In this article, we examine the role of primary dealers as clearing members at U.S. central counterparties (CCPs) and their importance in liquidity risk management at those CCPs. We find that primary dealers are key contributors to concentration in central clearing—they make up a significant portion of clearing members and an even larger portion of activity cleared by U.S. CCPs. Second, we find that primary dealers are a major source of interconnectedness across U.S. CCPs. Further, we estimate that the bulk of clearing activity in the U.S. is conducted by the primary dealers that are also the most interconnected across CCPs.1

The U.S. Securities and Exchange Commission (SEC) rule mandating expanded central clearing of U.S. Treasury securities and repo (repurchase agreement) transactions has drawn increased attention to the role CCPs can play in mitigating or amplifying vulnerabilities in the U.S. financial system. While expanded central clearing will reduce counterparty risk and standardize risk-management practices across a greater share of the Treasury market, the increased volume of cleared activity will also inevitably expose more market participants to shocks that can pass through CCPs. These shocks, which can include a spike in market volatility, a credit event due to a clearing member default, or an operational disruption from a cyberattack, can create unanticipated, time-critical liquidity demands at CCPs, such as higher intraday margin requirements.2

Among the firms most exposed to vulnerabilities of CCPs are their clearing members, which are key contributors to and beneficiaries of CCP risk-management processes. To participate in CCP risk-management processes, clearing members must have access to sufficient liquidity, whether from cash on hand, the ability to enter repurchase agreements, lines of credit, or other sources. Notably, clearing members that are Federal Reserve primary dealers have an additional source of same-day liquidity at their disposal—the Fed’s Standing Repo Facility (SRF).The concentrated interconnectedness of primary dealers in the U.S. CCP ecosystem means that a failure of any single primary dealer is a key potential systemic vulnerability for CCPs. It also raises an important use case that is related to financial stability for the SRF. In an extreme adverse scenario, the SRF could be a tool for primary dealers to acquire same-day liquidity to meet sudden cash demands from CCPs and prevent spillovers of market stress to the broader financial system. However, for the SRF to be most viable in stabilizing liquidity events in the U.S. CCP ecosystem, primary dealers would most likely need to draw from the morning SRF operations and opt for settlement earlier in the day to meet intraday payment deadlines at CCPs.

Background

Here, we explain the circumstances surrounding the implementation of the SEC’s Treasury clearing mandate and provide overviews of central clearing and the primary dealer system.

The SEC’s Treasury clearing mandate

In December 2023, the SEC announced a new rule that will require any covered clearing agency for U.S. Treasury securities to ensure its members clear all eligible secondary market transactions to which those members are a counterparty. It also amended risk-management standards for covered clearing agencies to improve risk-management practices and broker-dealer customer protection rules to facilitate more clearing of customer trades. In adopting these changes, the SEC aims to make the Treasury market “more efficient, competitive, and resilient.”

The Fixed Income Clearing Corporation’s Government Securities Division (FICC-GSD), the sole current provider of clearing services in the Treasury securities market, recently surpassed $11 trillion in peak daily cleared volumes—a number that will likely grow significantly larger as the clearing mandate goes into effect.3 It is presumed that FICC-GSD will absorb most of the increase in clearing volume over the coming years. However, other firms have signaled their intent to compete with FICC-GSD for the Treasury clearing business; if they succeed, the expected increase in clearing volumes may be distributed among multiple CCPs.

Overview of central clearing

CCPs transform, but do not eliminate, risk. When trades are cleared, a CCP “interposes itself between the counterparties …, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the performance of open contracts.”4 The original buyer and seller are no longer exposed to the risk of the trading counterparty and instead are each exposed to the counterparty risk of the CCP. This arrangement has many advantages, such as centralized risk management and data processing operations that benefit clearing members of the CCP. Yet centralized clearing could also have some disadvantages, including the “concentration of credit, liquidity, operational, and legal risk in the CCP” (Steigerwald, 2013, p. 12).

From the perspective of clearing members, while central clearing mitigates credit risk, it potentially increases liquidity risk. A key example of this is that CCPs regularly pass through gains and losses on positions, known as variation margin (see also note 2), from buyers to sellers as market prices change. Variation margin must be paid in cash and is collected at specific cutoff times during the trading day as mandated by each CCP, creating a need for time-critical liquidity, especially when sharp market moves necessitate large variation margin demands (Marshall and Steigerwald, 2013).

