Risk Management in an Uncertain World

Introduction

Thank you for that warm introduction. It is a great pleasure to join the impressive list of speakers to your group. I look forward to your insightful remarks. My views are sharpened through comments I get from the audience and getting an international perspective is particularly helpful. So, I am most appreciative for this opportunity.

Today I will first discuss recent developments and my outlook for the U.S. economy. I will then explain how that outlook and the risks around it shape my views about the appropriate timing and pace of eventual Federal Reserve policy normalization. I should note that my commentary reflects my own viewpoint and does not necessarily represent the views of my colleagues on the Federal Open Market Committee (FOMC) or within the Federal Reserve System.

In particular, I expect to see continued solid growth in real activity and further improvements in labor markets in the U.S. Our outlook for economic activity is probably on its best footing since the recovery began in mid-2009.

However, inflation is too low relative to the FOMC’s 2 percent objective. In fact, inflation has averaged just 1-1/2 percent for the past six years, and it is hard to see inflation heading up to target in the near term. This worries me quite a bit, and I will spend a good deal of time today explaining my concern.

It is largely because of this outlook for inflation that I think the FOMC should refrain from raising the federal funds rate (our traditional short-term interest rate policy tool) until there is much greater confidence that inflation one or two years ahead will be at our 2 percent target. I see no compelling reason for us to be in a hurry to tighten financial conditions until then.

Goal-Oriented Approach to Monetary Policy

For some time now, I have been advocating a goal-oriented approach to monetary policy[1]. This is distinct from an instrument-rule approach, like in Taylor (1993). In fact, it is more closely related to a seminal Taylor (1979) article’s treatment of optimal monetary policy. The Federal Reserve Act mandates that monetary policy should work to foster financial conditions that promote both full employment and price stability. To me, this means setting our policy tools with the aim of achieving both of our goals in a reasonable amount of time while minimizing potential risks associated with uncertainty over the course of future economic events. This is a tall order, but that’s the stuff of central banking.

Before I get to the specifics of how I think policy should be set in the current circumstances, let me first discuss where I see the U.S. economy standing today with respect to our goals of full employment and price stability.

Nearing Our Employment Goal

Following years of false starts and tepid growth, the pace of U.S. economic growth these past two years has been quite good. Real gross domestic product (GDP) increased at an average rate of 2-3/4 percent over this time, and growth was at a quite rapid 3-1/2 percent annualized pace in the second half of 2014. Looking ahead, I am expecting growth to average near 3 percent for the next couple years.

As output growth has improved, so has the labor market.Average payroll employment growth was 260,000 per month in 2014 and early 2015. This is well above the average monthly gain of roughly 190,000 during the previous two years. With 3 percent output growth, the average monthly job gain should remain above the 200,000 mark for some time before gradually moving back down toward its longer-run trend.

Since the end of 2010, the unemployment rate has declined significantly and steadily. In each of the past four years, it has fallen by about 1 percentage point and now stands at 5.5 percent. This is terrific progress, but 5.5 percent remains somewhat higher than what a normal, sustainable unemployment rate should be. Most FOMC participants’ estimates for the longer-run normal rate of unemployment fall in the range of 5.0 percent to 5.2 percent.[2] Based in part on the extensive analysis done by my staff on compositional and demographic changes in the labor force, I think that it it’s more like 5.0 percent.[3] So, in my mind, the degree of labor market slack may be somewhat larger than what some others infer from the 5.5 percent U.S. unemployment rate.

Some other labor market indicators support this assessment of slack. For example, the number of people who are involuntarily employed part time remains unusually high. If the economy were closer to full employment, these individuals would have more opportunities to find full-time jobs. Furthermore, wage growth has been much lower than one would expect if labor markets were closer to normal.

