Michigan Automotive, More Than Production

The dispersion of auto assembly line-type jobs from Michigan to the rest of the U.S. has been widely discussed. But it may be important to examine whether other jobs in the automotive value chain have also dispersed, particularly R&D and headquarters-administrative jobs. It is possible that a sizable part of automotive R&D and administration are spatially separable from production, with important implications for the economic health and growth prospects of Michigan.

To shed some light on this, we use microdata from the IPUMS CPS to track trends in production, office, and R&D jobs in both Michigan and the rest of the U.S. We sort any individual who reports working in the auto industry into one of these three occupational categories.1 For example, we classify engineers and technicians as R&D and assembly line workers as production workers. (We further classify as “other” those occupations that could fall into multiple categories, such as security or janitor).

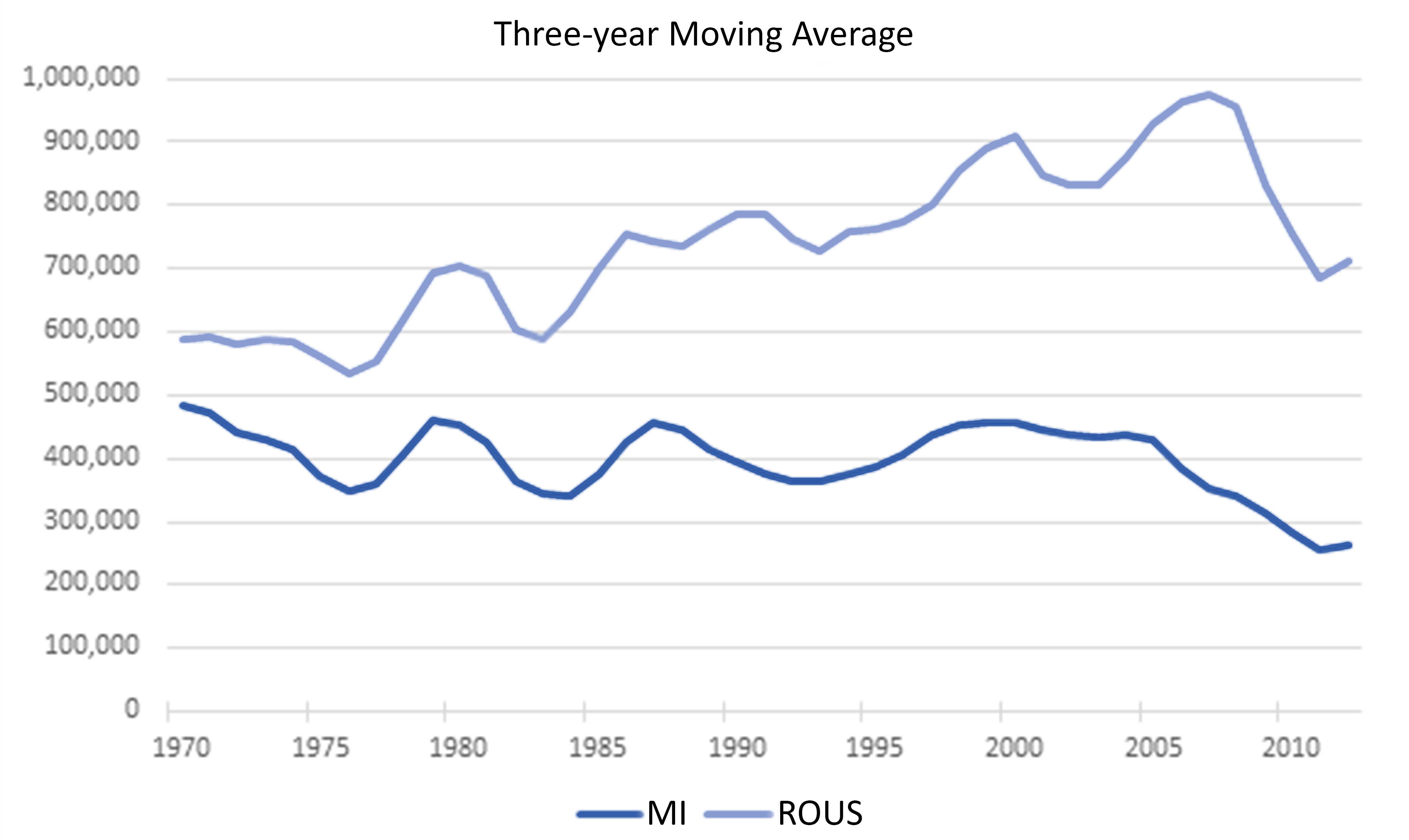

Figure 1 shows that total employment in the automotive industry has been relatively steady in Michigan, averaging 413,000 from 1970 to 2005. Since then, there has been a distinct decline; by 2012, Michigan’s auto employment was 262,000. In contrast, auto employment steadily increased in the rest of the U.S., rising from 588,000 in 1970 to a peak of 974,000 in 2007. The rest of the U.S. also saw heavy losses in the second half of the 2000s, with auto employment at 710,000 in 2012.

