Third Quarter 2019 Review—Growth Remained Moderately Below Trend

Summary

Growth in the Seventh Federal Reserve District remained moderately below trend in the third quarter of 2019 as activity in the manufacturing sector continued to be soft. There were signs, however, that the slowdown in growth we’ve experienced over the past year and a half has abated. And while our business contacts expect the economy to continue to grow slowly, they are not anticipating a recession in the near future.

Now let’s look at some economic indicators that support this summary.

Analysis

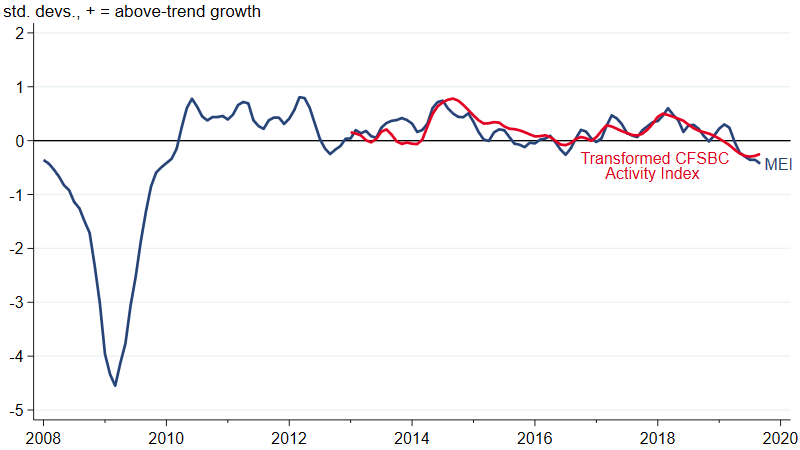

We start with two indicators of overall economic activity for the Seventh Federal Reserve District—namely, our Midwest Economy Index (MEI) and the Chicago Fed Survey of Business Conditions (CFSBC) Activity Index. The MEI summarizes more than 100 economic indicators for the five Seventh District states (Illinois, Indiana, Iowa, Michigan, and Wisconsin). The CFSBC Activity Index summarizes about 100 responses from business leaders in the Seventh District to a survey question about product demand. In spite of using very different information sources, the indexes track each other closely. Figure 1 shows the MEI and CFSBC Activity Index together. For this figure, I’ve transformed the CFSBC Activity Index to match the timing and scale of the MEI. Both indexes indicate that growth has slowed and is now moderately below trend. There appears to be some disagreement, though, about whether the slowdown has ended. While the MEI has been flat to slightly down in recent months, the CFSBC Activity Index has been flat to slightly up.

1. MEI and transformed CFSBC Activity Index

Source: Author’s calculations based on data from the Federal Reserve Bank of Chicago.

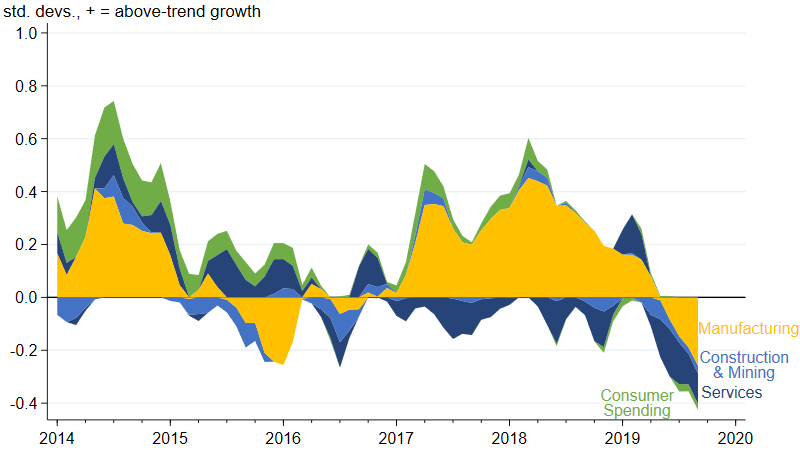

If we look at the contributions from the sectors that make up the MEI (figure 2), we can see that growth has slowed for all sectors—with the largest decline in growth registered in the manufacturing sector. Manufacturing has been the primary driver of the slowdown that started in the middle of 2018.