Even with these caveats, the U.S. economy and labor markets have seen great improvement over the past two years. Monetary policy has been an important factor in this progress. The Federal Reserve initially responded to the financial crisis and ensuing deep recession by providing accommodation in the usual way — by cutting short-term interest rates. But once rates hit their zero lower bound (ZLB), we had to turn to other nonconventional tools to provide further accommodation, notably large-scale asset purchases (LSAP) and guidance regarding future movements in the federal funds rate.[4]

One of our most notable and controversial responses followed our September 2012 meeting. At that time, three years into the recovery, the unemployment rate was over 8 percent. Moreover, forecasts showed a strong risk that improvements in the labor market were about to stall.[5] It was clear that more accommodation was needed, but just how to provide that accommodation was unclear. Against this backdrop, the FOMC announced that the Fed would steadily purchase $85 billion of long-term Treasury and mortgage-backed securities each month until we saw substantial improvement in the outlook for the labor market. This open-ended program is often referred to as QE3.[6]

Within a year, more accommodative financial conditions helped reenergize employment gains. Borrowing rates declined. Car sales rose, and consumer conditions improved. This recovery is all the more remarkable in that it occurred at a time when already strong headwinds — such as higher income tax rates and cuts in federal spending — were gaining strength.

Of course, to be completely fair, the U.S. economy was long overdue for just such an acceleration in growth and employment. So, maybe the past couple of years have been a combination of luck and good policy. I don’t think it was all luck. Just as it’s good to be lucky, it’s also good to be resourceful.

Regardless of whether it was good fortune or effective policy that propelled growth, our asset purchase program and the explicit conditions of its implementation demonstrated clearly that the Federal Reserve is fully committed to undertaking goal-oriented monetary policy actions. The sheer size of our asset purchases certainly had some direct effect on lowering interest rates. But these policies were all the more effective because of their open-ended, goal-oriented nature that confirmed our commitment to act until we saw the desired improvements in labor markets.

Now let me turn to inflation.

Missing Our Inflation Goal

Since 2012, the FOMC has set an explicit longer-run goal for inflation of 2 percent as measured by the year-over-year rate of change in the Price Index for Personal Consumption Expenditures (PCE).[7] Inflation has been running well below this rate for quite some time, averaging 1-1/2 percent for the past six years. Currently, core PCE prices are up 1.3 percent from a year ago.[8] Of course, there are other measures of inflation, such as the well-known Consumer Price Index (CPI).[9] The CPI inflation runs 1/4 to 1/2 of a percentage point higher than PCE inflation on average due to differences in methodology. So a 2 percent target for PCE inflation equates to something closer to a 2-1/2 percent goal in terms of CPI inflation. By this measure, too, inflation is falling well short of our goal, as changes in the CPI have averaged less than 2 percent since 2008.

Simply put, inflation is too low. I know that it sounds unusual for a central banker to make that claim. I certainly never expected I would utter those words. Those of you who are as old as I am have heard the refrain for most of your mature life that inflation is too high and it needs to be lower.

My long-held views on inflation were forged in the 1970s and early 1980s. U.S. inflation rose to an alarming 10 percent during that period and seemed destined to remain there.[10] Fearing that inflation was spiraling out of control, the Paul Volcker-led Fed raised interest rates steeply and successfully broke the back of double-digit inflation. By the time of Volcker’s departure in 1987, inflation was running about 4 percent a year. The Greenspan-led Fed then spent the next dozen or more years trying to inch inflation down to about 2 percent. That goal was achieved in the early 2000s, and the Fed has aimed to bring PCE inflation in at 2 percent for the past ten or more years. First, this was an informal objective, but later it was made an explicit goal.

Why is it important for the Federal Reserve to achieve its 2 percent inflation objective? What is the problem posed by too-low inflation? Simply put, prolonged and significant deviations of actual inflation from what consumers and businesses are expecting when they make long-term investment decisions could impose significant costs on the economy.

For instance, interest rates on loans are set high enough to compensate lenders for expected inflation. From the lender’s point of view, if actual inflation exceeds the level expected when the loan was originated, loan payments remain fixed in nominal terms, but the purchasing power of those interest receipts is less than lenders had expected. So, unexpectedly high inflation hurts creditors.

On the flip side, when prices and, along with them, wages and incomes rise at a slower rate than anticipated, borrowers’ fixed monthly loan obligations become more burdensome. And the longer inflation undershoots borrowers’ expectations, the higher are these real costs. These costs have been accumulating for the past six years, during which inflation has underrun the FOMC’s 2 percent target that borrowers had relied upon. To meet these higher real costs, borrowers must cut back other spending, reducing aggregate demand and ultimately weighing on economic activity.