1. Total auto industry employment

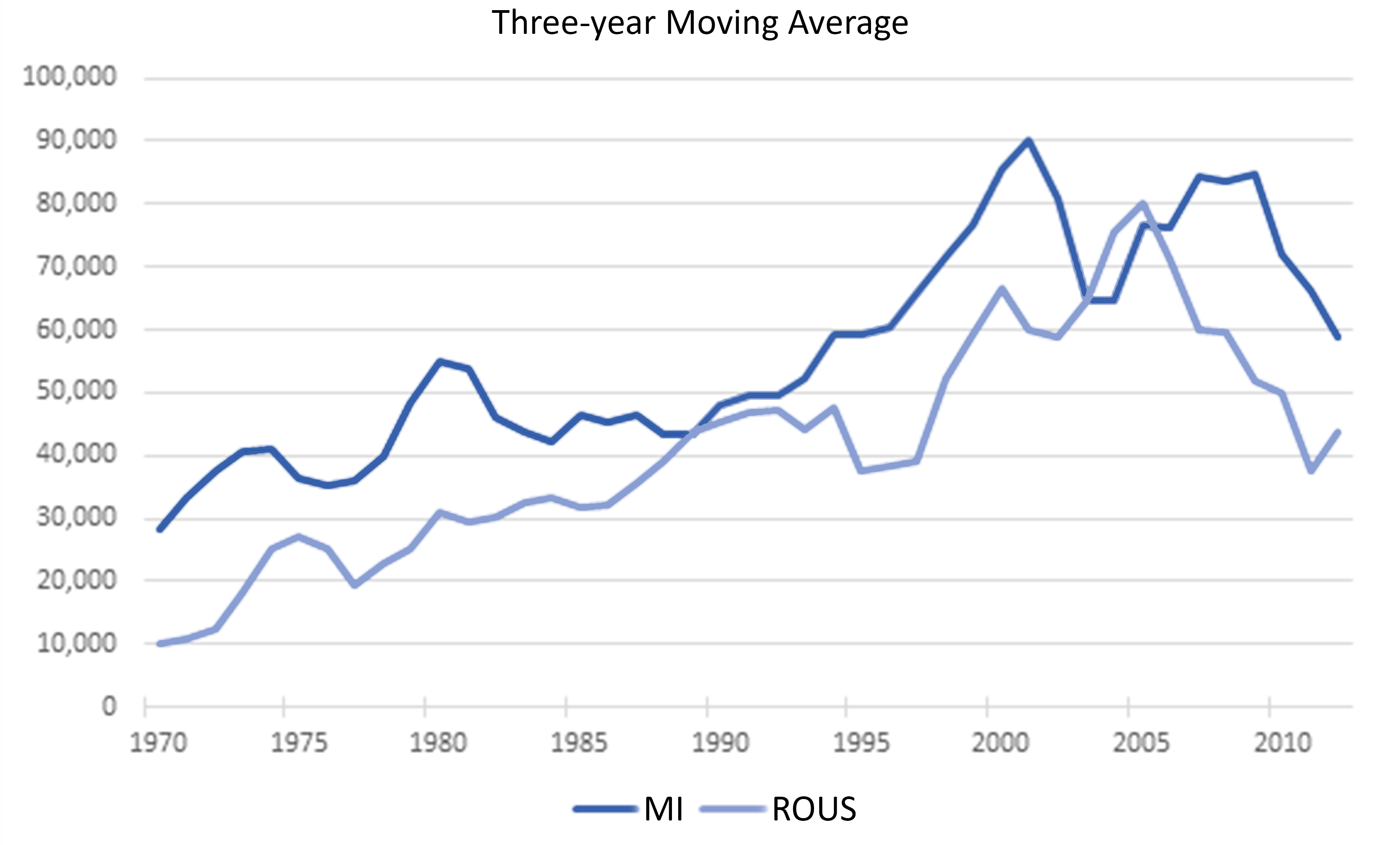

Trends in the R&D segment of the auto assembly are quite different. As figure 2 shows, R&D employment in Michigan grew steadily until the 2000s, from 28,000 in 1970 to a peak of 90,000 in 2001. Growth in R&D jobs in the rest of the U.S. generally kept pace, though with the exception of a couple years in the early 2000s, the majority of R&D jobs have resided in Michigan.

