The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Despite the challenges raised by the California energy crisis and the bankruptcy of Enron, efforts continue to increase competition and restructuring in electricity markets. Of the five states in the Seventh District, Illinois and Michigan have been aggressively pursuing restructuring, while Iowa, Indiana, and Wisconsin have adopted a more cautious approach. A recent Chicago Fed conference brought policymakers and industry leaders together to discuss the status and prospects of electricity policy in the region.

On January 17, 150 participants from business, government, and academia came to the Federal Reserve Bank of Chicago to discuss the current status and future prospects of electricity policy in the Midwest. This conference was the first part of a bank initiative to study the infrastructure of the Midwest economy. The program focused on policy issues that require multistate regional cooperation. In particular, federal, state, and industry representatives discussed how to create the proper regulatory environment to encourage needed investment in generation and transmission facilities.

Michael H. Moskow, president and chief executive officer of the Federal Reserve Bank of Chicago, opened the conference by underlining the importance of electricity policy in promoting the health of the region’s economy. Moskow noted that there are few things as basic to an industrial and information-based economy as the terms on which we acquire our electric power. However, he noted that many analysts feel that an uncertain regulatory climate and volatile financial conditions may be discouraging needed investment in basic electricity infrastructure. In particular, Moskow said that promoting an efficient electricity grid and the movement toward a less-regulated and more market-oriented system requires the coordinated development of regional infrastructure that addresses interstate transmission and interconnection. Developing or adapting institutions to guide this regional approach is a clear challenge to electricity policymakers.

Moskow suggested that conference participants should focus on the following critical questions:

- Are we developing the necessary regional electricity infrastructure to support the economic development needs of the Midwest?

- What is the relationship between meeting new air emissions goals and generating power? Can electricity capacity be increased even as we improve air quality?

- What are the roles and institutions that are needed to guide electricity policy? Are new institutions needed? How can they be successfully organized so as to have the proper resources and incentives to meet the long-term requirements of the increasingly less-regulated and more market-oriented environment?

A federal perspective on electricity policy

Presenter: Robert Dixon, deputy assistant secretary, U.S. Department of Energy

Robert Dixon began by suggesting that the energy industry will need to make significant capital investments in the next ten to 20 years to replace aging infrastructure and meet rising demand. Dixon noted that the President’s National Energy Plan, released in May 2001, details the need for hundreds of new power plants and thousands of miles of power transmission lines and natural gas pipelines. The total capital requirement for these energy resources could reach into the hundreds of billions of dollars. Given that these investments are in long-lived capital assets, it is critical that the best technology choices are made to ensure that the cleanest, most efficient, reliable, and affordable electricity is produced.

Dixon acknowledged that most electricity policy decisions are made at the state level. In the broadest sense, the federal role in electricity policy is to develop a national energy plan and to work with the state and private policymakers to implement the plan. To this end the President’s National Energy Plan recommends that the “Secretary of Energy propose comprehensive electricity legislation that promotes competition, protects consumers, enhances reliability, promotes renewable energy, improves efficiency, repeals the Public Utilities Holding Company Act of 1935 and reforms the Public Utilities Regulatory Policy Act of 1978.”

The revisions to the basic federal electricity laws are necessary to reflect the new conditions in electricity markets. In 1935, electricity markets were local, with virtually no interstate transmission grid. Power generation was built near consumers and electricity provision was considered a natural monopoly. Today, the transmission grid is not only interstate but also international. Electricity markets include large multistate regions, and interstate bulk power transactions are becoming an increasingly large share of the electricity trade.

Dixon suggested that it is the federal role to focus on core federal issues in electricity legislation that are beyond state control. These core issues include: regulation of interstate commerce, electricity transmission, ensuring reliability of the interstate transmission system, protecting against the use of market power, ensuring consumer protection, defining the role of federal electric utilities, reforming existing electricity laws, and defining regulatory jurisdiction.

In elaborating on the federal role, Dixon noted that investments in new transmission capacity have failed to keep pace with the growth in demand and the changes in industry structure. Since 1989, electricity sales have increased at a rate of 2.1% per year, while transmission capacity has increased by only 0.8% per year. Dixon suggested that since the transmission system is both interstate and international, regulation of the grid is a federal responsibility. To provide economic incentives for investment in new transmission, the National Energy Policy proposes encouraging the Federal Energy Regulatory Commission (FERC) to advocate incentive rates to promote transmission expansion. In addition, transmission investments could be promoted by improvements to the siting process. This could include permitting siting by the federal government for facilities used for interstate transmission.

