Introduction and summary

The disproportionate impact of the recent financial crisis and housing market shocks on racial and ethnic minority neighborhoods has prompted researchers to revisit economic issues that relate to financial inclusion and the role of minority depository institutions (MDIs) and community development financial institutions (CDFIs), whose missions often include the promotion of financial services and credit in traditionally underserved communities (Reuben, 2010; Phillips, 2010; Rugh and Massey, 2010; and Kashian, McGregory, and McCrank, 2014). Minority-owned community banks were hit particularly hard during the 2008 financial crisis, as evidenced by higher rates of failures and closures relative to nonminority bank peers. Nearly all states with MDI banks saw a net decline in MDIs between 2008 and 2015. Illinois, one of the states in the Seventh Federal Reserve District, lost the highest percentage of MDI banks in the country (eight banks or 47 percent of its MDIs). There were five African American-owned banks in Chicago in 2001. By 2017, however, with the demise of Seaway Bank (acquired by an Indian American [Asian] bank, State Bank of Texas, then sold two months later to Self-Help Federal Credit Union), this leaves Chicago with two black-owned banks, Illinois Service Federal and Urban Partnership (which succeeded ShoreBank), a CDFI.1 These trends have raised questions about the extent to which MDIs can continue to help redress inequality in credit and access to financial services, while remaining viable and sustainable.

In this article, we analyze the experience and performance of MDIs in their primary local service areas in recent periods, including before, during, and after the 2008 financial crisis. We provide a review of the sector, highlighting key policies and initiatives pertaining to and affecting these institutions, and provide a brief review of previous research. We document trends in the sector, including: 1) the characteristics of the locations where MDIs tend to do business; 2) the changing landscape of MDIs in terms of openings, closings, and mergers by ethnic ownership; and 3) the performance of MDIs as measured by selected financial ratios, including loan quality, operating income, and funding sources. We present these trends over time, comparing MDIs with nonminority-owned (non-MDI) community banks.

We compare MDIs with non-MDI community bank peers ($10 billion in assets or less) in similar local service (census tract) areas. By considering small geographical areas, as measured by census tracts, our analysis thus controls to some degree for MDIs and non-MDIs that are located in the same metropolitan areas but may be serving different neighborhoods and customers. This setup also allows us to determine other differences, which might be associated with the type of local service areas specific to MDIs and their competitors.

The results of our analysis confirm previous research findings that suggest that MDIs are more likely to focus on communities of diverse ethnic and immigrant backgrounds, and within similar markets MDIs may be lending to different customers that have relatively lower income and more credit constraints than those served by non-MDIs (for example, Kashian, McGregory, and McCrank, 2014). In addition, we analyze the implications of changes to MDI banking structure (such as institutional closures) in places in which these banks have traditionally operated. We find mixed prospects for access to financial services. On the one hand, the MDI sector as a whole appears to have continued to maintain a presence in some markets to a greater extent than the closure rates of these institutions would suggest. That is, even during an active period of mergers, acquisitions, and failures within the sector, new MDIs were being formed, and some MDIs were able to expand their deposits and geographical footprint. However, there is reason for concern in terms of the overall MDI sector’s prospects for expanding its reach to customers in lower-income areas, subsequent to the financial crisis. In some instances where MDIs have closed, they are being replaced by non-MDIs.

Differences in various characteristics and indicators of performance (that is, nonperforming loans, returns on assets, and leverage capital ratios), which previous research has taken as evidence of sector underperformance, lessen between MDIs and non-MDIs if we compare them in the same primary local markets. This would seem to underline the importance of controlling for location and finding comparable benchmarks in peer banks. Even so, our analysis does identify various sources of differences between MDIs and non-MDIs even when controlling for location, particularly related to loan performance, funding resources, and capital. These affect the sector’s relative efficiency and overall performance, compared with non-MDI peers in the same markets. We conclude this article with a short discussion of some policy implications.

