In order to understand better how the unfolding economic crisis is likely to affect U.S. households, this Chicago Fed Letter looks at what happens when borrowers miss debt payments and how long it takes for them to face a severe adverse consequence, such as foreclosure, wage garnishment, or repossession.

In summary, a household would face the fastest repercussion if they were to miss a payment on an auto, credit card, or payday loan (see figure 1). In response to delinquency, auto lenders can initiate repossession, while the main recourse of payday and credit card lenders is to cut off further access to credit. Auto loans are an area of particular concern, as they had relatively poor credit quality before the Covid-19 crisis began. In contrast, mortgages and student loans typically allow borrowers much longer periods to get back on track with their payments. Moreover, mortgage and student loan borrowers are likely to receive extensive forbearance through recently announced federal government initiatives.

1. Summary of repercussions to missed payments

|

Debt product |

After missed payment |

|

Payday loan |

Immediate cessation of credit, but lender recourse is limited. |

|

Auto loan |

Repossession process typically initiated after 90 days, but faster for some subprime loans or title loans. |

|

Credit card balance |

Penalty interest rate can be imposed immediately; 30–60 days before new charges disallowed (subprime cards can be faster); 180 days before account closure. |

|

Residential mortgage |

Three to six months before foreclosure proceedings begin; foreclosure can take several months or more in judicial states. |

|

Student loan |

Nine+ months, and myriad available modifications before wage garnishment. |

We highlight three implications for households. First, liquidity-constrained subprime borrowers can quickly lose access to their marginal sources of credit, e.g., payday loans, credit card loans, and alternative or subprime auto loans. These households, if they experience unemployment, may be able to avoid default if they receive extended unemployment benefits and other assistance established under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.1 One critical question is how fast people will receive this assistance. For example, will state unemployment offices have the capacity to deliver assistance in a two- to four-week period that is typical during normal times? Liquidity-constrained subprime borrowers will be especially at risk if assistance is significantly delayed.

Second, for borrowers with better credit scores, the combination of savings, forbearance initiatives, along with CARES Act and unemployment assistance, will likely be enough to enable these households to make payments or ward off adverse repercussions from missed payments for several months. This is especially true for households whose main debts are mortgage or student loans, which have long fuses (that is, a long time before adverse consequences occur if a payment is missed) and for which federal authorities have announced wide-reaching forbearance plans.

Third, households may face important choices about which debts to pay. These choices will be shaped by the institutional features and forbearance initiatives described here—which might nudge borrowers to put off student loan and mortgage payments—but also by constraints on households’ information, their financial literacy, and pressure from lenders to make payments.

In the remainder of this article, we examine each consumer debt market in turn. Figure 2 shows the size and value of these markets and the share of households holding each type of loan.

2. Size of consumer debt markets

|

Type of loan |

Share of households |

Outstanding debt |

Number of accounts |

|

Payday/payday installment/other alternative credit |

n.a. |

$20–$40 billion |

More than 12 million unique payday borrowers a year |

|

Auto loan |

33.8 |

$1.2 trillion |

116 million accounts |

|

Credit card balance |

43.9 |

$1.1 trillion |

508 million accounts |

|

Residential mortgage, primary residence |

41.9 |

$10.6 trillion |

81 million accounts |

|

Student loan |

22.4 |

$1.6 trillion |

39 million accounts (8 million still in school) |

Sources: Board of Governors of the Federal Reserve System, 2016, Survey of Consumer Finances; Federal Reserve Board Z.1 and G.19 statistical releases; Financial Health Network, 2019, “Financially underserved market size study,” Chicago, IL; Federal Reserve Bank of New York, Consumer Credit Panel; U.S. Department of Education; and the Consumer Financial Protection Bureau.

Alternative credit products

Payday loans are probably the best known alternative credit product.2 Like other alternative credit products, payday loans are small, short-term loans to subprime borrowers at high effective interest rates. The dollar volume of the payday lending market is relatively small in magnitude compared with other types of household debt, given that these loans are typically $500 or less. That said, it is estimated that over 12 million borrowers take out payday loans each year.3 These borrowers tend to have very low credit scores, are heavily credit constrained, and are at relatively high risk of financial distress. As payday loans are relatively representative of the larger alternative credit market, we use them here as an illustrative example of the overall market.4

Economic research has described payday lending as a double-edged sword. Access to payday loans immediately after natural disasters or during temporary financial distress has been shown to improve economic well-being by helping borrowers smooth their finances and spending through those temporary shocks. However, use of these loans for prolonged periods has been found to cause substantial declines in economic well-being as measured by overall consumer spending, and food- and housing-related spending in particular. Moreover, research has shown payday loan use increases personal bankruptcy rates by a factor of two, due to their negative impact on household cash flow positions.5