In the area of jurisdiction, Dixon noted that the boundaries between the federal and state regulators have increasingly blurred. While it is important that federal jurisdiction in matters of interstate commerce is recognized, the states should still be able to tailor their electricity policy to consumers’ interests. For example, public purpose fees for utilities are often proposed to promote programs such as conservation and low-income assistance.

Dixon believes that it is best to let states determine which public purpose fees suit them best.

Dixon concluded his presentation with some comments on the direction of electricity policy following the Enron bankruptcy. He suggested that a return to a more tightly regulated electricity markets would be a mistake. The lesson to be learned from Enron is to do a better job setting the rules of the road and to continue to move forward with open and competitive electricity markets. Dixon noted that in the past, heavy regulation had led to such abuses as utility construction programs unrelated to consumer needs, billions of dollars of “stranded costs”1 imposed on ratepayers, and bloated utility budgets.

Emissions policies for utilities

Presenter: Brian McLean, director, Clean Air Markets Division, U.S. Environmental Protection Agency

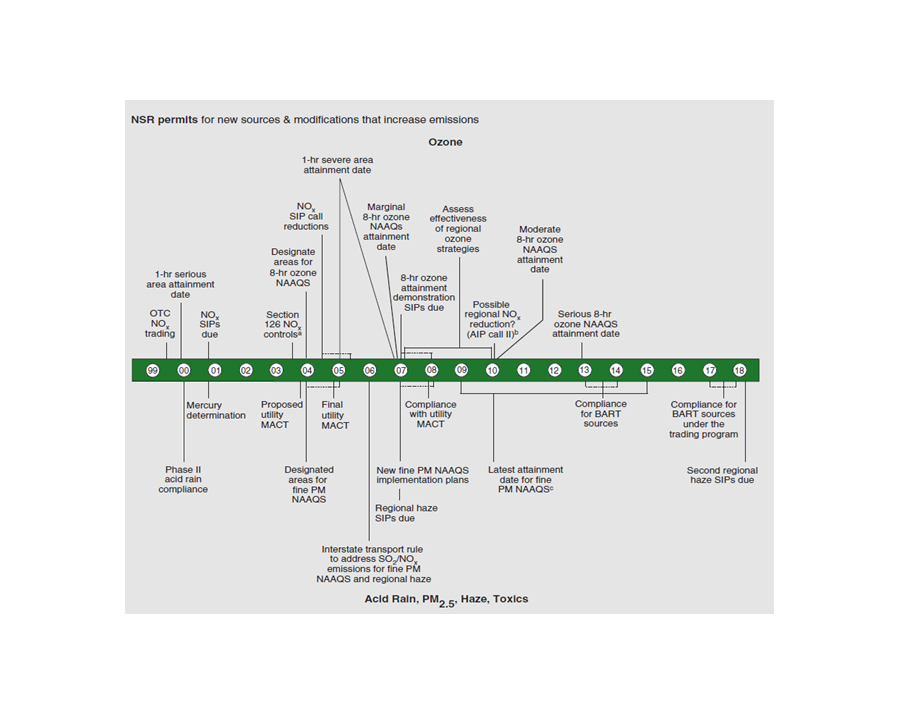

Brian McLean’s presentation focused on the development of emissions policies for the power sector. Electricity power generation is a major source of such air emissions as sulfur dioxide (SO2), nitrogen oxides (Nox), and mercury. Current policies favor individual strategies for addressing each type of pollutant (see figure 1.) New policies in development by the Environmental Protection Agency (EPA) favor a comprehensive, multipollutant strategy. A multipollutant strategy has the ability to address multiple environmental issues, including particulate matter, visibility, ozone, acid rain, eutrophication,2 and mercury. This approach can also help reduce costs by consolidating regulations, increasing flexibility for meeting standards, and creating a predictable regulatory outlook for emissions sources. This type of program (with appropriate measures to address local concerns) would provide significant public health benefits even while increasing electricity supplies.

