for the next year were typically within half a percentage point of the realized core PCE inflation rate (on average, they were off by just about a quarter of a percentage point). The projections converged to 2% within a couple of years, which is the inflation target the FOMC announced in January 2012. During the 2011–19 period, however, actual inflation (i.e., the black line) failed to converge back to 2% consistently.

The second period, starting in 2020, features large and persistent forecasting errors, as shown in figure 1. The projections made in December 2020 and December 2021 are particularly interesting examples. In the December 2020 SEP, published when current (headline and core) inflation values were still below 2%, the median projections of core PCE inflation were 1.8% for 2021 and 1.9% for 2022. These SEP projections were significantly below the realized values of core inflation for 2021 and 2022—which were 4.5% and 4.7%, respectively. In the December 2021 SEP, the median projections of core PCE inflation were 2.7% for 2022 and 2.3% for 2023. These projections were again much lower than the realized core inflation values of 4.7% in 2022 and 3.1% in 2023.

To quantify the accuracy of these SEP projections, we report in figure 2 the average forecasting error (i.e., the mean absolute error, or MAE) of the SEP median projection for the current year, the next year, and the year after next. Graphically, this measure is the average vertical distance between the SEP projection and realized core PCE inflation data lines, as displayed in figure 1.5 We use all the SEP projections to calculate the MAE results reported in figure 2 (not just the December ones plotted in figure 1). We report the average error for the entire sample period (projections made from 2011:Q4 through 2023:Q4), as well as for the pre-pandemic period (2011:Q4–2019:Q4) and the pandemic era and its aftermath (2020:Q2–2023:Q4).

2. Mean absolute errors for projections of core PCE inflation: SEP projections versus professional forecasters’ projections

| Current year projections |

One-year-ahead projections |

Two-years-ahead projections |

|||||||||

| SEP | SPD | SPF | SEP | SPD | SPF | SEP | SPD | SPF | |||

| Full sample period (2011:Q4—2023:Q4) |

0.26 | 0.29 | 0.34 | 0.64 | 0.71 | 0.72 | 0.64 | 0.71 | 0.68 | ||

| Pre-pandemic period (2011:Q4—2019:Q4) |

0.15 | 0.17 | 0.18 | 0.28 | 0.36 | 0.34 | 0.38 | 0.44 | 0.39 | ||

| Pandemic era and aftermath (2020:Q2—2023:Q4) |

0.47 | 0.51 | 0.64 | 1.39 | 1.46 | 1.54 | 1.31 | 1.38 | 1.40 | ||

Sources: Authors’ calculations based on data from the Federal Reserve, Federal Reserve Bank of New York, and the U.S. Bureau of Economic Analysis from Haver Analytics and data from Federal Reserve Bank of Philadelphia.

Consistent with figure 1, the average forecasting error is substantially smaller at short horizons, as shown in figure 2. In the full period, it goes from 0.26 percentage points for the forecast for the current year to 0.64 percentage points for the one-year-ahead and two-years-ahead forecasts (coincidentally, the error is the same for both). It is not surprising that forecasts for the current year have a lower error. First, these projections become mechanically more accurate throughout the year, as more data for the current year is released and there are fewer months to project. Second, the near-term behavior of the economy (over the next quarter or two) can usually be projected well given the current economic situation. But forecasts over the next year or two are more difficult to make accurately as more events can unfold and the medium-run dynamics of inflation are still not well understood.

Figure 2 also shows that the SEP’s forecast errors were much larger in the pandemic era and its aftermath than in the pre-pandemic period.6 For the current year projection, the MAE more than triples from 0.15 percentage points in the pre-pandemic period to 0.47 percentage points in the pandemic era and its aftermath; for the one-year-ahead projection, it nearly quintuples from 0.28 percentage points to 1.39 percentage points; and for the two-years-ahead projection, it again more than triples from 0.38 percentage points to 1.31 percentage points. This confirms the view that the FOMC made large forecast errors during the pandemic era and its aftermath.

Professional forecasters’ projections versus the SEP

To know if the FOMC’s forecast errors were particularly egregious requires a benchmark. The natural one is projections made by professional forecasters—private sector economists whose job is to forecast the evolution of the economy. We use two surveys of professional forecasters. The first one is the Survey of Primary Dealers (SPD), which used to be conducted by the Federal Reserve Bank of New York ahead of each FOMC meeting until 2025.7 One key advantage of the SPD is that its timing most closely aligns with the SEP projections. For the sake of completeness, we also use the traditional Survey of Professional Forecasters (SPF), which is conducted by the Federal Reserve Bank of Philadelphia.