2. R&D employment

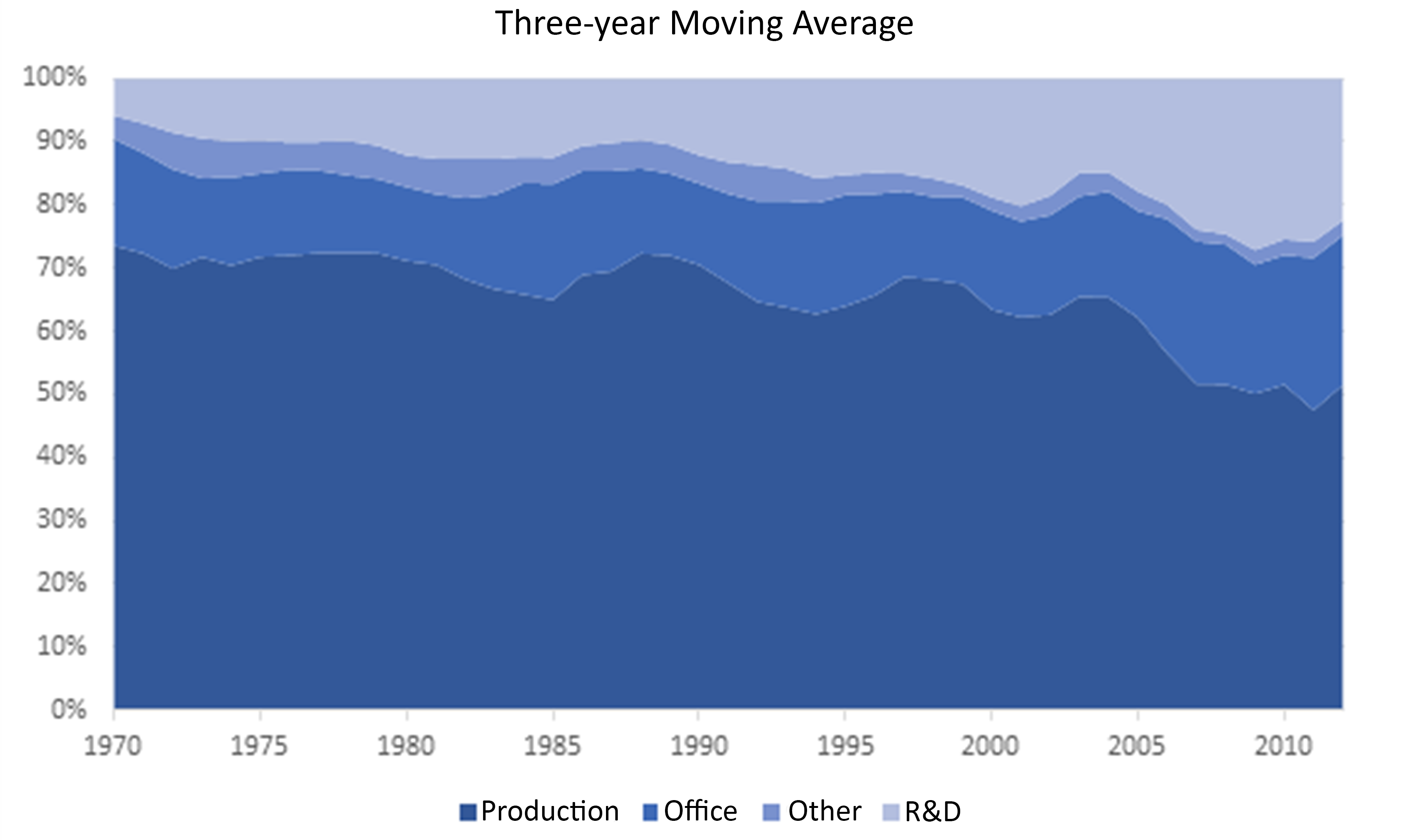

And so we see that R&D employment has made up an increasing share of overall auto employment in Michigan. In 1970, 6 percent of Michigan’s auto employment was found in R&D. By 2012, this share had climbed to 22 percent. This contrasts sharply with the rest of the U.S., where the proportion of auto employment in R&D grew from 1 percent in 1970 to 6 percent in 2012. Looking more broadly, 46 percent of Michigan’s employment is in either R&D or office occupations, compared with 24 percent in the rest of the U.S. At least by this measure, Michigan remains the nerve center and the creative engine of the U.S. auto industry, even as production jobs have dispersed.

This glimpse of the changed employment composition of Michigan’s auto assembly sector in figure 3 raises further questions. In particular, what is the outlook for Michigan’s R&D activities in light of the shifting geography of auto production activities? And what, if any, public policies might be influential to R&D’s continued success in the state?

3. Michigan auto employment composition

Footnotes

1 IPUMS CPS provides an occupation variable that is unified across changing occupational coding schemes from 1968 to present. The CPS survey combined Michigan and Wisconsin from 1968 to 1976. To allow the time series to extend back to 1968, we calculated by employment category the proportion of worker-years Wisconsin contributed to combined MI-WI totals from 1977 to present. We then used that proportion to scale down the pre-1977 MI-WI employment numbers to represent only Michigan and to scale up the ROUS numbers so to include Wisconsin. Available online.