1. Timeline: Electric power sector faces numerous Clean Air Act regulations

a The Washington DC Circuit Court has delayed the May 1, 2003, EGU compliance date for the section 126 final rule.

b Further action on ozone would be considered based on the 2007 assessment, as well as on the success of states in attaining the new ozone NAAQS by 2009.

c The SIP-submittal and attainment dates are keyed off the date of designation; for example, if PM or ozone is designated in 2004, the first attainment date is 2009.

McLean noted that adopting market-based incentives is an important part of moving to a multipollutant strategy whose goal is to cut SO2, Nox, and mercury emissions from power generators by 70% to 80% over the next 15 to 20 years. In particular, this means establishing a national emissions trading and banking program for these pollutants. Establishing a national cap and trade system would provide assurance of environmental protection, while permitting the replacement or streamlining of a variety of existing regulations, including new source review, regional haze BART (best available retrofit technology), mercury MACT (maximum achievable control technology), Nox SIP (State Implementation Plan) call, and Title IV requirements.

In establishing such a program, McLean suggested that the EPA’s acid rain trading program has provided a useful example for how these markets can operate. This trading program has reduced SO2 emissions by 50% from 1980 levels, with a compliance rate of nearly 100%. Compliance costs for the acid rain program have been low, and the program has created incentives for innovation. In addition, the program has not led to pollution “hot spots” from trading activity. A multipollutant program would lead to savings of $9 billion per year by 2020 as compared with a “business as usual” emissions program. McLean also noted that additional benefits of this approach include greater compatibility with utility industry restructuring efforts and state and local air quality programs. Finally, since this program would be patterned after the existing acid rain program, much of the infrastructure is already in place to facilitate trading and monitor reporting on emissions levels.

Industry perspectives on restructuring

Presenters: John Rowe, president and co-chief executive officer, Exelon Corporation; Karl McDermott, vice president, National Economic Research Associates; and Robert Schainker, product manager, Electric Policy Research Institute

The final panel of the morning provided a perspective from the power industry on electricity restructuring. John Rowe began by noting that the vision for electricity restructuring was to promote efficiency through a competitive generation market, while maintaining regulation for electricity transmission and distribution. Prompting this policy shift was the concern that during the late 1970s and the 1980s, excess generating capacity was being created and this in turn was leading to rising electricity prices. Rowe endorsed the continuing efforts to increase competition and restructuring in electricity markets, despite the challenges raised from the California energy crisis and the bankruptcy of Enron. He suggested that there is evidence that restructuring has made progress. Between 1999 and 2001, more than 65,000 megawatts of new generating capacity was built, and wholesale power markets were created. Annual wholesale power market sales increased from 27 million megawatt hours (MWhs) in 1995 to 2.7 billion in 1999. Consumers have also been beneficiaries of restructuring, with electric competition in Pennsylvania having saved employers and consumers nearly $4 billion since it was enacted. Finally, regional transmission organizations (RTOs), critical to efficient grid operations and a vital wholesale market, are beginning to evolve.

Rowe commented that utilities, customers, and competitors do not want a return to the days of monopoly utilities. He cited several factors that would help make electricity competition work. First, he endorsed FERC Chairman Pat Wood’s objective of “making competition work.” Second, he noted that it is critical that policymakers permit flexibility as competitive markets help define the intersection between regulated and unregulated services. Third, Rowe said that FERC should use its authority to ensure the development of robust wholesale markets that operate efficiently and competitively. Finally, state authorities should ensure that the benefits of competition are passed on to retail customers without unacceptable risks to reliability or price volatility.

Rowe went on to detail some of his recommended policy actions. The first touched on the role of FERC in implementing RTO policies. While Rowe objected to FERC’s selection of the Midwest Independent Transmission System Operator (MISO) as the Midwest RTO, he said he was hopeful that arrangements could be made to effectively integrate Alliance RTO and achieve the broader policy goal of an effective transmission system. Rowe argued that large scale RTOs need to be created for the southeast and western United States as well. Proper RTO design will help encourage much needed transmission infrastructure investment.

A second objective that FERC should pursue, Rowe said, is establishing a standard market design for wholesale electricity markets. This should include a bid-based, real-time balancing market using locational marginal pricing. FERC should also insist on the use of standardized business rules and could model these rules after the Gas Industry Standards Board.