In recent years, international standard-setting bodies have engaged market participants on ways to reduce potential liquidity risks during periods of above-average variation margin calls from CCPs. These include increasing the predictability of variation margin calculations and collections; allowing more time for collection of payment; offsetting variation margin with other payment obligations to the CCP; and using excess collateral to fulfill variation margin obligations.5

If one party fails to make a variation margin payment to the CCP, the CCP has established tools to ensure it can still meet its obligations to its other participants. Among these protections are the routine resources that the CCP holds to protect itself from a clearing member default (such as initial margin or default funds) and contingent liquidity resources (e.g., credit lines) (Paddrik and Zhang, 2020). If a default is large enough to deplete these resources, the CCP could draw on member assessments, raising new funds from solvent clearing members to resolve the positions of the defaulting member. This obligation may be difficult for members to meet during periods of broader market stress.

Overview of the primary dealer system

Primary dealers are trading counterparties of the New York Fed in its implementation of monetary policy. They have several responsibilities, which include making markets for the New York Fed on behalf of its official accountholders, bidding in all Treasury auctions, and participating in the Federal Reserve’s open market operations. Primary dealers are also eligible to participate in the Fed’s Securities Lending Program, Overnight Reverse Repurchase Agreement Facility (ON RRP), and Standing Repo Facility.

Primary dealers must have triparty repo/reverse repo settlement arrangements with U.S. clearing organizations for which the New York Fed has a relationship. Currently, BNY (Bank of New York Mellon Corporation) facilitates clearing of all repo and reverse repo transactions for the New York Fed’s open market operations with all of its primary dealers.

Importantly, primary dealers must be participants in the central counterparty service for the government securities market. This requirement creates an indirect structural link between a U.S. CCP and the standing liquidity tools available through the Fed’s open market operations. It also indirectly connects all other U.S. CCPs to Fed open market operations through common clearing members that are also primary dealers.

The role of primary dealers in central clearing

Figure 1 shows that the percentage of clearing members that are also primary dealers varies by U.S. CCP. Given the New York Fed requirement for primary dealers noted in the previous section, FICC-GSD unsurprisingly counts all its roughly two dozen primary dealers as clearing members. However, since FICC-GSD has more than 200 clearing members, this represents around 10% of its total membership count. In contrast, the CCPs that clear derivatives—such as Nodal Clear, ICE Clear U.S., and ICE Clear Credit (firms with fewer clearing members)—have a relatively higher percentage of clearing members that are also primary dealers, at 45%, 41%, and 38%, respectively.

1. Primary dealers that are clearing members at U.S. central counterparties (CCPs)

| CCP | Total number of clearing members | Number of clearing members that are primary dealers | Percentage of clearing members that are primary dealers |

| CME | 63 | 18 | 29 |

| FICC-GSD | 248 | 25 | 10 |

| MBSD | 77 | 19 | 25 |

| NSCC | 148 | 20 | 14 |

| ICE Clear Credit | 32 | 12 | 38 |

| ICE Clear U.S. | 34 | 14 | 41 |

| MIAX | 15 | 4 | 27 |

| Nodal Clear | 20 | 9 | 45 |

| OCC | 103 | 19 | 18 |

Sources: Authors’ calculations based on data from central counterparties’ websites.

Estimate of primary dealer footprint in U.S. derivatives clearing

While the share of primary dealers among clearing members at CCPs provides some insight into their footprint in the centrally cleared ecosystem, a better measure of concentration is primary dealers’ volume of cleared activity. This can be proxied by the amount of margin that primary dealers set aside at CCPs. There are no publicly available data that break down the clearing member contribution to clearing activity by individual CCP. However, the Commodity Futures Trading Commission’s (CFTC) financial data for futures commission merchants (FCMs) provide us with some insights on the role that primary dealers play in this ecosystem.6 FCMs are clearing members of CCPs that clear derivatives transactions on behalf of their clients.

Figure 2 shows a breakdown of FCM customer segregated assets by whether the FCMs are also primary dealers.7 By this measure, FCMs that are also primary dealers are responsible for 77% of all customer clearing activity at CCPs that clear derivatives as of June 2025. This degree of concentration has remained high over the past ten years—a finding consistent with the broader trend of concentration in cleared markets (Patel, 2024).

2. Primary dealer concentration of activity at central counterparties (CCPs) that clear derivatives

| June 2025 | June 2015 | ||||||

| Primary dealer | Number of firms | Customer segregated assets (billions of dollars) | Percentage of total customer segregated assets | Number of firms | Customer segregated assets (billions of dollars) | Percentage of total customer segregated assets | |

| Yes | 19 | 261 | 77 | 19 | 116 | 79 | |

| No | 44 | 78 | 23 | 56 | 31 | 21 | |

Source: Authors’ calculations based on financial data for futures commission merchants from the Commodity Futures Trading Commission.