This is one of several reasons why we need to achieve our 2 percent inflation objective. It also explains why achieving symmetry around our 2 percent goal is important.

Slow and Uncertain Improvement toward Our Inflation Goal

To reiterate, I am concerned about the current low inflation environment in the United States and about the inflation outlook. Core inflation is about 1.3 percent today, and my forecast has it rising to 2 percent only by the end of 2018. This is a woefully gradual pace. Furthermore, there are downside risks to my projection.

Since last summer, the dollar has appreciated nearly 23 percent against major currencies. The stronger dollar presents a clear disinflationary pressure through its influence on U.S. import prices. Similarly, the dramatic decline in oil prices lowers consumer inflation, albeit temporarily, even as it bolsters the real spending capacity of consumers and businesses.

If lower energy and import prices result in just a one-time drop in consumer prices, then they would not be an issue for monetary policymakers to worry about. But if the lower pricing gets embedded more persistently in the longer-run inflationary expectations of households and businesses, this would make it even harder to get inflation back to its 2 percent target. The Fed needs to be ready to take steps counteracting any indications that longer-run inflation expectations are deviating from 2 percent.

I should note that low inflation is a global phenomenon. In part, this reflects slower global growth and disinflationary pressures in most advanced economies. Of course, a global slowdown also presents some downside risk to the outlook for growth in the U.S.

An Appropriate Path for Monetary Policy

Given this assessment, what is my outlook for monetary policy and the most appropriate path for the U.S. interest rates?

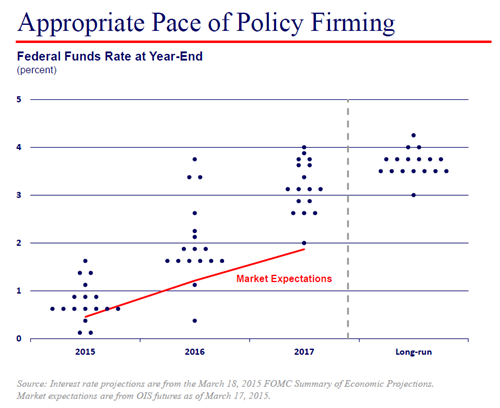

Four times a year, my colleagues and I submit forecasts of real GDP growth, the unemployment rate, and inflation over the next three years. There is no single assumption of appropriate policy that all the FOMC participants use to shape their forecasts. Therefore, along with those projections, we provide our individual assumptions for the appropriate path for monetary policy that underlies our economic forecasts. These forecasts are reported as the Summary of Economic Projections (SEPs), with the policy expectations presented in what is often referred to as the “Dot Plot.”

Our Chair, Janet Yellen, discusses this chart during her press conferences.

In the latest projections made just last week, 15 of the 17 FOMC participants expected that it would be appropriate to raise the federal funds rate sometime this year.[11] As you can see from the chart, while there is a fair amount of dispersion among the individual participants’ projections, the median for the target federal funds rate at the end of this year is a bit above half a percent. And note that FOMC participants’ views differ even more in regard to the end of 2016: Most expect the fed funds rate to be set below 2 percent, but three of my colleagues think the fed funds rate should be in the range of 3 to 4 percent by the end of that year.

The “median participant” expects the target fed funds rate to be about 1-3/4 percent by the end of 2016. In other words, according to the median path for the target fed funds rate as projected by FOMC participants, rate increases of about 50 basis points for this year and 100 basis points next year are to be expected. The FOMC meets eight times a year. So, the projected path is consistent with a 25 basis point increase at every other FOMC meeting. I should note that this would be a considerably slower, more gradual pace of rate increases than those implemented in 2004 through 2006 — the last time the Fed normalized policy following an extended period of very low interest rates.

The solid red line in the dot plot shows financial market participants’ expectations for our policies. Currently, they expect an even slower pace of rate hikes than the FOMC participants do. In fact, market expectations puts the target rate at the end of 2016 at about 1 percent — 75 basis points below the median FOMC forecast.

What is my personal view of the appropriate path for Fed policy? I think economic conditions are likely to evolve in a way such that it will be appropriate to hold off on raising short-term rates until 2016.

Economic activity appears to be on a solid, sustainable growth path. However, inflation is low and is expected to remain low for some time — and I have serious concerns that inflation will run even lower than I expect.