Evolution of MDIs2

Regulators categorize minority ownership into five broad ethnic groups: African American, Asian, Hispanic, Native American, and other. The Federal Deposit Insurance Corporation (FDIC) defines minority depository institutions as banks in which: 1) at least 51 percent of the voting stock is owned by minority individuals, or 2) the majority of the board of directors are minority individuals and the community that the institution serves is predominantly minority. The Office of the Comptroller of the Currency (OCC) and the Federal Reserve System each has its own definition of MDIs that is consistent with the MDI categories defined by section 308 of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, which states that a minority depository institution is a federally insured depository institution where 51 percent or more of the voting stock is owned by one or more “socially and economically disadvantaged individuals.” However, the list of MDIs that the Federal Reserve System publishes includes any depository institutions that participate in the Treasury’s Minority Bank Deposit Program (OCC, 2016).3 At its discretion, the OCC may consider additional factors when evaluating mutual institutions and their MDI designation. For example, it may consider a mutual federal savings association an MDI if the majority of the board of directors are minority individuals and the communities that it serves are predominantly minority. It may also consider a mutual institution an MDI if women comprise a majority of the board of directors and hold a significant percentage of senior management positions. The OCC may continue to treat a national bank or federal savings association previously designated as an MDI as covered by the policy statement, even if that institution no longer meets the ownership criteria, provided that the institution primarily serves the credit and other economic needs of the community in which it is chartered and that community is predominantly minority. For our analysis, we combine the lists of MDIs from all three regulators: the FDIC, Federal Reserve System, and OCC.

Historically, minority depository institutions were formed to provide credit to groups of people who were typically denied credit (Gerena, 2007). After the Civil War, many African American banks were created to provide financial services to African Americans; for example, between 1888 and 1934, 134 black-owned banks were formed mostly in the southern states (Okonkwo, 2003). Most of them closed as a result of the Great Depression, and only nine black-owned banks were in business in the 1930s. The sector remained depleted up through the 1960s. Black-owned banks experienced a resurgence during the 1970s, with the civil rights movement encouraging blacks to empower themselves economically, along with some government interventions such as the Minority Bank Deposit Program (Gerena, 2007). Their number grew to 50 nationwide by 1976 (Okonkwo, 2003). The 1980s savings and loan crisis dealt a blow to the banking industry as a whole and losses occurred for the minority-owned sector in a disproportionate manner; thus, by 1988, 35 black-owned banks had failed (Okonkwo, 2003). As of 2001, we identify 48 African American-owned (or with African American-majority boards of directors) banks and thrifts. And by 2015, we count 27 African American-owned banks.4

The first Asian-owned and Hispanic-owned banks in the United States, established to specialize in financial services for their respective communities, opened in the 1960s.5 The first Native American-owned bank on a reservation began in the mid-1980s when the Blackfeet tribe of northwestern Montana took over a failed bank in the city of Browning. By 2015, we count 39 Hispanic-owned banks, 83 Asian-owned banks, and 19 Native American-owned banks.

Several government policies and initiatives have been crafted over time to support minority-owned banks and their services in traditionally underserved communities, although it is not clear that they have always ended up strengthening these institutions. One of the earliest, started in 1970, was the Minority Bank Deposit Program, which still exists today. The program directs the U.S. Department of the Treasury, as well as other interested state, federal, and local government agencies and private sector companies, to make efforts to place deposits with minority-owned institutions.6 The research on this program has been mixed, with some studies suggesting that the volatile nature of large amounts of government deposits has created greater instability in these institutions (Lawrence, 1997; Gerena, 2007; Price, 1990; Clair, 1988; and Kashian, McGregory, Jr., and Lockwood, 2014).7

The passage of the Community Reinvestment Act (CRA) in 1977, which encouraged banks and thrifts to help meet the credit needs of communities in their service areas (consistent with safe banking practices) in a sense brought additional competition to smaller or more geographically focused institutions like MDIs; and some studies have connected minority bank failures to the increase in competition (Hays and DeLurgio, 2003).8

Bank regulators introduced additional initiatives in the late 1980s and 1990s to recognize the contribution of minority depository institutions to the banking system. Section 308 of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 included a stated goal to preserve minority depository institutions and to provide technical assistance to these institutions to help prevent their insolvency. With the creation of the Community Development Financial Institutions (CDFI) Fund in 1994, policymakers provided an additional source of community development financing and technical assistance to help financial institutions promote economic revitalization and community development. In 2013, 41 MDIs (23 percent) were CDFIs.9 As of 2015, 38 MDIs were CDFIs, out of a total of 171 MDIs.