It is important to emphasize that the SEP, SPD, and SPF are not conducted at the same time. This makes the comparison slightly biased in favor of the SEP, which is produced after the SPF and the SPD in each quarter and hence is based on more information for that quarter. (The SPD is collected a couple of weeks prior to the FOMC meeting, and the SPF is collected about one month prior to the FOMC meeting.) These differences in the information available to each group are reflected in the errors shown in figure 2: For the most part, the SPF has slightly higher forecast errors than the SPD, which itself has slightly higher errors than the SEP. The forecast errors for the SPD and SPF are markedly higher in the Covid era and its aftermath than in the pre-pandemic period—and by roughly the same proportion as forecast errors for the SEP. Overall, the picture that emerges from figure 2 is that the forecast errors are quite similar among the three sets of projections (one from the FOMC and two from professional forecasters): The SEP does slightly better than the SPD and SPF at forecasting core PCE inflation, but that may reflect its slight timing advantage. Hence, overall, while the FOMC made large projection errors, they were similar to those of professional forecasters.

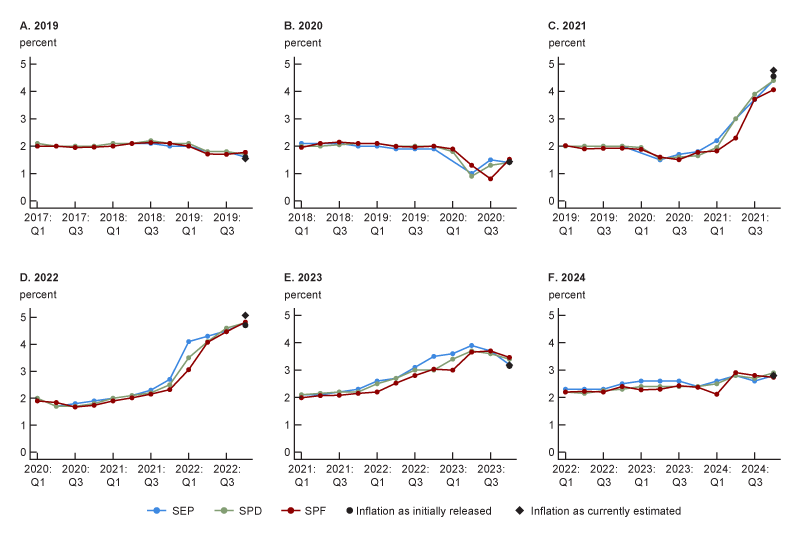

Figure 3 illustrates more precisely the close agreement between professional forecasters’ projections and the SEP. Each panel in this figure shows how the projections for core PCE inflation at the end of a specific year were updated over time. The black dots and diamonds show realized core PCE inflation when initially released and in the “current” data, as available in June 2025 (see note 3), respectively. Consider first panel A, which depicts projections for 2019 inflation. All three sets of projections—the SEP, SPD, and SPF—initially projected inflation very near 2% when they first started forecasting it for 2019—from early 2017 through the end of 2018. This is consistent with inflation expectations being “anchored” near the Federal Reserve’s longer-run target of 2%. Starting in the second quarter of 2019, the forecasts were updated in tandem downward over time, reflecting incoming data that pointed toward weak inflation that year. The projections then converged to the actual rate of inflation represented by a black dot. (In that specific instance, the current estimate of inflation, represented by a black diamond, is nearly on top of the initial estimate, represented by the black dot; revisions had little impact on that year’s inflation rate.) The forecast for 2020, shown in panel B of figure 3, follows a similar pattern, though with a bigger inflation surprise on account of the pandemic (there are no 2020:Q1 data for the SEP in figure 3, as explained in note 6).

3. Evolution of core PCE inflation projections for the years 2019–24

Sources: Federal Reserve, Federal Reserve Bank of New York, and the U.S. Bureau of Economic Analysis from Haver Analytics; and Federal Reserve Bank of Philadelphia.

Let’s now turn to 2021 (panel C of figure 3), which had the highest level of inflation since the 1980s. All projections for 2021 core PCE inflation dipped at first during the pandemic, as most FOMC participants and professional forecasters expected a slow recovery. As inflation surged in early 2021 and remained high, the projections increased sharply. That year is unusual in that the three groups of forecasters responsible for the SEP, SPD, and SPF all made large mistakes even just a few months before the end of the year—as most FOMC participants and professional forecasters expected inflation to come down faster. A striking feature of panel C, however, is that, just as in panels A and B for the years 2019 and 2020, the projections overall move very closely together. The same pattern holds for 2022 inflation (see panel D of figure 3).