A third objective would be to clarify market power rules. Rowe objected to the new market power test approved by FERC on November 20 and suggested that the previous “hub and spoke” test would be sufficient for generating companies that have demonstrated progress in working with RTOs and standardizing market designs. Finally, Rowe endorsed efforts by FERC to standardize rules for interconnections and to make it clear that new generators pay for the facilities necessary to serve them.

Rowe concluded his remarks by asking, “how can we strike the correct balance between supply and price security versus developing a thriving marketplace with multiple suppliers to choose from?” The solution from Rowe’s perspective is developing a market-oriented method of limiting the delivery company’s supply obligation and stimulating competition by taking advantage of important differences between large customers and mass market customers. Mass market customers would continue to be offered a fixed price energy supply. Utilities would be obligated to plan for load growth for mass market customers and would assume the price risk for changes in wholesale markets. In contrast, default service for large customers would be at wholesale market prices. The large customer would assume the price risk. Rowe believes that this default-supply solution would promote the development of a mature competitive market, while maintaining electricity stability and reliability.

Next, Karl McDermott, a former commissioner of the Illinois Commerce Commission, observed that there is a current mismatch between power industry objectives and the regulatory paradigm. The regulatory model still favors an insular approach, while what is needed is a more multistate strategy that recognizes that electricity is an interdependent system. McDermott suggested that the wholesale power market should be viewed as a commons and that regulatory philosophy should look outward, emphasizing how best to serve customers. An important aspect of this regulatory shift is a focus on wholesale rather than retail production in the electricity system.

McDermott noted that the electricity system is facing many issues but suggested that one of the most critical is the failure to optimize the transmission system. An efficient national grid is critical to the functioning of the wholesale market and is necessary to allow the greater interdependence that is occurring in the electricity business.

McDermott argued that several policies could help better align industry needs and the regulatory paradigm. These policies include using performance-based regulation that provides benchmarks and incentives for electricity provision and the increased use of real-time metering, in order to send price signals to customers. McDermott stressed the importance of getting the demand side of the market working better—one way to do this is to expose consumers to price signals in the electricity market. It is particularly important that prices charged by the “provider of last resort” are permitted to reflect some of the dynamics of wholesale markets.

McDermott suggested that an increasing challenge for regulators will be trying to measure the rates of substitution between competing policy options. For example, investments in transmission may reduce the need for investments in generation. Efforts to promote distributed generation may reduce the need for investments in both transmission and generation. Making these determinations will be a difficult task as new technologies will affect these choices. Finally, McDermott touched on the topic of infrastructure siting. He suggested that FERC should take responsibility for infrastructure siting, such as transmission. This would promote a better planned national grid and reduce the local opposition that often accompanies transmission projects where the primary benefits flow to another state.

The final presenter on this panel was Robert Schainker, who emphasized that investment in electricity infrastructure is falling behind. Annual generation expansion lags demand growth by 30%. Transmission expansion is less than half the rate needed to meet forecast demand growth. As a result, electricity generation capacity margins have fallen from 25% of capacity to less than 10% over the last two decades. Schainker indicated that capacity margins in the Midwest are estimated to be slightly better at 13.1% (see figure 2.) This infrastructure investment lag has also led to increased transmission congestion, jeopardizing the ability to execute wholesale power contracts. Transmission infrastructure investments have fallen by about 10% in real terms over the last decade.

2. Electricity generation capacity margins

| United States | 9.4% |

| California | 1.3 |

| West | 8.3 |

| Texas | 16.8 |

| Midwest | 13.1 |

| Southeast | 3.9 |

| Mid Atlantic | 13.3 |

| New York | 12.1 |

| New England | 16.1 |

Improvements in the electricity infrastructure are also needed to improve the reliability of electric power. Schainker noted that the costs of electricity disruptions are very high for a digitized economy. Power disruptions or power quality problems can have severe impacts on computer operations in particular. The electricity demands of “internet hotels” (facilities that host computer network servers), are particularly high. These facilities require 100 watts to 200 watts per square foot, compared to 5 watts to 8 watts in most commercial buildings. These types of facilities may add 10 million to 20 million square feet in 2002, and significant infrastructure improvements are required to serve these types of loads.