More recently, as part of its efforts to stabilize the financial system in 2008 and 2009, the Treasury created the Community Development Capital Initiative (CDCI) for mission-oriented banks. A component of the Troubled Asset Relief Program (TARP), the CDCI was similar to the Capital Purchase Program (CPP), wherein the government helped to recapitalize banks through the purchase of preferred equity stakes10 (see Acharya and Sundaram, 2009; Bodurian, 2011; and Isyuk, 2013). The CDCI program had better terms than the CPP, and capital injections were made via the purchase of subordinated debentures in addition to the purchase of preferred shares. A handful of CDFIs exchanged CPP disbursements for CDCI funds, and 35 certified CDFIs received CPP, 12 of which were MDIs.

Since the financial crisis, federal banking regulators have enhanced their initiatives to support MDIs. Although the Federal Reserve System had been working with MDIs prior to the crisis, it officially launched the Partnership for Progress in 2008. The partnership provides technical assistance to MDIs on topics such as regulatory and capital-planning processes, with the goal of preserving the number of MDIs (Duke, 2009). In 2013, the Federal Reserve System reaffirmed its commitment to MDIs, recognizing that they, like the households they serve, were hit hard by the recession.11 For its part, the FDIC, which has become the primary federal regulator of minority depositories, conducted a research study on minority banks in 2014, has held regular conferences for MDIs in partnership with the Federal Reserve System and OCC, has facilitated ongoing regional discussion sessions, and has helped match MDIs with minority investors, in addition to participating in an interagency group that coordinates support among regulators. In 2013, the OCC also established a Minority Depository Institutions Advisory Committee to recommend steps for ensuring the health and viability of minority depository institutions.12

Previous research

Academic interest in minority banks dates back to Brimmer’s (1971) seminal study on the performance of black-owned banks. Studies on minority-owned banks have generally fallen into two main categories: 1) an examination of their performance/efficiency and their prospects for long-term survival; and 2) the impact of these banks on the economic development of their local service areas and the clientele they serve (for example, Irons, 1971; Emeka, 1973; Bradford, 1974; Boorman, 1974; Black, 1979; Bates and Bradford, 1980; Clair, 1988; Elyasiani and Mehdian, 1992; Cole et al., 1985; Kwast and Black, 1983; Hasan and Hunter 1996; and Iqbal, Ramaswamy, and Akhigbe, 1999). According to the majority of these studies, minority banks are confronted with some unique challenges, not necessarily common to all small (community) banks, which might create greater constraints on their efficiency. These studies have noted that lending is generally much lower for MDIs than for their peers, due to their having lower capital and serving a clientele with liquidity constraints or less stable income profiles in low-income neighborhoods. However, some researchers (for example, Lawrence, 1997, and Clair, 1988) found that some MDIs (black and/or Hispanic) generally underperformed their nonminority peers competing in the same marketplace, suggesting that their underperformance was not driven by the market they served.

A 2006 U.S. Government Accountability Office (GAO) report finds that asset size matters when it comes to the performance of MDIs, as MDIs with less than $100 million in assets perform worse than their peers. The study also finds that lower profitability relates to having higher reserves for potential loan losses and having higher operating expenses relative to earnings and assets. Qualitative information in the GAO (2006) study from interviews with minority bank officers sheds light on the higher costs associated with MDI banking markets. MDI banks often provide financial literacy services and often serve customers who prefer to do business in person at bank branch locations rather than through lower-cost alternatives such as phone or internet, thus generally requiring more time and resources per transaction. Retaining and attracting qualified staff and growing competition from larger banks in traditional MDI markets are other challenges to profitability that bankers noted in interviews.

Figure 1. Distribution of minority-owned banks/branches, 2015

Reserve System, U.S. Department of Housing and Urban Development, and authors’ calculations.

A more recent analysis by the FDIC (2014) finds that while the financial performance of MDIs resembled that of their peers prior to the 2008–10 recession, their performance (for example, in terms of returns on assets), diverged during the crisis and MDIs increasingly underperformed community banks and noncommunity banks. The study suggests that future research is needed to gain insights into the factors behind this divergence, including a better understanding of the characteristics specific to MDIs, which include being younger institutions and serving more-distressed geographies.