The SEP is nearly always slightly more pessimistic than the SPD and SPF in the pandemic era and its aftermath; i.e., the SEP points to higher inflation, though that could again reflect the slight difference in its timing relative to the SPD and SPF. For instance, in 2021:Q4, the SEP indicates 2.7% core PCE inflation for 2022, while the SPF and SPD collected in the previous month or weeks forecast 2.3% and 2.5%, respectively (as shown in panel D of figure 3). Figure 3 overall demonstrates that professional forecasters and FOMC participants tend to adjust their projections similarly.8

Households’ projections versus professional forecasters’ projections

It is perhaps not too surprising that the SEP and the projections from professional forecasters are closely aligned: FOMC participants and professional forecasters tend to use similar frameworks, based on macroeconomics, to understand inflation, and both groups pay a lot of attention to inflation developments. But how do their projections compare with those of nonprofessionals, i.e., regular households, which may be less attentive to and less informed about the macroeconomy and have a different understanding of inflation? A large research literature9 documents that households’ forecasts are typically less accurate than those of professional forecasters and that these nonprofessional forecasts are highly affected by some particularly salient prices, such as those for food and gasoline. With that said, how did households’ forecasts perform during the pandemic era and the months that followed?

To answer this question, we use two surveys: the Survey of Consumer Expectations (SCE), commissioned by the Federal Reserve Bank of New York, and the University of Michigan’s Surveys of Consumers (MSC). Every month, both the SCE and MSC ask respondents about their views on inflation over the next year.10 The SCE and MSC do not specify a price index when they ask about inflation, but we choose to compare the SCE and MSC inflation forecasts with the realized values of the Consumer Price Index (CPI) (inclusive of food and energy components) from the U.S. Bureau of Labor Statistics because that index reflects out-of-pocket expenses for consumers and is used more broadly (e.g., to adjust Social Security payments).11

Unlike the SEP, which asks about annual inflation over a set period (from the fourth quarter of a year to the fourth quarter of the following year), the SCE and MSC ask households about inflation over the following year (that is, over the next 12 months from when the survey respondent is asked). This makes a direct comparison between the SEP and the SCE or MSC impossible (except during the fourth quarter of a given year when the two forecast periods approximately coincide). However, we can construct a closely matching series of professional forecasts using the Blue Chip Financial Forecasts, or BCFF (published by Wolters Kluwer)—which on a monthly basis surveys economists who work at investment banks and asks them about their inflation forecast over the following quarters. The inflation forecast from the BCFF follows the inflation forecast from the SPF fairly closely.12