Accordingly, in my view, a prudent risk-management and goal-oriented approach to U.S. monetary policy dictates that we continue to assess inflation developments for some time before generating more restrictive financial conditions.[12] One risk I worry about is that we begin to raise rates only to learn that we misjudged the strength of the economy. Another is that some disinflationary shock will hit as we drift along a low inflation path. In either of these cases, we would find ourselves in the extremely uncomfortable position of being forced to lower short-term rates back to their zero lower bound — a policy position that has already proved challenging for the Fed (and for other central banks). On the other hand, if we were too timid and did not lower short-term rates back to the zero lower bound under either of those circumstances, policy would be overly restrictive.

Now consider an alternative risk: We wait too long to raise rates, and subsequently, inflation picks up faster than the projected gradual path to 2 percent. Given how far inflation is from our target, some greater-than-expected pickup in inflation would actually be welcome. Furthermore, if we were to end up with a period of inflation running moderately above 2 percent, the associated costs would be low. It would just be the symmetric flip side of our recent below-target inflation experience. And in the event the risk of overshooting our target by an uncomfortable margin did arise, given the inertia in inflation, we would likely have ample time to address the problem with moderate increases in interest rates.

I should note that this type of risk-management approach is a long-standing feature of U.S. monetary policy. I quote former Fed Chairman Alan Greenspan from a speech he made in 2004:

"The conduct of monetary policy in the United States has come to involve, at its core, crucial elements of risk management. This conceptual framework emphasizes understanding as much as possible the many sources of risk and uncertainty that policymakers face, quantifying those risks when possible, and assessing the costs associated with each of the risks."[13]

In a recent Brookings paper, some of my colleagues at the Chicago Fed and I show that the FOMC’s policy communications contain numerous instances when the Committee appeared to use a variety of risk-management rationales for slightly shifting the funds rate higher or lower than conditions might otherwise call for.[14] The Committee often cited uncertainty about the economic outlook or the need to take out insurance against low-probability but potentially costly outcomes as a rationale for such actions. The Asian financial crisis in 1997–98 and then the tragedy of September 11, 2001, are two of the more prominent examples that prompted the Committee to respond in this way.

In our Brookings paper, we develop some simple theoretical models that illustrate the importance of risk management at the zero lower bound. We show that when the economy is at or near the zero lower bound, monetary policymakers should be cautious about raising rates if there is uncertainty about the potential for unforeseen shocks to push the economy back toward the ZLB. The ZLB induces an important policy asymmetry: Although rates can be raised to bring down inflation if inflation comes in surprisingly high, rates cannot be lowered below zero to boost activity or lift inflation after downside shocks. Of course, the further rates are from the ZLB and the closer we are to meeting our policy targets, the less important this effect is. But we aren’t there yet.

I should also note that these risk-management considerations mean that the best policies can and should deviate from simple rules that mechanically adjust interest rates as employment and inflation diverge from their long-run targets. These simple rules often will not lead to the best responses to the uncertain economic environment policymakers face day to day. Once again I cite former Chairman Greenspan (2004):

"Prescriptions of formal rules can, in fact, serve as helpful adjuncts to policy, as many of the proponents of these rules have suggested. But at crucial points, like those in our recent policy history — the stock market crash of 1987, the crises of 1997–98, and the events that followed September 2001 — simple rules will be inadequate as either descriptions or prescriptions for policy."

Markers of Progress

Of course, at some time, it will become appropriate to increase the federal funds rate. For me to feel comfortable doing so, I will need to be confident enough that we will achieve our dual mandate goals within an acceptable period of time and that we are at low risk of regressing back to economic conditions that necessitate policy rates returning to their zero lower bound. There are several important indicators that will assure me that growth and inflation are on the right sustainable trajectories.

First, it goes without saying that we need to see continued improvements in labor markets and GDP growth. Even though we have made great strides, the U.S. economy has not yet returned to full employment, and we must be confident that growth will not stall before getting there.

Second, we should feel quite confident that inflation will reach our goal of 2 percent on a sustainable basis within a reasonable amount of time — say, within a year or two. I don’t have that level of confidence yet. My forecast assumes policy rates will begin to rise sometime in the first half of 2016, which is a critical element in my approach to generating higher inflation. Even with a liftoff in 2016, my forecast is that we will achieve 2 percent inflation only in 2018. Certainly, I would like to reach our target inflation rate earlier than that — say, in 2017 or 2016, which would be a much more successful outcome.