The second category of inquiry, focusing on the effects of MDIs in their service areas, is of interest given that policies supporting MDIs hinge on the assumption that they support minority areas or customers in ways that other banks do not. The findings of this research, which is rooted in “ethnic affinity theory,” have been mixed. An earlier study by Black, Collins, and Cyree (1997) investigated this issue in relation to black-owned banks and African American borrowers, and failed to find that otherwise similar African American applicants were relatively more successful in securing loans from black-owned banks. However, Bostic (2003) found support for the theory that minority clients may be treated more favorably by minority-owned banks. Questions concerning who minority banks serve have renewed importance in light of ongoing demographic changes and out-migration of minority populations from many metro/urban areas, which traditionally have been target markets for MDIs. These changes have been shifting the relationship between MDIs and their primary depository customer base (Ladd, 1998).

In the wake of the financial crisis, various studies have explored the impact of the changes in bank infrastructure—branch openings, closings, and acquisitions—on local communities, particularly for people in low- and moderate-income neighborhoods who might rely more on banking relationships. On the one hand, efforts by regulators to encourage acquisitions by banks that have a similar mission as the closing minority bank could mitigate the impact of these structural changes on the communities where the closing bank is located.13 According to analysis based on data from the FDIC, the number of bank branches is unaffected in 80 percent of cases of bank closings nationwide (Nguyen, 2014). Provisions such as loss-share agreements are also designed to soften the impact on local communities in that they provide incentives to purchasers to assume some or all of the assets of the closing bank (FDIC, 2013).14 Even so, bank closings and changes in bank structure have been shown to disrupt small business and consumer credit supply. While technology and deregulation may have largely erased geographical boundaries for the provision of financial services and may have reduced bank branch spatial dependence more generally, in markets for certain types of loans that are more localized due to information considerations, such as small business loans, bank closings can result in sizable credit disruptions in the local environment (Berger, Goldberg, and White, 2001; Nguyen, 2014; Greenstone, Mas, and Nguyen, 2014; and Toussaint-Comeau and Newberger, 2017).15 The special nature of relationship lending, which may be lost when a community-based bank closes or fails, in some instances may not be easily replaced, even if the newcomer appears similar in terms of minority designation or mission statement.

Our review of the literature makes it clear that while we have learned a lot about the performance and outcomes of mission-driven institutions, more remains to be understood concerning the experiences of MDIs in the specific local market context and service areas in which they operate, especially in the wake of the financial crisis and the significant stress that seems to have affected the sector and its markets.

Location and other characteristics of MDIs

Although MDIs hold a very small share of total banking sector deposits (less than 2 percent), they tend to be concentrated in particular places (see figure 1). Fourteen states have never had a minority depository institution, but in certain states and certain large counties, for example, Los Angeles and Miami-Dade, MDIs hold about 10 percent of county-level deposits. This amounts to more than $37 billion in Los Angeles and $10 billion in Miami-Dade.16 In several rural counties of Oklahoma and Texas, as well as in other states, more than half of county deposits are held by MDIs. Differences by location exist even at the state level. Tracing various characteristics during the 2008 financial crisis by MDI state location, we see that the unemployment rate was higher in states with an MDI bank, as were various indicators of housing market distress, including foreclosure rates and the share of subprime mortgages (table 1).

The local/neighborhood level provides an even clearer picture of the relationship between MDIs and their locations. We measure the local market service areas of banks based on the census-tract location of their branch offices.17 Indeed, CRA evaluations are often predicated on demonstrating lending to or services in low- and moderate-income (LMI) census tracts.18 If financial institutions differentially serve specific neighborhoods (for example, high-minority and low- to moderate-income), we expect the patterns to be apparent at the census-tract level. Table 2 shows the characteristics of census tracts in which we find branches of MDIs (and other banks) and only MDIs, respectively, relative to areas with only non-MDIs. For comparison, we also report these characteristics for census tracts overall in the nation and by income category, whether low- to moderate-income or middle- to high-income. Census tracts with an MDI branch present have a higher proportion of nonwhites and immigrants. More than 50 percent of census tracts in which we find only MDI bank branches are low- to moderate-income areas. While poverty at the national level affects less than 15 percent of the population as a whole, it stands at more than 20 percent in the census tracts that only have MDI branches. Other indicators suggest that on average, these neighborhoods have relatively lower socioeconomic status. As table 2 also shows, fewer of their population have a college education, and more of them are unemployed. In addition, more are unmarried and/or living in single-female-headed households, which tend to correlate with lower average family income. These census tracts also tend to have lower homeownership rates and higher rates of multifamily (rental) housing units.