Schainker suggested that the solution to these issues lies in a national electricity policy that provides stable rules and financial incentives for the industry. In particular, he noted that electricity policy needs to reflect the complexity and integration of the transmission and generating system. This means having national reliability and operating standards and eliminating transmission bottlenecks that prevent the seamless movement of power from electricity generation centers to electricity load centers.

Schainker pointed to several positive changes. For example, FERC has proposed consolidating the North American electric grid into four large RTOs. FERC has also shown a willingness to consider innovative transmission pricing that could reduce pricing barriers in the transmission of electricity. In addition, Congress is examining new electricity legislation and the National Governors’ Association and the U.S. Department of Energy have formed a task force to study transmission problems.

Schainker suggested that there is both a technical and economic paradox that must be resolved as part of the restructuring debate. On the technical side, there is the need to expand an infrastructure that is complex and expensive to serve an electricity system where supply and demand must be in instantaneous balance at all times. On the economic side, there is the theory that deregulation will lead to the lowest electricity prices versus the market reality that deregulation will encourage power companies to seek the highest profits.

Schainker concluded with a series of recommendations. First, he suggested that investments in transmission infrastructure should be financed in the same manner as the federal interstate highway system. Second, he expressed support for establishing a comprehensive grid security program to deal with the vulnerability of the grid to possible disruptions. Third, he suggested incentives be provided to automate and increase asset utilization and maintenance of the existing grid components. Finally, Schainker noted, there is a need to provide incentives to overcome market barriers and improve efficiency in electricity generation, storage, system operation, transport, distribution, and use of electricity.

3. Corporate structure before electric restructuring

Keynote address

Speaker: Patrick Wood III, chairman, Federal Energy Regulatory Commission

As the nation’s top electricity regulator, Patrick Wood provided a perspective on developments at FERC that are shaping electricity restructuring. He began by emphasizing FERC’s continuing efforts to create incentives for electricity infrastructure investments that will enhance the reliability and security of the electricity system. In particular, this means promoting the development of an improved national transmission grid through the formation of RTOs. Wood said he was optimistic about recent developments in the Midwest, suggesting that this region is at the cutting edge of developing many of the basic rules needed to implement effective electricity policy. In particular, he noted that the recent approval by FERC of the Midwest Independent Transmission Systems Operator (MISO) as the regional grid operator for much of the Midwest would help to promote fair and smooth access to the electricity grid and bolster the development of the region’s wholesale market. Wood also indicated that talks are underway to join MISO with the Mid-Atlantic based PJM Interconnections, which would create an even larger regional transmission operation.

Wood stated that FERC is not looking to overrun state authority in electricity matters but wants to actively partner with state utility commissions in promoting policies that support local customization. However, FERC is committed to policies that will optimize the performance of the nation’s electricity grid and contends that this can only be accomplished through a more regional approach. In carrying out this policy, FERC is trying to set the standards for grid performance and establishing performance measures. FERC is not attempting to suggest what type of RTO structure is best for meeting these standards. Many variations in organizational structure or business plan are permissible as long as the performance standards are met.

Wood also noted that FERC has recently revised its test for determining market power by electricity providers. Suppliers are only allowed to charge market rates for electricity if they demonstrate that they do not have market power. He acknowledged that this new market power test is controversial and has already led to the removal of market pricing authority for three large utilities. Wood argued that protecting the wholesale market from market power abuse is a fundamental function of FERC.

Wood further suggested that efforts such as distributed generation and other efforts that create small-scale, decentralized power generation hold great promise for improving the quality of the nation’s electricity system. Regulators need to support these efforts as they move forward. Regulators also need to develop a keener understanding of emerging market and competition issues in electricity restructuring. The experience from California’s electricity crisis and the failure of Enron demonstrates that regulators need to have strategies for resolving these issues quickly, while decreasing the current tendency for regulatory actions to end up in litigation.

Wood concluded his remarks by citing some organizational changes at FERC that are aimed at dealing with the changes in electricity markets. One of the most fundamental changes has been expanding FERC’s market monitoring capability. FERC has added staff to examine electricity trading in order to understand how trading patterns are affecting electricity prices and market operations.