So what would make me more confident that inflation is heading higher?

A simple signal will be if we start seeing a pickup in the year-over-year rate of change in the price index for core PCE — which strips out the volatile changes in food and energy prices. As a matter of practical forecasting, core inflation today may be about the single best predictor of where total inflation will be a year from now. So I would like to see core PCE inflation begin to rise above its current 1.3 percent rate in a sustainable fashion. If it does not, then that’s a clear sign that there are important factors persistently driving down inflation.

I would also need to see stronger growth in wages and other forms of labor compensation. Wage growth has been very weak for quite some time, averaging only 2 to 2-1/2 percent per year for the past five years. Usually, productivity growth of 1 to 2 percent annually and 2 percent inflation would produce wage growth in the range of 3 to 4 percent per year. Wage and compensation growth closer to this range is an important sign not just of diminished labor market slack, but also of cost increases more consistent with an economy running closer to a 2 percent inflation rate.

The last signal I will need to see relates to measures of inflation expectations. Specifically, I need more evidence that the public and financial markets expect that inflation will be rising over the medium term in line with our 2 percent objective. Survey measures of long-term inflation expectations in the U.S. have been remarkably stable since the late 1990s. The optimist in me sees this as an indication of the Fed’s credibility with respect to its price stability goal. However, I also worry that survey measures might be like a stopped clock that won’t provide a timely signal of changes in inflation attitudes. Some will recall that surveys in Japan showed stable inflation expectations even after the economy had experienced several years of deflation. When expectations did move down, it took extraordinary policy actions by the Bank of Japan to edge them back up. So, I can’t help but be cautious and not take too much comfort from the U.S. survey measures.

The large declines in long-term interest rates we have experienced over the past year — and what they might imply for the inflation outlook — offer no comfort either.

Since last July, the yield on ten-year U.S. Treasury securities has declined by about 70 basis points. Over the same period, the difference between the yields on nominal Treasury securities and Treasury Inflation-Protected Securities, or TIPS,[15] has declined almost one for one with long-term nominal yields. This difference, of course, represents the compensation that investors purchasing nominal Treasury securities need to receive because the returns on those bonds are exposed to inflation risk while TIPS returns are not. So it seems these investors now require less extra yield to compensate for bearing inflation risk than they did before. Investors are currently demanding about 1.8 percent in extra yield as compensation for CPI inflation six to ten years from now; however, last July, they were demanding nearly 2.5 percent.[16] These are large declines that have brought long-term inflation compensation in the U.S. down to the bottom tenth percentile of its historical levels in just a few months.

These data are clearly flashing a warning sign. But are they giving us a reliable signal of a shift in long-term inflation attitudes in the U.S.? Sophisticated econometric models of the term structure of interest rates can be used to parse inflation compensation into a number of factors: market participants’ expectations of future inflation, an inflation risk premium, and a residual factor reflecting differences in liquidity and other trading features in these markets. As with most models, the results critically depend on the models’ identifying assumptions and the estimation methodology used.

The estimates from some of these models suggest that the primary driver of the fall in yields has been the residual factor. Such developments should be short-lived and soon reverse themselves. Indeed, in the last couple of months, we have seen a small upward movement in inflation compensation and the residual factor.

However, it is possible that some of these term structure models might be conflating movements in liquidity and other trading features with unknown or unmodeled elements that have less benign interpretations and are more persistent. For instance, the changes in the residual factor might reflect a stronger preference for safe assets by global investors.