Table 1. State-level housing market indicators and presence of minority-owned banks

Sources: Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; Loan Processing Services; Equifax; Federal Housing Financial Agency (FHFA); U.S. Census Bureau; U.S. Bureau of Labor Statistics; and authors’ calculations.

The branch office deposit distribution, as well as the small business and mortgage loan portfolio of MDIs, also reflect greater exposure to lower-income neighborhoods, places that tend to have relatively more subprime borrowers with greater income and credit constraints, and that experienced stronger shocks from the 2008 housing and financial crisis (Justiniano, Primiceri, and Tambalotti, 2016; and Mian and Sufi, 2009). On average, about 50 percent of MDI banks’ deposits come from branches located in LMI neighborhoods (table 3). Non-MDIs overall obtain around 20 percent of their deposits from branches in LMI areas. In addition, just under 20 percent of MDI deposits are from branches in census tracts with a majority black population, compared with less than 5 percent of non-MDI deposits; and 10 to 20 percent of MDI deposits are from branches in neighborhoods with a majority foreign-born and/or Hispanic population, compared with less than 1 percent of non-MDI deposits (table 3).

With respect to small business lending, based on CRA small business lending disclosure reports data, 38 percent of loans from MDIs are to business borrowers in LMI neighborhoods, compared with 21 percent of loans from non-MDIs (table 4). The pattern is similar for home loans—31 percent of mortgage loans from MDIs are made in LMI neighborhoods, compared with 14 percent of non-MDI mortgage loans. Moreover, 15 percent of mortgage loans from MDIs are made in neighborhoods with a majority black population; close to 20 percent are in areas with a majority Hispanic population; and more than 10 percent are in areas with a majority foreign-born population. By comparison, between 1 percent and 3 percent of mortgage loans from non-MDIs are made to applicants in similar locations (table 4).

Table 2. Demographic characteristics of local service areas (census tracts)

Sources: U.S. Census Bureau, American Community Survey ; U.S. Department of Housing and Urban Development; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

In sum, a comparison of branch location between MDIs and non-MDIs indicates that MDI branches are more likely to be located in nonwhite communities, with lower incomes and higher poverty rates than the national averages. MDIs are located in areas with higher shares of multifamily housing units, and a larger share of their lending goes to those places, suggesting that, consistent with their mission, they are targeting customers, neighborhoods, and types of housing markets that may be underserved by other banks.

Changing banking structure and implications for financial services access

In this section, we take a closer look at the changes in the number of MDIs over time to understand the implications for financial services access in places that have traditionally been served or targeted by MDIs. Regulatory developments over the past few decades have created conditions resulting in large declines in the number of banking institutions, both in general and among MDIs.19 Between 2000 and 2015, the number of banking institutions at the national level declined by more than 35 percent, from 10,046 to 6,358 (figure 2). The smallest community banks, with assets under $100 million, shrank by 60 percent (from 4,619 to 1,835), and larger community banks with assets up to $10 billion declined by 17 percent (from 5,305 to 4,411).20 In contrast, the number of larger banks, with assets of more than $10 billion, declined by just 8 percent, hovering between 126 and 106 over the period (figure 3).

Table 3. Bank branch deposits and characteristics of local market areas served by minority-owned and nonminority-owned banks

Sources: U.S. Census Bureau, American Community Survey ; U.S. Department of Housing and Urban Development; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

