How Have Rising Domestic and Foreign Tariffs Affected the Chicago Fed's Business Contacts?

In the spring of 2018, the Trump administration began imposing higher tariffs on imports of certain goods into the United States. In March, the administration put tariffs on imports of steel and aluminum from most countries. And then in July, it placed tariffs on $34 billion worth of Chinese imports. This was followed by tariffs on an additional $16 billion worth of Chinese goods in August and on another $200 billion worth of such goods in September. China and other affected countries responded with tariffs of their own on U.S. exports. (For a full description of the ramp-up in tariffs by the United States and other countries, see this timeline from the Peterson Institute.)

In May, we asked the Chicago Fed’s business contacts how they expected the steel and aluminum tariffs to affect their businesses, and most indicated that they expected a slightly negative impact. In the most recent Chicago Fed Survey of Business Conditions (CFSBC), we followed up and asked how the broad increase in tariffs had affected them so far. Most contacts reported that the overall impact had been fairly small, although some said it was too soon to tell. Among those affected by the tariffs, more said the impact had been negative than positive. In addition, a number of contacts reported that rising tariffs had created uncertainty about the prices of their inputs and demand for their firms’ products. The increased uncertainty had led some firms to delay hiring and capital spending.

In what follows, I’ll briefly explain how standard economic theory suggests tariffs affect businesses, and then I’ll explore the full results of our survey, which asked respondents to characterize the impact of the tariffs in terms of demand, input costs, output prices, employment, and capital spending.

In general, a tariff on a good imported to the United States helps domestic producers of that good and hurts domestic consumers. Domestic producers experience increased demand and pricing power, while domestic consumers pay higher prices. If the domestic consumer is a firm that uses the good as input for its production, it may choose to raise prices, which will reduce demand.

A tariff on a good exported from the United States hurts domestic producers and helps domestic consumers. Domestic producers experience decreased demand and pricing power, while domestic consumers pay lower prices. If the domestic consumer is a firm that uses the good as input for its production, it may choose to lower prices, which will increase demand.

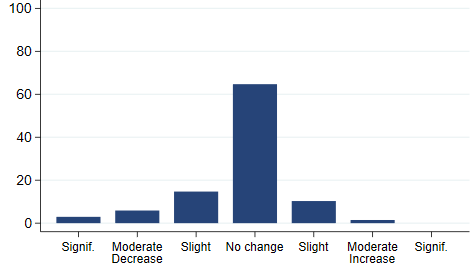

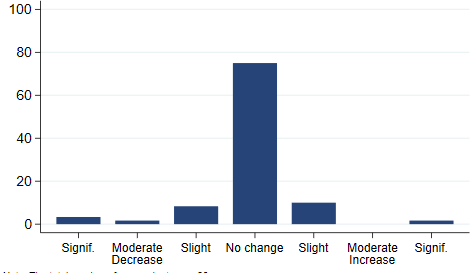

What happened to the Chicago Fed’s business respondents?1 Figure 1 shows that the majority of our contacts indicated that rising tariffs had not affected demand for their firms’ products. Among those whose demand changed, more experienced declines in demand than increases. Those who had experienced increases in demand were primarily in the manufacturing sector.

1. Change in product demand

Source: Federal Reserve Bank of Chicago.

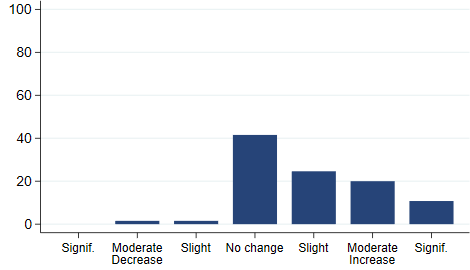

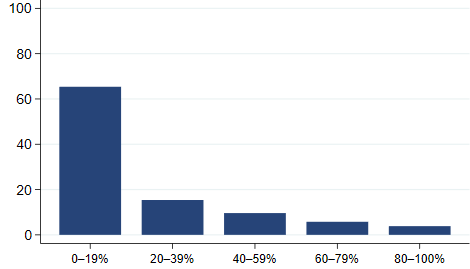

As noted previously, with rising domestic and foreign tariffs, costs could go up or down depending which inputs are subject to tariffs. Figure 2 shows that for most firms in our survey, costs had increased, but that generally the increases had been small. This is because, as figure 3 shows, most firms do not have a large share of input costs that are subject to tariffs. In addition, among contacts for whom a large share of their input costs are subject to tariffs, all reported that they had been able to pass along most of their increased costs to their customers.

2. Change in costs

Source: Federal Reserve Bank of Chicago.

3. Share of costs subject to tariffs

Source: Federal Reserve Bank of Chicago.

Rising tariffs could influence firms’ business decisions through demand and cost channels. Moreover, increased uncertainty about whether tariffs will change again could also have an impact on their decisions. I next look at how our contacts said rising tariffs had affected their immediate business decisions and their plans for the future.

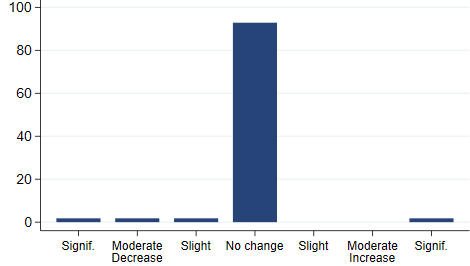

Figure 4 shows that almost none of our contacts had changed their employment levels in response to rising tariffs. And figure 5 shows that most contacts did not change their current capital spending either, although a higher proportion had made some change. There was one firm that significantly increased hiring and capital spending: This firm is in an industry where increased foreign tariffs on its primary input led to lower domestic prices and increased U.S. tariffs on its primary output led to higher domestic prices. With much improved margins, the firm could justify a robust expansion.

4. Change in current employment

Source: Federal Reserve Bank of Chicago.

5. Change in current capital spending

Source: Federal Reserve Bank of Chicago.

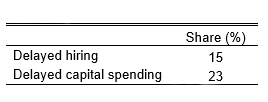

Figure 6 shows that, overall, 15% of firms had delayed hiring and 23% had delayed capital spending. A number of firms noted that the rising tariffs had created uncertainty about prices for capital equipment. Other contacts said that they were hesitant to make new investments because they were unsure of how the rising tariffs would affect their clients’ businesses.

6. Delays in hiring and capital spending

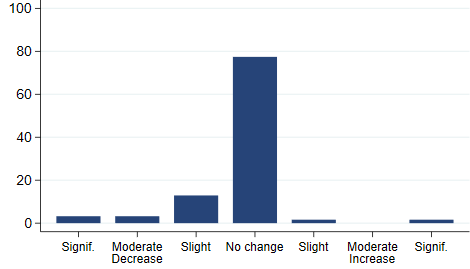

Figures 7 and 8 show that firms’ plans closely mirrored their current activities, with most firms indicating that they expected no effect of rising tariffs on future decisions. And, among those who did expect an effect, more said they anticipated a negative impact rather than a positive one.

7. Change in planned employment

Source: Federal Reserve Bank of Chicago.

8. Change in planned capital spending

Source: Federal Reserve Bank of Chicago.

All told, rising domestic and foreign tariffs appear to have had a small effect on the Chicago Fed’s business contacts so far. That said, the tariff changes have affected some companies significantly and have created uncertainty that is likely to affect businesses’ decisions into 2019.

Footnotes

1 Note that in our survey we did not distinguish between producers and consumers of the goods subject to domestic and foreign tariffs.