Report from the Midwest Independent Transmission Systems Operator

Presenter: John Catlin, director of client relations, MISO

John Catlin began by noting that MISO was approved by FERC as the first RTO in the nation on December 19, 2001. MISO’s current geographic footprint includes 15 states and one Canadian province, consisting of more than $9 billion in transmission assets. MISO’s service territory covers more than 13 million customers through 86,000 miles of transmission lines. The peak electricity load carried over the system is 75,000 megawatts. Catlin characterized MISO as a confederation of transmission and nontransmission owning members that is actively interested in partnering with other organizations. In addition to potentially merging with the Southwest Power Pool, MISO is investigating an agreement with PJM Interconnections and has developed a memorandum of understanding with the federal Tennessee Valley Authority.

Catlin noted that as of December 15, 2001, MISO’s operations include security coordination, maintenance coordination, long-term planning, market monitoring, dispute resolution, operations planning, generation interconnection agreements, and scheduling. On February 1, 2002, MISO began offering point-to-point network tariff service.

Catlin said that a clear challenge for MISO is developing a plan to integrate the Alliance RTO. The December ruling by FERC that granted MISO official RTO status suggested that the Alliance group could not function as a stand-alone organization and should come under the MISO umbrella. Negotiations are underway to develop a plan to integrate the two groups.

If MISO can effectively merge with the Southwest Power Pool, Alliance, TVA, and PJM, it will create a super-regional RTO with an enormous geographic footprint. Catlin emphasized that MISO is trying to offer transmission owners flexible options for joining MISO. These can include membership, a coordination agreement, and joining MISO as part of a for-profit transmission company.

Catlin concluded by identifying the three roles MISO will play as an RTO. First, it will be responsible for long-term planning. This will include identifying areas of constrained transmission capacity and identifying options to relieve transmission congestion. These options could include building new transmission, recommending the location for new generation or promoting demand-side management. Second, MISO will order new construction to support grid reliability. Third, MISO will address long-term congestion management issues through its tariff structure.

View from Seventh District Public Utility Commissions

Presenters: Ken Rose, senior economist, National Regulatory Research Institute; Richard Mathias, chairman, Illinois Commerce Commission; David Ziegner, commissioner, Indiana Utility Regulatory Commission; Diane Munns, chairman, Iowa Utility Board; Ave Bie, chairperson, Public Service Commission of Wisconsin; and Laura Chappelle, chairman, Michigan Public Service Commission.

The final panel of the day provided a perspective on electricity policy from public utility commissioners of the five states in the Seventh Federal Reserve District. Of the five, Illinois and Michigan have been the most aggressive in their restructuring activities, while Indiana, Iowa, and Wisconsin have adopted a more cautious approach. First, Ken Rose provided a context for state policy actions by noting that recent events in electricity markets have cooled state enthusiasm for certain aspects of restructuring. According to the most recent National Regulatory Research Institute survey, four states have delayed restructuring efforts. In addition, Rose noted that the number of competitors in the retail market has shrunk, which has reduced the retail choices available to customers in states that have restructured. Rose concluded by posing two questions to the panel of commissioners. First, has California’s failed experiment in restructuring affected electricity policy in their states? Second, has the slow development of retail competition in states that have restructured influenced electricity policy?

4. Corporate structure after electric restructuring

Next, Richard Mathias provided an overview of the Illinois Customer Choice and Rate Relief Law that has guided the restructuring of the Illinois electric market. The law has phased in customer choice across different classes of customers over several years and will allow retail choice in May 2002. The act will not be fully phased in until January 2005, when utilities will be permitted greater pricing freedom. Mathias noted that Illinois’s interest in restructuring was driven in part by the high cost of power in the state and the desire of large customers to be able to shop for their electricity provider, thereby lowering their costs.

Mathias noted that restructuring has had several effects. First, the utility industry has restructured, with every investor-owned utility in Illinois having been sold. Incumbent Illinois utilities still own generation facilities; however, these have generally been spun off to affiliated companies. Restructuring has also encouraged the development of new holding company organizations for utilities (see figures 3 and 4). This has narrowed the scope of companies that are under the regulatory authority of the Illinois Commerce Commission; however, it has not decreased its workload. Restructuring has also shifted more regulatory oversight to Washington, DC. The federal government is having a much larger role in the wholesale system, with the state’s role being more focused on retail issues.