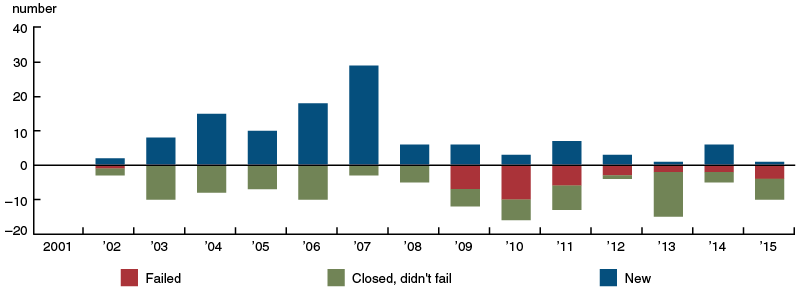

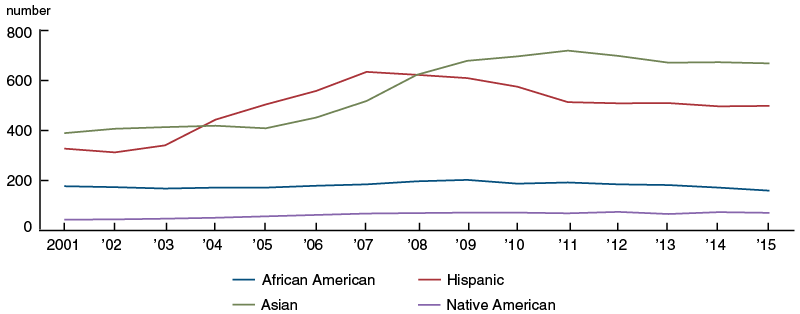

The decline in the number of MDIs (almost all of which are under $10 billion in assets) during and after the financial crisis mirrors that of small banking institutions, although some differences exist by minority ownership designation (figure 4). Overall, the number of MDIs fell from a high of 219 banks in 2008 to 171 banks in 2015, a decline of 22 percent. The highest net percentage decline in MDIs was among African American-owned banks; 20 of these banks closed during and after the 2008 recession, and only one new bank (Urban Partnership) was added to the sector from this group. Although more than 35 Asian-owned banks closed between 2008 and 2015, 26 new Asian-owned banks were added to the list of MDIs after 2008, such that this group showed an 18 percent net reduction between 2008 and 2015. As for Hispanic banks, 16 have closed since 2008 and another six have been created, for a net decline of 18 percent. Overall, there was more volatility in the MDI sector than among community banks as a whole. By our count, 45 percent of the MDIs that existed in 2001 no longer operated in 2015. The FDIC (2014) study found that only 30 percent of MDIs operated continuously throughout the study period, from 2002 to 2013, compared with 57 percent of community banks.

Voluntary bank closures among MDIs, whereby owners sell their assets and liabilities to another bank, were not uncommon in the first part of the 2000s, particularly among Asian-owned banks. However, much of the decline in MDIs after 2008 was the consequence of bank failures. For example, of the 20 black-owned banks that were closed by the FDIC between 2008 and 2015, 60 percent had failed. Among the Hispanic- and Asian-owned banks, about 40 percent of the closures (since 2008) were categorized as failures. Thus, while the average failure rate of MDIs from 2008 to 2015 was 2.4 percent (compared with less than 1 percent for nonminority banks), the average annual failure rate of African American-owned banks was 4.5 percent. For Hispanic-owned banks, the rate was 2.7 percent; and for Asian-owned banks, it was 1.9 percent.

Figure 2. U.S. banking institutions

Figure 3. Banks by asset size

Figure 4. Banks by minority ownership

Table 4. Small business loans and mortgages in minority-owned and nonminority-owned bank locations

Sources: U.S. Census Bureau, American Community Survey ; U.S. Department of Housing and Urban Development; Home Mortgage Disclosure Act; Community Reinvestment Act Disclosure Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Table 5. Minority-owned bank closures and acquisitions by ethnicity, 2001-15

Sources: Federal Deposit Insurance Corporation (FDIC) Insured Institution Directory; FDIC Failed Bank List; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

As with the banking sector more generally, however, the fluctuations in MDI banks reflect not only incidences of failures, but also structural changes from new charters, redesignations, and mergers and acquisitions (figure 5). Between 2001 and 2015, when an MDI bank closed, whether voluntarily or otherwise, it was typically acquired by another institution and in many cases, the acquisition was from a co-ethnic minority-owned institution or investor (table 5).21 Among the Asian-owned banks that closed between 2001 and 2015, 58 percent were acquired by an existing Asian-owned bank. Similarly, among the African American banks that closed, half of these institutions were acquired by another African American-owned bank.22 Of the Hispanic banks that closed, about 10 percent were acquired by another Hispanic-owned bank.23

In spite of the structural changes, some trends are worth highlighting that offer a mixed view of the MDI sector as a whole and implications for continued, targeted market reach. First, if we compare the trends in the number of banking institutions and bank branches, the overall branch network of MDI banks has diminished to a lesser extent than the decline in the number of MDI institutions would suggest during and after the financial crisis. For example, between 2008 and 2015, the number of African American-owned banks declined by more than 15 percent (figure 4), but the number of branches operated by African American-owned banks declined by only 18 percent (figure 6). The number of Asian-owned banks fell by 18 percent over that period (figure 4), but the number of branches operated by Asian-owned banks increased by 7 percent (figure 6).24