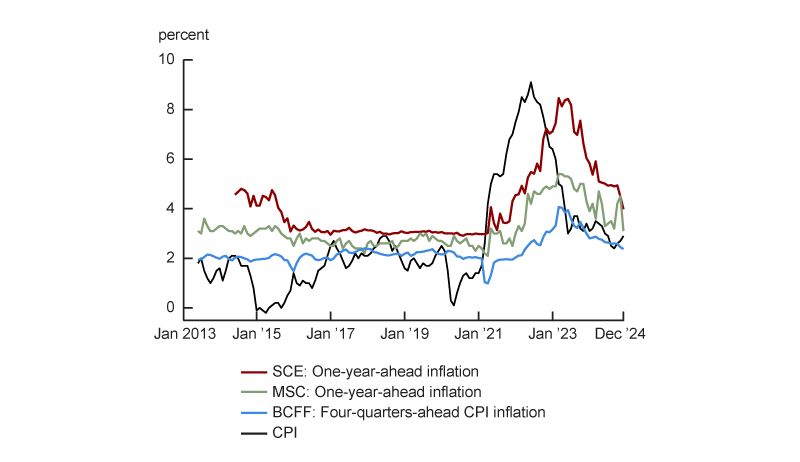

Figure 4 plots the median inflation expectations from the SCE, MSC, and BCFF, along with realized inflation according to the CPI. In this figure, forecasts are plotted according to the forecast horizon, not the date when the forecast was made; for instance, the January 2022 point corresponds to the forecast that was made in January 2021 for inflation in January 2022. An accurate forecast is one that hems closely to the realized inflation line. Prior to the pandemic, both surveys of consumers (SCE and MSC) displayed fairly stable one-year-ahead inflation expectations—between 2% and 3% (a historically very low level). But as soon as the pandemic hit in early 2020, households’ expectations for inflation started rising—in contrast to the expectations of professional forecasters, which dipped. This increase in inflation expectations proved prescient, as inflation rose over the following year. Over the next few months in 2020–21, inflation expectations of consumers kept increasing faster than inflation expectations of professional forecasters. Moreover, consumers anticipated the persistence of the inflation outburst, while the professional forecasters did not. This pattern of forecasts of consumers (regular households) outperforming those of professional forecasters continued until early to mid-2023, when the professionals’ forecasts again became more accurate.

4. One-year-ahead inflation projections made 12 months prior versus realized CPI inflation

Sources: Authors’ calculations based on data from Wolters Kluwer; and U.S. Bureau of Labor Statistics, Federal Reserve Bank of New York, and University of Michigan from Haver Analytics.

Figure 5 quantifies the average forecasting errors made by each group during each period (full sample, pre-pandemic period, and pandemic era and aftermath).13 Over the full sample period, the professional CPI inflation projection from the Blue Chip Financial Forecasts has the lowest average error (1.44 percentage points versus 1.60 percentage points for the MSC inflation projection and 2.11 percentage points for the SCE one). The forecast errors in figure 5 are generally larger than those in figure 2, since CPI inflation is more volatile than core PCE inflation (owing in part to the volatile prices of the food and energy components). In the pre-pandemic period, the professional projection of the BCFF has an even more substantial advantage over the projections of the MSC and SCE.

5. Mean absolute errors for one-year-ahead projections of CPI inflation: Professional forecasters’ projections versus households’ projections

| BCFF | MSC | SCE | |

| A. Unadjusted forecasts | |||

| Full sample period (June 2013—December 2023) |

1.44 | 1.60 | 2.11 |

| Pre-pandemic period (June 2013—February 2019) |

0.70 | 1.22 | 1.83 |

| Pandemic era and aftermath (April 2020—December 2023) |

2.57 | 2.18 | 2.55 |

| B. Forecasts adjusted for pre-pandemic average error |

|||

| Full sample period (June 2013—December 2023) |

1.56 | 1.46 | 1.61 |

| Pre-pandemic period (June 2013—February 2019) |

0.61 | 0.80 | 1.03 |

| Pandemic era and aftermath (April 2020—December 2023) |

3.01 | 2.48 | 2.49 |

As in figure 2, we see that the average forecast error in the pandemic era and its aftermath was higher than in the pre-pandemic period for all groups in figure 5. However, the effect is now much more uneven. While the professional forecasters’ (BCFF’s) average forecast error again more than triples, that of the consumers (MSC and SCE) less than doubles. Indeed, we see that during the pandemic era and its aftermath, consumers surveyed for the MSC (2.18 percentage points) were overall a little bit more accurate than the professional forecasters (2.57 percentage points), who did almost as well as the consumers surveyed for the SCE (2.55 percentage points). One potential explanation is that people have a tendency to “extrapolate” (they tend to use current inflation to forecast future inflation)—which proved a useful heuristic during this period. (This extrapolation pattern is striking in the SCE, as seen in figure 4: The one-year-ahead inflation expectations of the SCE lag by exactly one year the realized CPI inflation.)

However, there are some reasons to believe that households’ forecasting prowess does not simply reflect extrapolation. First, as we noted previously, households’ inflation expectations started rising as soon as the pandemic hit, even though actual inflation did not increase at first. Second, Lebow and Peneva (2024) show that households had a fairly accurate perception of the current rate of inflation during the pandemic era, at least until mid-2022, which suggests that they were well informed. Third, the median inflation expectations from the University of Michigan survey rose far less than actual inflation; consumers surveyed for the MSC, just like professional forecasters, expected inflation to fall. They were simply less sanguine about the prospects for a rapid disinflation—and they were proved right, at least until 2023.

As figure 4 shows, during the pre-pandemic period, households had systematically higher inflation expectations than professional forecasters. One might think, then, that the outperformance of households over professionals during the pandemic era and its aftermath simply reflect this “bias” (in the statistical sense of systematic error), which was beneficial to their projection after the start of the pandemic, when inflation became higher. To gauge this possibility, panel B of figure 5 adjusts each forecast by its average error in the pre-pandemic period. For instance, the MSC was on average 1.11 percentage points higher than actual inflation before the pandemic, so we adjust its forecast down in the pandemic era and its aftermath by 1.11 percentage points. We see that the results are robust to this adjustment: Over the pandemic era and its aftermath, the average absolute error remains the lowest for the MSC. (This is because, while the adjustment reduces the quality of the MSC forecast when inflation increased from 2021 to 2022, it improves the quality of that forecast when inflation decreased from 2023 to 2024.)