Since payday loans tend to have short maturities, as soon as two weeks after origination, borrowers may face default on these loans quickly after becoming unemployed. Payday lenders typically pursue default immediately, with no grace period. The consequences of default are limited, however, as these loans are uncollateralized and not reported to credit bureaus. Instead, lenders can cut borrowers off from further credit and attempt to collect the outstanding loans. The bad news is that payday loans are a key, if expensive, source of liquidity for certain households, namely deeply subprime and credit-constrained households that are often at the margin of insolvency.

In response to the current public health crisis, three of the largest payday lenders have stated they are willing to work with customers facing hardship, but have not announced any specific new assistance programs for their customers.6 Generally, the business model of payday lenders is to rely on a postdated check drawing on future earnings to quasi-collateralize loans. For customers whose incomes may be interrupted indefinitely, it is unclear whether payday lenders will provide them with credit.7 However, payday lenders may be willing to lend against anticipated stimulus checks provided under the CARES Act. In this case, the benefits of any stimulus payments may be muted by the smoothing effects of payday loans; research also suggests that intensive use of these loans leads to a decrease in overall consumption.8

Auto loans

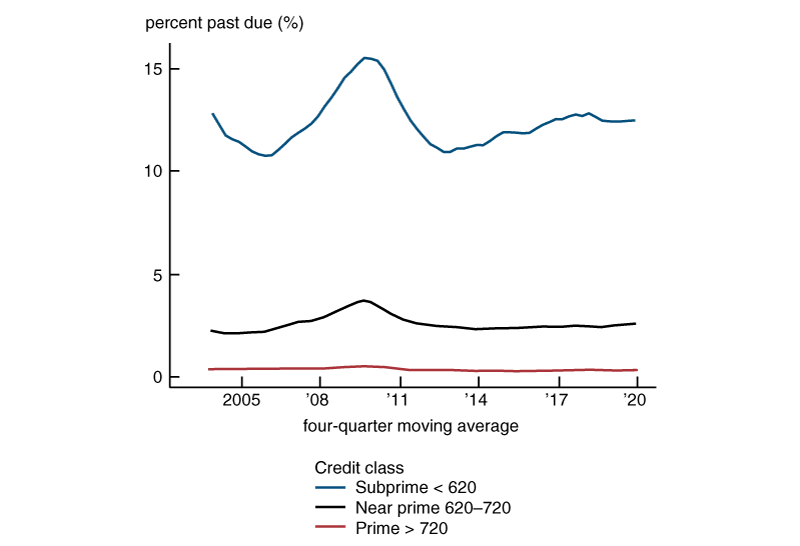

Consumer auto loans total $1.2 trillion, with about one-third of American households holding at least one such loan. Delinquency rates on auto loans have increased in recent years, in contrast to most other consumer loan markets in which delinquency rates have been generally flat or declining. As shown in figure 3, this rise in auto loan delinquency rates has been largely confined to subprime auto loans, which account for about 20% of outstanding auto loans.9

3. Auto loan delinquency rates (past due 30 days or more)

Subprime auto borrowers have, over the past decade, increasingly taken out nontraditional and potentially exploitative auto loan products. First, “buy here pay here” (BHPH) loans are made by dealers, typically involving used cars sold at higher than market prices. Dealer-lenders make most of their money from the initial down payment and fees, as defaults are common and lenders are quick to repossess. Indeed, one study of these loans found a reported default rate of more than 30% (and defaults here may be underreported). As such, these loans are often more akin to extended car rentals and are typically most attractive to borrowers with very low credit scores.10 Credit bureau data suggest that BHPH loans account for at least 6% of auto loans, but this is likely an underestimate since these loans are not always reported to bureaus. Second, title loans allow households to borrow against the value of their cars. They therefore function as a source of liquidity, albeit an expensive and risky one, given high interest rates and fees and the prospect of repossession. Undoubtedly, many subprime households entered the public health crisis with an already tenuous ability to meet their auto loan payments.