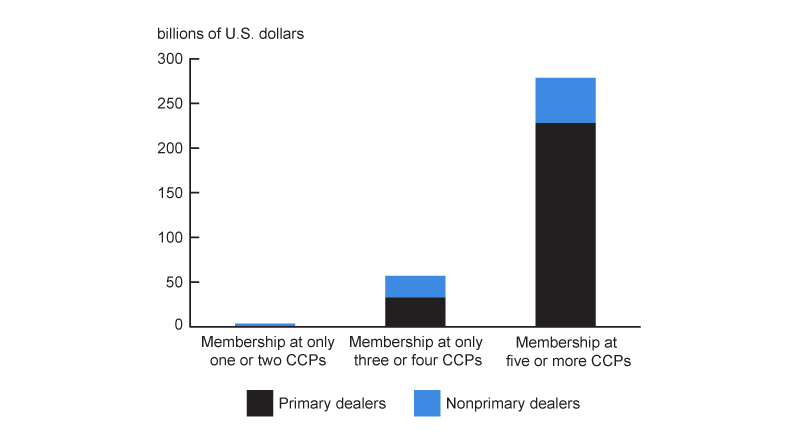

Figure 3 combines our earlier estimate of primary dealers’ contributions to derivatives clearing activities with these firms’ level of interconnectedness across CCPs that clear derivatives. We place firms into bins according to the number of CCPs for which they are clearing members. Then, we sum the shares of firms’ customer segregated assets as a percentage of the total. Of the 63 FCMs, 15 FCMs are the most interconnected, which we define as having five or more CCP memberships. As of June 2025, these highly interconnected firms held about $279 billion out of a total of $339 billion in customer segregated assets. Further, $228 billion of this, or two-thirds of total customer segregated assets, was held by these most interconnected FCMs that are also primary dealers. This measure of primary dealers’ clearing activity concentration and their interconnectedness across CCPs makes it clear that primary dealers’ access to liquidity is vital in case there are large margin calls or other demands for liquidity from multiple CCPs, which may occur during periods of significant market stress.

3. Customer segregated assets with clearing members, by number of memberships at central counterparties (CCPs) that clear derivatives

Source: Authors’ calculations based on financial data for futures commission merchants from the Commodity Futures Trading Commission.

What’s the use case for primary dealers tapping the SRF for liquidity for CCPs?

Unanticipated, time-critical liquidity demands at a CCP can arise in various forms. A very common liquidity demand is variation margin, which, as noted earlier, must be paid in cash and can be demanded at various points throughout the trading day. In a routine case, suppose that a clearing member needs to make a cash payment to a CCP, either to post variation margin or to settle a cleared transaction, and the clearing member has securities available to pledge as collateral but insufficient cash. Without access to alternative sources for raising cash, the clearing member would default on its obligation and the CCP would face a cash shortfall. Given what is shown in figures 2 and 3, it is reasonable to assume that this shortfall would involve one or more clearing members that are also primary dealers. Such a shortage could potentially destabilize the CCP. To prevent this outcome, a clearing member could use their securities holdings to enter into repurchase agreements in the private markets to raise cash (in other words, they could “repo” their securities) and then transfer funds to the CCP settlement bank via Fedwire.

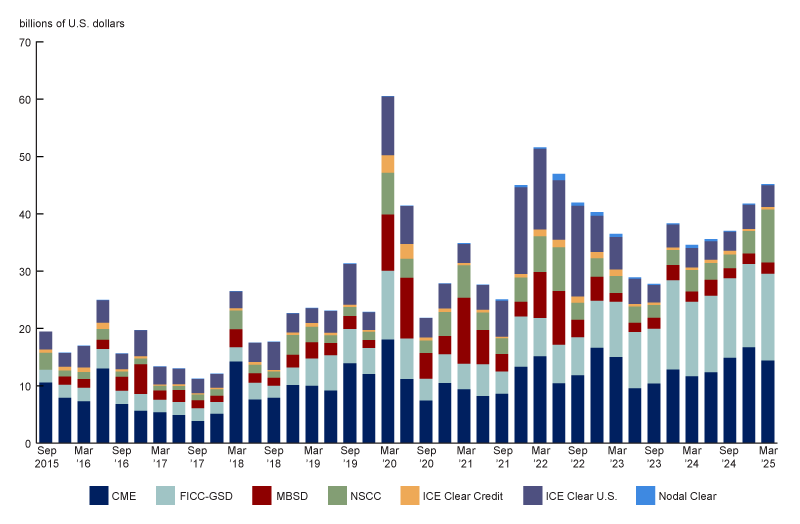

Cash demands from variation margin payments are not trivial. Figure 4 shows historical data on the largest amounts of daily variation margin paid to each CCP each quarter. While these peak variation margin calls can be large during normal times, they can increase even further during market stress events. Indeed, during the Covid-19-related market stress experienced in the first quarter of 2020, the peak daily variation margin calls at U.S. CCPs totaled over $60 billion. While these data do not tell us that the peak for each CCP occurred on the same day, it gives us an indication of the historical worst-case scenario of cash needs by clearing members. Given what we know about CCP clearing member concentration and interconnectedness, the cash demands from variation margin calls were likely experienced by a fairly small number of firms.