2. Midwest Economy Index sectoral contributions

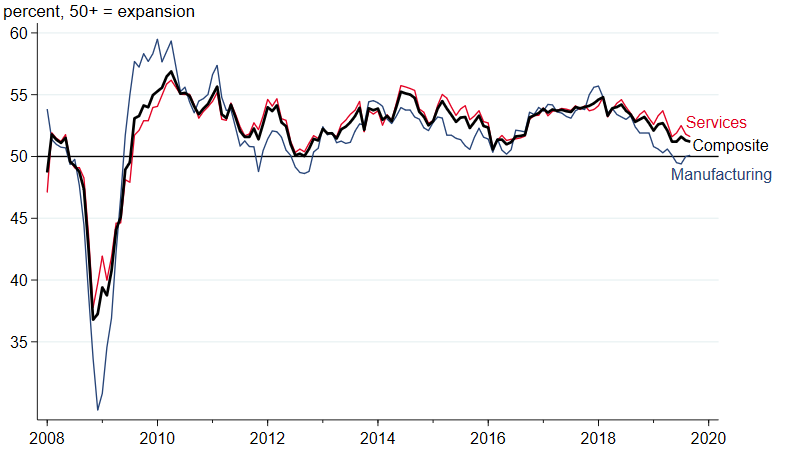

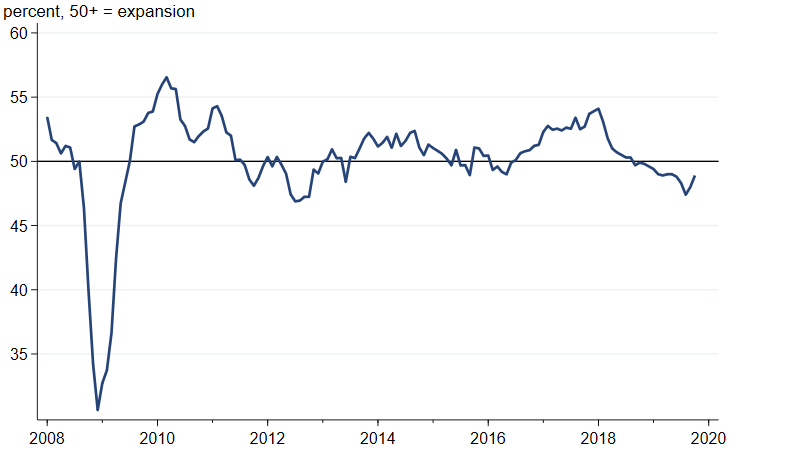

What can explain the slowdown in Seventh District manufacturing over the past year and a half? As I’ve been noting for a while now, slower growth in the United States and across the world has resulted in falling demand for the District’s manufactured goods. The J. P. Morgan Global Manufacturing & Services PMI (purchasing managers’ index) indicates that the pace of global growth started slowing in the second half of 2018 (figure 3). In addition, the manufacturing component of the composite index tells us that Seventh District manufacturers have not been alone in experiencing a slowdown—indeed, figure 3 shows us that manufacturers throughout the world have seen growth slow to the point of being slightly in contraction territory. A decline in trade is perhaps the best explanation for manufacturers’ difficulties across the globe. According to the J. P. Morgan Global Manufacturing New Export Orders PMI, new export orders have been declining since September 2018 (figure 4). This is in line with what we’ve been hearing for quite some time from many our CFSBC contacts—that elevated trade policy uncertainty has been clouding their outlooks and making them more reluctant to make new investments, which often involve the purchase of manufactured goods.

3. J. P. Morgan Global Manufacturing & Services PMI

Sources: J. P. Morgan and IHS Markit.

4. J. P. Morgan Global Manufacturing New Export Orders PMI

Sources: J. P. Morgan and IHS Markit.

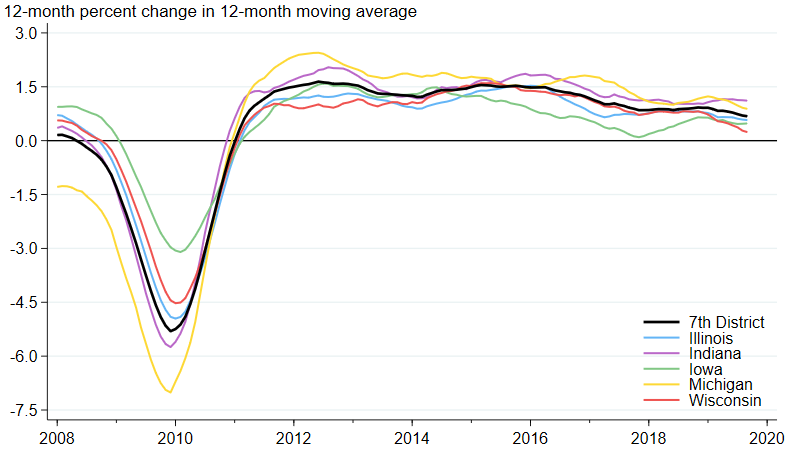

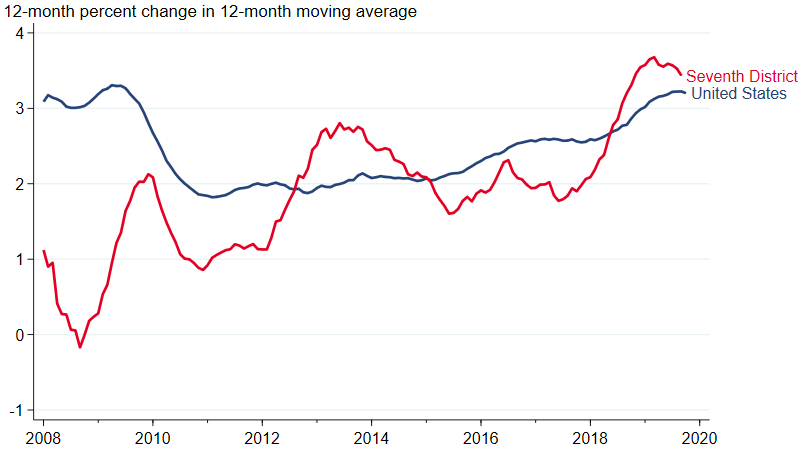

While the Seventh District’s growth has fallen below trend, its labor market is still in very good shape. Employment continues to grow across all five Seventh District states (figure 5). Moreover, even though wage growth has been flat since the beginning of this year, it remains near its ten-year peak in the Seventh District states and the United States as a whole (figure 6).

5. Employment growth rates for Seventh District states

6. Average hourly earnings growth for Seventh District states and the United States

While our CFSBC contacts expect growth to continue to be slow, they do not foresee a steep drop in demand that would characterize a recession. Figure 7 shows the distribution of our contacts’ responses to our question about expected change in demand over the next 12 months. A majority of our nonmanufacturing contacts expect demand to increase, while our manufacturing contacts expect flat demand on balance.

7. Responses to CFSBC question concerning expected change in demand over next 12 months as of 10/16/2019

Source: Federal Reserve Bank of Chicago.

Conclusion

The Seventh District’s pace of economic growth continued to be moderately below trend in the third quarter of 2019. That said, the labor market was still doing well. Our business contacts do not expect growth to pick up much over the coming year, but they do not expect it to slow further either.