The main recourse for a delinquent auto loan is repossession. Under most state laws, lenders have the option to initiate repossession immediately and without notice after a missed payment, but whether they do so depends on their business model.11 For traditional auto loans made to prime borrowers, the typical advice given to consumers is that repossession is rarely initiated until a borrower is 90 days delinquent.12 In contrast, repossession is often much faster and more routine for subprime, BHPH, and title loans. Once initiated, repossession reportedly takes 37 days on average, but the process can be very fast if lenders use GPS and remote ignition cutoff devices, which are more common for subprime loans.13

After repossession, lenders can also pursue borrowers for additional collections if the value of their repossessed car is insufficient to repay their debts. Lenders can ask courts to garnish the wages of borrowers, or they can sell the unpaid debt to collectors. While these can be severely adverse outcomes for households, they occur at some delay relative to repossession.14

In response to the Covid-19 crisis, lenders have announced a variety of programs to provide some flexibility to borrowers.15 Some programs include suspensions of involuntary auto repossessions. Others provide borrowers the ability to skip payments, although it is often difficult to assess from these announcements whether the programs would require skipped payments to be paid at the end of the suspension period or as a lump sum at the end of the loan. These programs will likely continue to evolve, and it is too early to evaluate their efficacy. However, some patterns are already evident. In particular, subprime lenders generally encourage borrowers to call their servicer, which is more or less their standard policy.16 In contrast, many auto manufacturers are offering generous financing arrangements to new car buyers if they are “well-qualified” (which typically means prime credit scores of 720 or more).

Credit card loans

Overall, about 44% of families have outstanding credit card balances, according to the Federal Reserve Board’s 2016 Survey of Consumer Finances, and credit card debt outstanding totaled $1.1 trillion at the end of 2019. However, these figures overstate the debt exposure of households, as about 18% of outstanding credit card debt consists of balances that are in fact paid off each month in full, known as “transacting” balances.17 The remainder is known as “revolving” debt.18 Credit card borrowers that revolve a balance are a small share of open accounts, but comprise a substantial portion of accounts with any activity, and a large proportion of observed credit card debt. Conditional on revolving a balance, the average account balance is $5,700 for general purpose credit cards.19 The average time a positive balance persists for revolvers of credit card debt is just under one year (though 15% maintain a positive balance beyond two years).20 This prolonged time to repayment is exacerbated by the fact that approximately 29% of active accounts regularly make payments at or near the minimum (which can require many years to pay off the debt).21

Credit cards carry high interest rates because they are unsecured and have relatively high loss rates compared with other household credit instruments. The total cost of credit card debt is approximately 18.5%, with revolvers paying the majority of this in finance charges.22 Annualized charge-offs in the general purpose credit card market equated to 5.7% of balances in 2018, down from a peak of 16% in 2010:Q1.23 The share of delinquent accounts is about 1.5%, with more than 2% of general use balances delinquent. However, as consumers often have more than one credit card account, the borrower-level delinquency rates are higher. For example, 9% of general purpose credit card borrowers have had at least one instance of an account delinquent for 60-plus days in the past year.

Credit card lenders can react fairly quickly to a borrower’s missed payment, but their recourse is limited. After 30 days of delinquency, a household will most likely see the interest rate on their balances move to a penalty rate (often 30% or more) and their access to additional credit limited. While subprime borrowers are likely to have their access to credit cut off quickly, subprime households typically utilize more than 80% of available credit and have less than $2,000 in available credit in the first place, suggesting that the average subprime household stands to lose access to only a few hundred dollars of credit.24 In addition, if a borrower loses access to credit on one credit card, they may still be able to access credit on their other accounts.

In response to the public health crisis, general purpose credit card issuers have encouraged their customers to contact them to discuss their needs. There are reports of some issuers allowing customers to request a payment deferral (which, however, would likely have to be paid at the next billing cycle) or waiving late fees and interest for two billing cycles.

Residential mortgages

The residential mortgage market is by far the largest household credit market. In total, 42% of households owe $10.6 trillion of mortgages on their primary residences. These loans are overwhelmingly to prime borrowers, as lenders substantially tightened their lending standards to subprime borrowers following the 2007–09 financial crisis and post-crisis regulatory changes.