Conclusion

Perhaps the most surprising finding of our study is that households outperformed professional forecasters during the pandemic. This is relevant today as inflation expectations from households have again risen suddenly earlier this year. This increase occurred even though inflation has moved little overall. It is quite possible that consumers are being excessively pessimistic about the outlook for inflation. However, our results suggest, at the very least, the possibility that these expectations provide a useful signal.14

Notes

1 The seven Federal Reserve Board Governors (including the Chair) and the 12 regional Federal Reserve Bank presidents participate in FOMC meetings. However, only a subset of these participants are members of the Committee (the seven Governors, the New York Fed president, and four of the remaining 11 Reserve Bank presidents, serving rotating one-year terms) and vote on the direction of monetary policy.

2 According to the SEP, the definition of “appropriate monetary policy” is “the future path of policy that each participant deems most likely to foster outcomes for economic activity and inflation that best satisfy his or her individual interpretation of the statutory mandate to promote maximum employment and price stability.” So, one caveat is that these projections are not, strictly speaking, forecasts because they are based on a monetary policy that may not be pursued. We also note that SEP projections reflect policymakers’ decisions, rather than the Federal Reserve staff’s forecast (known as the Greenbook or Tealbook)—which we do not use as it is only made public with a five-year lag.

3 We compare the projections with realized inflation when the core PCE inflation reading was initially released (i.e., the first release of the core PCE index). The difference between the first release and the “final” or “current” data following revisions (as available in June 2025) is relatively small over the period we cover, so it is not material for our results.

4 Some other measures of inflation (in particular, those that include the cost of food and energy) reached even higher values. For instance, Consumer Price Index inflation over the 12 months that ended in June 2022 was 9.1%.

5 Results are similar if we use an alternative measure (the root mean squared error, or RMSE) to quantify the accuracy of forecasts.

6 When calculating MAEs for figure 2, we exclude SEP projections made for one and two years ahead in 2019 and 2018, respectively, since they covered 2020, which was influenced by the unexpected pandemic. We also exclude the SEP projections that normally would have been published in March 2020 because the FOMC did not publish a SEP at that time. We apply these same exclusions to the professionals’ and households’ projections that we subsequently discuss. These omissions do not affect the results.

7 In 2025, the Survey of Primary Dealers was merged with the Survey of Market Participants (SMP) to form the Survey of Market Expectations, which is conducted by the New York Fed. The SMP focused on asset managers and “buy-side” participants.

8 The SEP, SPF, and SPD projections are also similar for short-term interest rates (including the federal funds rate, which is the FOMC’s primary tool to conduct monetary policy). This shows that the inflation projection similarity was not due to different monetary policy assumptions offsetting other factors.

9 Two other recent Chicago Fed Letter articles on household inflation expectations are Brave et al. (2024) and Fisher and Sarma (2024). For a summary of the recent academic literature on inflation expectations, see D'Acunto et al. (2023).

10 The SCE asks: “What do you expect the rate of inflation/deflation to be over the next 12 months? Please give your best guess.” The MSC asks: “By about what percent do you expect prices to go up/down on the average, during the next 12 months?”

11 In addition, the “official CPI” reported in the media—which is the Consumer Price Index for All Urban Consumers (CPI-U)—is considered “final when issued,” as explained by the BLS in its CPI FAQs; therefore, CPI inflation values are not later revised (unlike the core PCE inflation values, as discussed in note 3).

12 While the BCFF asks about the path of quarterly inflation, we can approximate the implied monthly year-over-year forecast by interpolation.

13 For figure 5 (and figure 4), we start in June 2013, when the New York Fed’s SCE was introduced, instead of in 2011:Q4 (as we did for figures 1 and 2). Furthermore, forecasts made between March 2019 and March 2020 are excluded from figure 5.

14 One possibility, of course, is that household expectations themselves drive actual inflation, so that the forecasting relationship we show is, at least in part, a causal mechanism. Even if that were the case, this does not excuse the relatively worse performance of professional forecasters, who could observe household inflation expectations, nor does it diminish the point that household expectations are an important signal.