4. Maximum total variation margin paid, 2015–25

Source: Authors’ calculations based on data from Clarus Financial Technology, CCPView.

In addition to “repoing” their securities in the private market, clearing members that are also primary dealers have the option to repo eligible securities to the Fed’s SRF and receive the cash needed to make variation margin payments. This alternative pathway to liquidity could alleviate potential strains at CCPs, which could be particularly valuable in preventing wider spillovers during times of broader market stress. However, given the time-critical nature of margin payments, the settlement timing must align with the CCP payment deadline. Figure 5 lists the variation margin payment deadlines of select U.S. CCPs, which occur at several points during the trading day and which all precede the settlement time of the afternoon SRF operations, currently in line with the BNY’s triparty repo settlement time of 3:30 pm Eastern Time.

5. Payment deadlines for select U.S. central counterparties

| Central counterparty | Products cleared | Margin payment deadlines (in Eastern Time) |

| CME (base products only) | Commodity, equity, foreign exchange, and interest rate futures and options on futures | 8:30 am and 2:30 pm |

| FICC-GSD | Treasury cash transactions and repurchase agreements | 9:30 am and 2:45 pm |

| ICE Clear Credit | Credit default swaps | 9:00 am |

| ICE Clear U.S. | Agriculture, energy, equity, and interest rate futures | 8:30 am and 1:00 pm |

| MIAX | Agriculture futures | 10:00 am and 12:30 pm |

| Nodal Clear | Energy futures and derivatives and cryptocurrency futures | 9:00 am and 2:00 pm |

Source: Central counterparties’ websites.

The New York Fed Desk’s recent introduction of SRF operations that are executed and settled in the morning now opens the possibility that primary dealers could turn to the SRF for this use case. Additional adjustments to the SRF could further reduce liquidity risks in centrally cleared markets. Since both market stress events and ad hoc, time-critical margin calls can happen at any time of day, making the SRF available throughout the trading day, rather than using the current auction-style approach available at discrete times, could further reduce risks to the centrally cleared ecosystem from destabilizing market events. Beyond this—and as has been discussed elsewhere (see, e.g., Duffie, 2025)—allowing certain CCPs to access same-day liquidity via the SRF would allow for a default within a CCP to be resolved while minimizing or eliminating resulting liquidity events among nondefaulting clearing members. These two adjustments may warrant future examination to better understand their legality, risks, and benefits.

Conclusion

CCP clearing members that are also primary dealers have a large footprint in clearing; we estimate that these firms represent a large portion of daily cleared activity. These firms also contribute to the high level of interconnectedness across U.S. CCPs. The risk of a sudden, time-critical increase in liquidity demands by a CCP could be mitigated through ensuring primary dealers have sufficient access to liquidity, which can include access to liquidity via the Fed’s Standing Repo Facility. Recent changes to offer morning SRF operations with early settlement may enable this use case, even if likely needed only in periods of extreme market stress, when other liquidity sources are unavailable. However, there are limitations to the role primary dealers can play in addressing unanticipated increases in liquidity demands in the centrally cleared ecosystem. If a large clearing member faces a sudden and sizable operational disruption and cannot meet its cash collateral or payment obligations to CCPs, several U.S. CCPs may quickly experience liquidity shortfalls simultaneously. With the new SEC Treasury clearing mandate, Treasury securities and repo markets will become increasingly exposed to vulnerabilities at U.S. CCPs.

We thank Alessandro Cocco, David DeCarlo, and Ketan Patel for their helpful comments.

Notes

1 See Steigerwald (2013) for more on central counterparties—plus their clearing members—and central counterparty clearing.

2 The definitions for margin (initial and variation) and several other key terms related to central counterparty clearing are available online from the Basel Committee on Banking Supervision.

3 The SEC has mandated central clearing for all cash Treasury and Treasury repo transactions by December 31, 2026, and June 30, 2027, respectively.

4 Committee on Payment and Settlement Systems and Technical Committee of the International Organization of Securities Commissions (2012, p. 9).

5 Committee on Payments and Market Infrastructures and Board of the International Organization of Securities Commissions (2025, table 1, p. 5).

6 In the U.S., clearing members that clear products regulated by the Commodity Futures Trading Commission for clients are registered as futures commission merchants. Clearing members that clear products regulated by the U.S. Securities and Exchange Commission for clients are registered as broker-dealers.

7 Customer segregated assets represent the amount of assets held by FCMs for their clients, which provides an estimate of the amount of client trading activity. More information on the segregation of customer funds is available online from the CFTC.