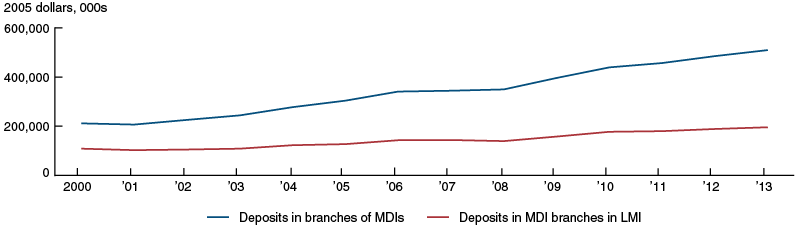

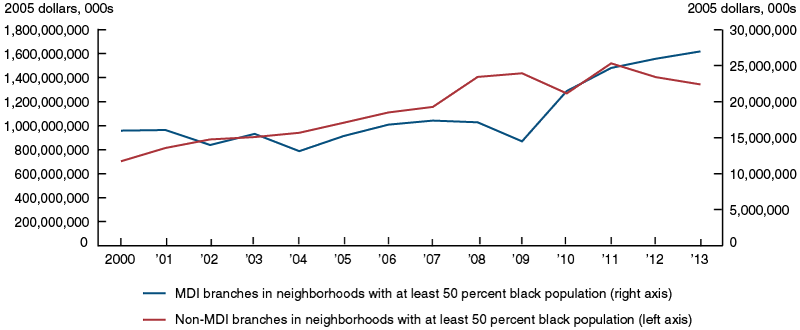

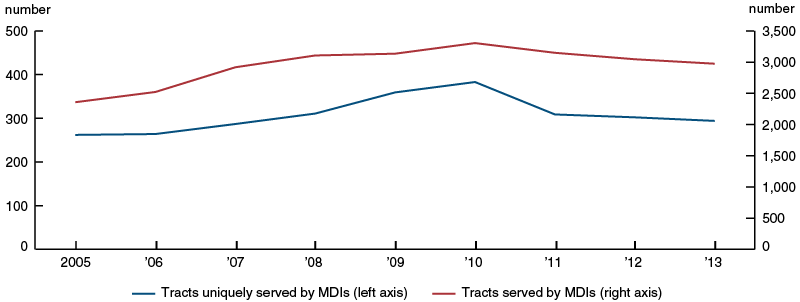

Second, consistent with the trend of branch office expansion, the total amount of deposits in branch offices has increased for the MDI sector, including deposits in MDI branch offices that are in low- to moderate-income neighborhoods (figure 7). The deposit base of MDI branch offices has expanded in places that have a majority-minority (black) population, and interestingly non-MDI banks’ branch deposits have increased even more in those same areas (figure 8). Finally, the number of primary local service areas (census tracts) where an MDI bank branch is present, including those where only an MDI branch is present, also expanded from 2005 to 2013 (figure 9).

In sum, these results suggest that the MDI sector has remained viable on several fronts. Most banks that closed or failed were acquired by other institutions; in the case of Asian and African American banks, half or more were acquired by co-ethnic institutions. Hence, during an active period of mergers and acquisitions within the sector, a smaller number of MDI banks were able to expand their branches and deposit base and, in some instances perhaps, their geographical footprint; overall more places still remained served by an MDI bank after the financial crisis than before. In the case of Hispanic banks that have closed, the appeal of the expanding Hispanic market has attracted a mix of different banks, and both Hispanic and nonminority-owned banks of different sizes have taken over those that have closed. The expansions of deposit base and MDI bank branch networks are seen consistently within low- to moderate-income and high-minority (black) locations, although in the latter cases, there seems to be growing competition from nonminority banks, which have shown faster growth in branch deposits post-2010 in lower-income areas.

Bank performance and local market areas

For the remainder of the analysis, we examine financial data to assess the relative performance and profitability of MDIs and to identify potential sources of vulnerability for these institutions. We follow previous research and focus on particular indicators that demonstrate how minority-owned banks performed (for example, FDIC, 2014). First, we examine the loan performance of MDIs since it has often been said that some MDIs may have difficulties lending to “high-quality” borrowers (Clair, 1988). Second, we look at income, expenses, and funding sources to address issues of cost and efficiency. Third, we examine capitalization and other measures of overall financial health of the sector. Again, our focus is on the years leading up to, during, and after the 2008 financial crisis, which provide a useful time frame to assess how the sector has been able to navigate and withstand financial shocks.