Residential mortgage borrowers have a relatively long period to bring their payments up to date before they can lose their house via foreclosure. Putting aside forbearance plans announced by state and federal authorities, borrowers generally can miss payments for three to six months before foreclosure proceedings begin. In states where foreclosure is executed through the judicial system, foreclosure proceedings can take a very long time. Illinois, for example, reportedly takes 300 days on average to process a foreclosure case through its court system after proceedings begin. By the time foreclosure is completed in Illinois, a residential mortgage borrower would have lived in their house without making a mortgage payment for an average of just over a year. Michigan, in contrast, does not require judicial proceedings. Foreclosures there take about 90 days on average for the property to be advertised and sold in a sheriff’s sale.25

Mortgage borrowers who can’t make their payments have other options besides foreclosure. In the extreme, a borrower can avoid foreclosure by selling their house, as long as they have positive equity. Less extreme options for a borrower include cash-out refinancing or a home equity line of credit, both of which would in effect allow the household to borrow against their equity in their property to temporarily cover monthly payments. In general, the “double trigger” theory of foreclosure suggests that borrowers generally must experience both an income shock and a house price shock to default.26 But can a borrower easily sell or refinance their house in the midst of a public health crisis? For an unemployed borrower to refinance their house, a mortgage originator would have to prioritize them over other still-employed borrowers looking to refinance amid record low interest rates. To sell a house, a homeowner would need to conduct an open house, sign and notarize documents, and so on, all the more challenging now with social distancing and other restrictions in place.

To reduce the impact of the Covid-19 crisis on housing markets, policymakers have announced forbearance programs for up to 12 months at two federal agencies—the Federal Housing Finance Agency (FHFA), which supervises the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, and the U.S. Department of Housing and Urban Development (HUD), which oversees loans insured by the Federal Housing Administration (FHA).27 These programs require servicers to not report borrowers receiving forbearance as having missed payments, allowing borrowers to maintain their credit scores. These policies will have broad reach, as the GSEs and FHA own or insure about $7 trillion out of the $10.6 trillion of residential mortgages currently owed by U.S. households. The remaining loans are held by private lenders, who have announced a variety of borrower assistance programs of their own, although it is difficult to know at this point whether they are likely to provide as much forbearance as the federal initiatives.

Student loans

U.S. households owe about $1.6 trillion in student loans, with about 22% of households owing this type of loan. The vast majority of this debt is owed to the federal government.

Federally owned student loans allow borrowers a great deal of flexibility. Most federal student loans do not transition from delinquent to default until they are nine or more months past due. Borrowers in default of student loans can have up to 15% of their wages garnished or their tax refunds seized to repay their debt. The federal government offers numerous programs to help borrowers avoid default, including deferment, forbearance, consolidation, and a variety of repayment options. In addition, the CARES Act suspended payments for all student loan borrowers on federal student loans for six months. As a result, student loan borrowers do not face any near-term prospects of delinquency, at least for federally owned loans.

Potential implications for bankruptcy

We have not discussed the prospects for household bankruptcies up to now. Households could respond to financial stress by declaring bankruptcy, which discharges many types of debt while potentially allowing households to keep some critical assets.28 A forward-looking consumer would be more likely to declare bankruptcy when their debt obligations are high and their expected future income receives a negative shock. This implies bankruptcies may increase in response to the labor market disruption associated with the Covid-19 crisis.

Bankruptcy is not typically a household’s first option in response to financial stress. However, one feature of the current economic environment suggests that a spike in household bankruptcy filings in the near term is possible. Research has found that temporary positive income shocks can help liquidity-constrained households overcome the legal costs of filing for bankruptcy. That research focused on tax rebates, which effectively increased bankruptcy filings in 2008.29 In the current economic environment, stimulus checks could serve a similar function, giving at-risk households an opportunity to file bankruptcy.

Conclusion

Consumer debtors will face the nearest-term pinch points on payday, credit card, and auto loans, especially if they have subprime credit and limited savings. Subprime auto borrowers are a population of particular concern, given the number of such borrowers that were already struggling to make payments before the Covid-19 crisis.

Notes

1 More details available online.

2 Other examples of alternative credit include installment loans, pawn loans, and rent-to-own arrangements. We discuss auto title loans in the next section. Although payday loans are declining in popularity and many payday lenders are transitioning to short-term installment loans, payday loans are the subject of most of the research and analysis in this segment.

3 Pew Charitable Trusts, 2012, “Payday lending in America: Who borrows, where they borrow, and why,” report, Washington, DC, July, available online.

4 There are some differences between payday and other alternative credit products in terms of the product structure, borrowing population, terms, rates, etc. For example, payday borrowers must maintain a bank account and provide evidence of “regular” deposits, while collateralized lending, such as pawn or auto title, requires no such documentation. Payday loans typically have higher rates than traditional installment loans but are frequently for shorter durations, resulting in lower total cost of borrowing. That said, the borrowers across these products are similar, often with deep subprime credit scores and severe credit constraints. As a result, their exposure to the negative consequences of economic disruption is likely to be similar and in contrast with borrowers who have “traditional” consumer loans.