Similarly, declines in inflation risk premia, even if inflation expectations remain stable, can signal that investors are now viewing low inflation outcomes as being more economically costly. My colleague Narayana Kocherlakota has spoken extensively about this and has pointed out how such a change in investors’ assessment of potential inflation outcomes should be a source of concern for monetary policymakers.[17]

Moreover, not all term structure models indicate that inflation expectations are stable. Most notably, a model estimated by Chicago Fed staff finds only small and unexceptional changes in inflation risk premia during the recent period.[18] It does suggest that expectations of future inflation in the U.S. have moved down. The model relies on the breakdown of inflation among food, energy and core components to better capture the dynamic relationship between interest rates and inflation. Although the model’s fitting errors have risen over the past year, its forecasts for inflation five years ahead also have fallen about 20 to 30 basis points over this time. In fact, the model has been projecting very low inflation for some time. For instance, at the end of 2013, its projection for core PCE inflation in 2014 was 1.4 percent, compared with 1.7 percent projected by the Survey of Professional Forecasters.[19] The actual core PCE inflation in 2014 was 1.4 percent. Today, the Chicago Fed model projects that average annual total PCE inflation between February 2018 and February 2021 — three to six years from now — will be only 1-1/2 percent. That is simply too low to be consistent with our longer-run inflation objective of 2 percent.

All told, we cannot definitively state what has driven inflation compensation in the U.S. down in recent months. It could be benign, transitory factors that will dissipate in a few months. In that case, we can take full comfort from the stability of survey measures of inflation expectations. That said, it is also quite possible that market-based measures are capturing unfavorable changes in investors’ inflationary attitudes and expectations that survey measures are missing.

Because it is uncertain which scenario is the true one, a risk-management approach to monetary policy, once again, seems appropriate. If it is the benign scenario, then waiting to see inflation compensation recover before normalizing policy would be appropriate. If it is the more worrisome scenario, then we should not begin the monetary policy normalization process until the 2 percent inflation target is closer to our reach. In either case, waiting to begin the policy normalization process seems appropriate.

Current Circumstances Call for Caution

In summary, I think we should be cautious in raising interest rates. There is no prescribed timeline that must be adhered to and no pre-set script to follow other than that we should let economic conditions and risks to the outlook be our guides for implementing appropriate policy. Given uncomfortably low inflation and an uncertain global environment, there are significant risks, but few benefits, to increasing interest rates prematurely. Let’s be confident that we will achieve both dual mandate goals within a reasonable period of time before taking actions that could undermine the very progress we seek.

[1] This is a point I’ve been making regularly in my public appearances since 2010. See, for example, Evans (2010, 2011, 2014c, 2014b). Minneapolis Fed President Kocherlakota (2015) supports the same approach.

[2] See Federal Open Market Committee (2015), which features the most recent results from the Summary of Economic Projections. The full range of longer-run projections for the unemployment rate is 4.9 percent to 5.8 percent.

[3] See Aaronson et al. (2014)—which is recent research by Chicago Fed staff on labor force participation rates and the natural rate of unemployment, or longer-run normal rate of unemployment (which represents the unemployment rate that would prevail in an economy making full use of its productive resources).

[4] For more on LSAPs, see Board of Governors of the Federal Reserve System (2015a). For more on our guidance regarding future movements in the federal funds rate, see Board of Governors of the Federal Reserve System (2015b).

[5] For instance, the central tendency of FOMC participants’ projections made in September 2012 (see Federal Open Market Committee, 2012a) was for the unemployment rate to edge down from 8.1 percent in 2012 to 7.9 percent in 2013. The September 2012 forecasts from the Blue Chip Economic Indicators showed a similarly shallow path for the projected improvements in the unemployment rate.

[6] The Fed halted LSAPs made under QE3 (the third round of quantitative easing) in October 2014; see Federal Open Market Committee (2014).

[7] This was first acknowledged in Federal Open Market Committee (2012b).

[8] Core PCE inflation strips out the volatile energy and food prices and thus provides a more accurate reading on underlying inflation trends than the overall PCE inflation. I discuss this measure again later.

[9] The CPI differs from the PCE in methodology and the basket of goods and services it tracks.

[10] For the four quarters ending in 1975:Q1, core PCE inflation was 10.1 percent and then, more than five years later, stood at 9.7 percent for the four quarters ending in 1980:Q4.

[11] See Federal Open Market Committee (2015). Note that the number of voting members differs from the number of participants. Every participant provides a forecast, but the voting members rotate annually. For example, the president of the Cleveland Fed and I alternate votes every other year.

[12] I have made the case for a cautious approach to tightening financial conditions based on risk-management considerations in earlier speeches. See, for example, Evans (2014a).

[13] Greenspan (2004).

[14] Evans et al. (2015).