Mathias noted that currently only spotty competition for customers has emerged in Illinois and virtually no competition is present outside of the ComEd (an Exelon company) service territory. In addition, many of the details of implementing the law are still being addressed and these will have a significant influence on how electricity markets develop. Mathias also suggested that it is important to develop clear goals and quantitative and qualitative measures for assessing the success of the Illinois restructuring law. These measures should include establishing the number of competitive suppliers available to customers (as well as the price they charge), along with measuring the quality of the service provided. In addition, it is important to gauge the ease of entry for power suppliers to the Illinois market.

Mathias noted that the real challenge in the Illinois restructuring effort will come in 2005 when the rate cap for retail customers expires and electricity prices are allowed to reflect market conditions. He stressed that a key to restructuring is understanding that different electricity customers have different desires. Most residential and small business customers want stable and reasonable prices and reliable service. Issues of choice are less important than predictable service. Large customers are more likely to be interested in accessing wholesale markets and negotiating their own electricity contracts. Mathias concluded by noting that the development of a wholesale market may not be the same as the development of wholesale competition.

The next presenter, David Ziegner, addressed developments in Indiana’s electricity policy. He noted that Indiana is a relatively low-cost state for electricity. The combination of good access to natural gas and coal supplies, sound regulatory policy, and the ability to attract new generation has allowed the state to maintain this advantage. Ziegner stressed that low-cost power is a critical aspect of the state’s economic development policy, and this has helped guide the state’s restructuring efforts.

Indiana expects to maintain this low-cost advantage, despite an anticipated increase of 1.9% in power usage per year. Indiana is actively adding new generation capacity and the commission has created incentives for demand-side management that have helped with load management. In addition, the recession has reduced electricity demand from industrial customers, particularly in the steel industry. Ziegner noted that future electricity demand growth will be concentrated in the residential and commercial market rather than being driven by industrial demand.

Ziegner stressed that the state has welcomed competition in the wholesale electricity market. However, he argued that retail competition should only occur once a fully functional wholesale market has developed in the Midwest. Ziegner noted that the U.K. waited until wholesale competition was established before it embarked on retail open access. He suggested that experience with rail and telephone deregulation has left some state policymakers skeptical of the benefits of restructuring. In a state where customers have low electricity prices, expanding generation supply, and profitable utilities, it is unclear why one would want to change the current structure. However, Ziegner noted that if states elect to allow retail competition, they must allow price changes in wholesale markets to be reflected in retail prices. He endorsed the development of real-time pricing as a mechanism for achieving this goal. Finally, Ziegner endorsed the work by FERC to create a regional transmission system and a standardized market design. In particular, he said that the success of the RTO process will be the ability to monitor electricity market activity and serve as a “cop” to enforce market rules.

Iowa has also taken a cautious approach to restructuring, according to the next speaker, Diane Munns. She noted that three legislative sessions failed to pass a restructuring plan for the state. The experience in California has made it unlikely that active restructuring will occur in the near future, but Munns noted that this has not reduced the need for the state to respond to changes in the electricity market. Some of these market changes include corporate mergers that have led to fewer Iowa-based utilities, deregulation efforts in neighboring states, and efforts to encourage investment in new generation and transmission. The challenge, Munns suggested, is determining how to adapt a regulatory structure based on traditional rate of return pricing principles to a changing electricity market.

In response to these market changes, Iowa has taken measures to improve its climate for new investments. This has included streamlining siting procedures for new transmission and generation facilities, establishing binding rate-making principles during preconstruction of facilities, and generally trying to introduce more certainty into the regulatory process. Munns suggested this approach has demonstrated some success, with new generation facilities proposed once many of these measures had been put in place.

Munns also noted that there has been a drive toward a greater federal role in electricity provision. She stressed that cooperation between the states and the federal government will be critical to the success of this strategy. In particular, she expressed the hope that litigation between the states and the federal government can be significantly reduced. However, she argued that certain functions, such as consumer protection and reliability and service standards, should be left primarily to the states. Transmission siting would be an exception, since this would need to be a regional effort with the states working in cooperation with FERC.