5 Christine L. Dobridge, 2018, “High‐cost credit and consumption smoothing,” Journal of Money, Credit and Banking, Vol. 50, Nos. 2–3, March–April, pp. 407–433, Crossref; Paige Marta Skiba and Jeremy Tobacman, 2019, “Do payday loans cause bankruptcy?,” Journal of Law and Economics, Vol. 62, No. 3, August, pp. 485–519, Crossref; Adair Morse, 2011, “Payday lenders: Heroes or villains?,” Journal of Financial Economics, Vol. 102, No. 1, October, pp. 28–44, Crossref; Brian Baugh, 2015, “What happens when payday borrowers are cut off from payday lending? A natural experiment,” Ohio State University, Fisher College of Business, working paper, August, available online; and Bart J. Wilson, David W. Findlay, James W. Meehan, Jr., Charissa Wellford, and Karl Schurter, 2010, “An experimental analysis of the demand for payday loans,” B.E. Journal of Economic Analysis and Policy, Vol. 10, No. 1, article 93, Crossref

6 This could be a function of the structure of these loans, where there is a single payment, and defaulting and paying later is, in effect, always an option for borrowers. The lenders are Advance America (details available online), Check Into Cash (details available online), and Check ‘n Go (details available online).

7 It is worth noting that the three largest payday lenders have statements on their websites indicating they are keeping as many stores open as possible, but encouraging consumers to take online loans where possible. This suggests they remain willing to lend.

8 For example, see Baugh (2015).

9 Melinda Zabritski, 2019, “State of the automotive finance market: Q3 2019,” Experian, webinar presentation, available online.

10 Brian Melzer and Aaron Schroeder, 2017, “Loan contracting in the presence of usury limits: Evidence from automobile lending,” Consumer Financial Protection Bureau, Office of Research, working paper, No. 2017-02, March. Crossref

11 Details available online.

12 Details available online.

13 Jennifer Brown and Mark Jansen, 2019, “Consumer protection laws in auto lending,” Western Finance Association Annual Meeting paper, June 7. Crossref

14 See Brown and Jansen (2019). Several states severely restrict or prohibit wage garnishment, but most allow it to some degree; see Richard Hynes and Eric A. Posner, 2002, “The law and economics of consumer finance,” American Law and Economics Review, Vol. 4, No. 1, January, pp. 168–207. Crossref

15 For a summary of programs among bank lenders, see this page; and for programs among captive lenders, see this page.

16 For instance, see this blog post from Santander.

17 Daniel Grodzicki and Sergei Kulaev, 2019, “Data point: Credit card revolvers,” Consumer Financial Protection Bureau, Office of Research, report, July, available online.

18 Consumer Financial Protection Bureau, 2019, The Consumer Credit Card Market, report, Washington, DC, August, available online.

19 See Consumer Financial Protection Bureau (2019). Note that credit cards can be segmented into general purpose and private label (often store-specific credit cards), with the former representing the majority of the market and facilitating broader consumption.

20 See Grodzicki and Kulaev (2019).

21 Benjamin J. Keys and Jialan Wang, 2019, “Minimum payments and debt paydown in consumer credit cards,” Journal of Financial Economics, Vol. 131, No. 3, March, pp. 528–548. Crossref

22 Consumer Financial Protection Bureau (2019).

23 All data are from the Consumer Financial Protection Bureau (2019). Generally, the private label market experiences lower balances, more revolving of those balances, and higher delinquency rates and charge-offs.

24 Consumer Financial Protection Bureau (2019).

25 These state-level estimates are available online. In addition, see Shuang Zhu and R. Kelley Pace, 2015, “The influence of foreclosure delays on borrowers’ default behavior,” Journal of Money, Credit and Banking, Vol. 47, No. 6, September, pp. 1205–1222, Crossref. Zhu and Pace estimate that the entire period from 30-day delinquency to completion of foreclosure took 13 months on average in Illinois in 2008, up from nine months on average in 2003.

26 Christopher L. Foote, Kristopher Gerardi, and Paul S. Willen, 2008, “Negative equity and foreclosure: Theory and evidence,” Journal of Urban Economics, Vol. 64, No. 2, September, pp. 234–245. Crossref

27 See the HUD press release, and FHFA press release.

28 For example, homes and vehicles may be protected if the payments are affordable to consumers after the eligible non-secured debts are discharged.

29 Tal Gross, Matthew J. Notowidigdo, and Jialan Wang, 2014, “Liquidity constraints and consumer bankruptcy: Evidence from tax rebates,” Review of Economics and Statistics, Vol. 96, No. 3, July, pp. 431–443. Crossref