[15] For more on TIPS, see U.S Department of the Treasury (2013).

[16] Note that this 1.8 percent compensation for CPI inflation would translate to about 1.5 percent in PCE inflation terms — well below the FOMC’s 2 percent target.

[17] Feldman et al. (2015).

[18] The specifics of the Chicago Fed term structure model can be found in Ajello, Benzoni and Chyruk (2012).

[19] The 2014 core PCE inflation forecast from the Survey of Professional Forecasters (conducted by the Philadelphia Fed) was calculated as the average inflation projected one to four quarters ahead as of the fourth quarter of 2013.

References

Aaronson, Daniel, Luojia Hu, Arian Seifoddini and Daniel G. Sullivan, 2014, “Declining labor force participation and its implications for unemployment and employment growth,” Economic Perspectives, Federal Reserve Bank of Chicago, Vol. 38, Fourth Quarter, pp. 100–138.

Ajello, Andrea, Luca Benzoni and Olena Chyruk, 2012, “Core and ‘crust’: Consumer prices and the term structure of interest rates,” Board of Governors of the Federal Reserve System and Federal Reserve Bank of Chicago, working paper, December 19.

Board of Governors of the Federal Reserve System, 2015a, “What are the Federal Reserve's large-scale asset purchases?,” Current FAQs, January 16.

Board of Governors of the Federal Reserve System, 2015b, “How does forward guidance about the Federal Reserve's target for the federal funds rate support the economic recovery?,” Current FAQs, January 16.

Evans, Charles L., 2014a, “Patience is a virtue when normalizing monetary policy,” speech, Peterson Institute for International Economics conference, Labor Market Slack: Assessing and Addressing in Real Time, Washington, DC, September 24.

Evans, Charles L., 2014b, “Monetary goals and strategy,” speech, 23rd Annual Hyman P. Minsky Conference, Levy Economics Institute of Bard College, Washington, DC, April 9.

Evans, Charles L., 2014c, “Like it or not, 90 percent of a ‘successful Fed communications’ strategy comes from simply pursuing a goal-oriented monetary policy strategy,” speech, U.S. Monetary Policy Forum, Initiative on Global Markets at the University of Chicago Booth School of Business, New York, February 28.

Evans, Charles L., 2011, “Monetary policy: Slow progress toward our goals,” speech, Rockford Chamber of Commerce Economic Outlook Luncheon, Rockford, IL, February 17.

Evans, Charles L., 2010, “Monetary policy in a low-inflation environment: Developing a state-contingent price-level target,” speech, Federal Reserve Bank of Boston’s 55th Economic Conference, Revisiting Monetary Policy in a Low Inflation Environment, Boston, October 16.

Evans, Charles L., Jonas D. M. Fisher, François Gourio and Spencer Krane, 2015, “Risk management for monetary policy near the zero lower bound,” Brookings Papers on Economic Activity, Spring, forthcoming.

Federal Open Market Committee, 2015, Summary of Economic Projections, Washington, DC, March 18.

Federal Open Market Committee, 2014, press release, Washington, DC, October 29.

Federal Open Market Committee, 2012a, Minutes of the FOMC meeting, Washington, DC, September 12–13.

Federal Open Market Committee, 2012b, press release, Washington, DC, January 25.

Feldman, Ron, Ken Heinecke, Narayana Kocherlakota, Sam Schulhofer-Wohl and Tom Tallarini, 2015, “Market-based probabilities: A tool for policymakers,” Federal Reserve Bank of Minneapolis, working paper, January 7.

Greenspan, Alan, 2004, “Risk and uncertainty in monetary policy,” speech, Meetings of the American Economic Association, San Diego, January 3.

Kocherlakota, Narayana, 2015, “Goal-based monetary policy report,” speech, Market News International event, New York, January 13.

Taylor, John B., 1993, “Discretion versus policy rules in practice,” Carnegie-Rochester Series on Public Policy, Vol. 39, Vol. 1, December, pp. 195–214.

Taylor, John B., 1979, “Estimation and control of a macroeconomic model with rational expectations,” Econometrica, Vol. 47, No. 5, September, pp. 1267–1286.

U.S. Department of the Treasury, 2013, “TIPS: FAQs,” Treasury Direct, November 26.