Next, Ave Bie discussed Wisconsin’s efforts in electricity policy development. She explained that Wisconsin has been careful in its approach to restructuring, given the state’s low power cost and aging infrastructure, which has led to concerns about its ability to compete in a more deregulated market. Bie also noted that the state has a special problem when it comes to increasing regional transmission opportunities, because its geographic isolation (bordering two Great Lakes) limits easy interconnections.

Bie noted that much of Wisconsin’s electricity policy development has been driven by concerns over power shortages that occurred during the summer of 1997. The immediate response to this problem was the passage of Act 204, which was designed to increase generation capacity and streamline and increase certainty in the regulatory process. Bie stressed that it is critical to establish clear ground rules for utilities so that they know what they can and cannot expect. Act 204 also encouraged the development of independent power producers and transferred transmission responsibilities to an independent systems operator. This has been complemented by the passage of reliability legislation. Bie agreed with Mathias of Illinois that most consumers are primarily interested in getting reliable electricity service at reasonable prices.

Bie concluded by suggesting that taking an interest in the fiscal health of utilities is also an important commission function. Healthy utilities are in a better position to provide low prices to their customers. Bie also emphasized the desire to develop better regional transmission connections and suggested this will require regional cooperation. She noted that the process of creating new transmission infrastructure is difficult but necessary. Wisconsin has just approved 250 miles of new transmission infrastructure that is critical to the reliability of the state’s electric system. The state has also received an application to build a new coal-fired plant that Bie said demonstrates its success in encouraging new electricity investment.

The final panelist, Laura Chappelle, suggested that Michigan’s approach to restructuring has fallen somewhere in between those of Illinois and Wisconsin. Like Illinois, Michigan has adopted a phased-in approach to deregulation, with full retail choice available on January 1, 2002. In preparation for this, Michigan has been running several pilot customer choice programs since the mid-1990s. Like Wisconsin, Michigan has been concerned about transmission constraints and increasing generation, particularly in the state’s baseload. While interest on the part of merchant power producers in Michigan has been favorable, most of this generation is designed only to serve intermittent needs during periods of peak demand. Michigan has also required the addition of 2,000 megawatts of new transmission capability. Chappelle agreed with Bie that taking an interest in the financial viability of state utilities was an important consideration in the work of the commission.

Chappelle reported that since the reported that since the retail market opened in January, only 1% of load has switched suppliers. She also identified several issues facing the Michigan Commission. These include adopting a code of conduct for utilities, working with utilities to resolve disputes over performance standards, and making stranded cost determinations. Chappelle suggested that the real success of restructuring would depend on creating confidence that electricity markets will work.

Conclusion

The views of the presenters at the conference clearly demonstrate the complexity and challenges facing electricity policy. In the Midwest, transmission issues are particularly important, and it is hoped that MISO will emerge as the organization best able to manage the regional transmission needs of the Midwest. An important aspect of transmission policy will be identifying needed infrastructure investments in the electricity grid. It is also clear that the rules of the road for electricity policy are still being created. Federal and state regulators are sorting out new roles and responsibilities in response to the many changes that have occurred in the electricity sector. While wholesale electric market restructuring has been embraced, extension to retail markets is occurring at a much more cautious pace. What is clear is that the utility industry has vigorously restructured; and returning to the old paradigm, that involved closely regulating vertically integrated monopoly utilities, seems highly unlikely.

An additional issue for the Midwest, given its dependence on coal-fired generation, is how to deal with utility plant emissions. Movement toward a cap-and-trade emissions reduction market may enable power suppliers to achieve multipollutant emissions reductions more cost effectively, while increasing electricity generation.

Finally, the need for electricity policy that addresses the changing market is not going away. While the national recession lowered electricity demand, and lower fuel prices have helped provide some breathing room over the past year for electricity policymakers, fundamental infrastructure investments and rules governing emerging electricity markets still need to be determined. Without critical infrastructure upgrades and investments in the national electricity grid, it is uncertain whether a strained electricity system will be adequate to support future economic growth.

Notes

1 Stranded costs are investments made by regulated utilities that may not be recovered through utility rates as a result of changing regulatory or market conditions.

2 Eutrophication is the process by which lakes gradually age and become more productive. However, human activity, including air pollution, has accelerated this process causing water pollution from excessive plant nutrients.