Figure 5. Structure change among MDIs

Sources: Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve System, and authors' calculations.

Figure 6. Bank branches by minority ownership

We disaggregate MDIs by ethnic group, with the hope of capturing potential heterogeneity based on ownership status. In some of the exercises, we also condition on bank size, whether the banks have assets less than $100 million or up to $10 billion, following previous research (for example, GAO, 2006) that finds systematic differences based on asset size. We compare MDIs with non-MDI community bank peers (with $10 billion in assets or less) that are in the same local service areas as the MDIs. We measure the similarity of local markets of MDIs and non-MDIs, based on market deposit shares in a given census tract by identifying all the census tracts where MDIs have branches. Then we look at the universe of non-MDIs with branches in each of these tracts and calculate the deposit market share of each one. If the deposit market share of the non-MDI correlates with that of the MDI bank in that census tract, within one or two standard deviations, we assign them as sharing a similar market. We adopt a simple methodology based on t statistics to assess the significance of the mean differences in the various characteristics of the MDIs and non-MDIs in the MDI local market.

Figure 7. Deposits in branches of MDIs, LMI neighborhoods

Sources: Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve System, U.S. Department of Housing and Urban Development, and authors' calculations.

Figure 8. Deposits in branches of MDIs and non-MDIs, black neighborhoods

Source: Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Board of Governors of the Federal Reserve System; U.S. Census Bureau, American Community Survey ; U.S. Department of Housing and Urban Development; and authors' calculations.

Figure 9. Locations with an MDI branch office

Sources: Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve System, and authors' calculations.

Loan portfolio quality and composition

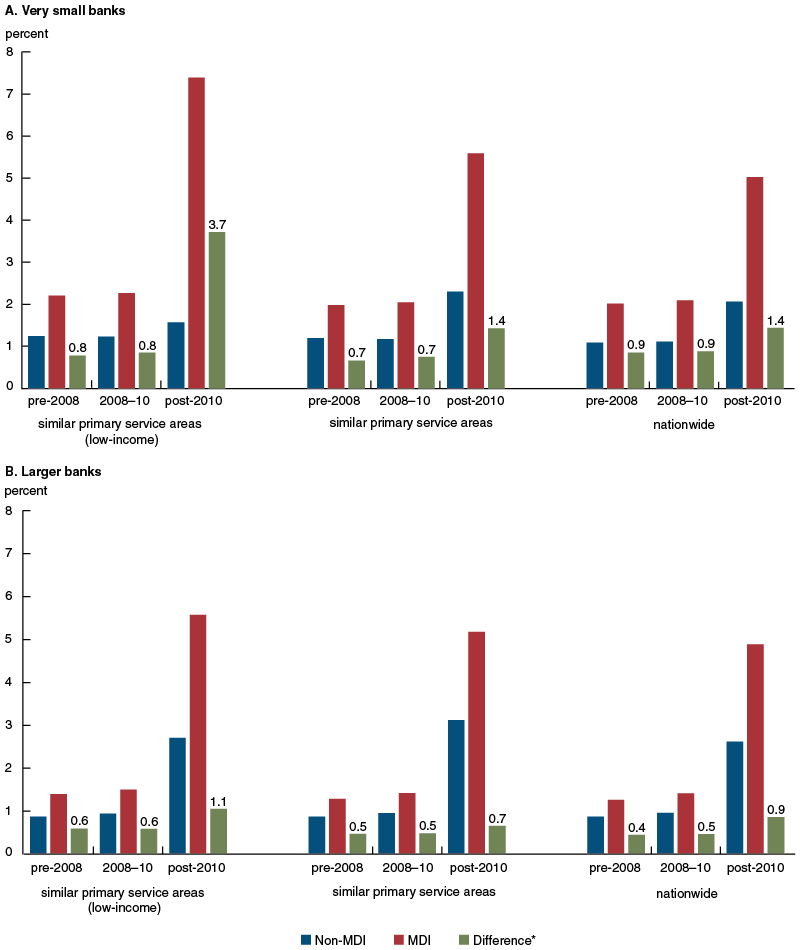

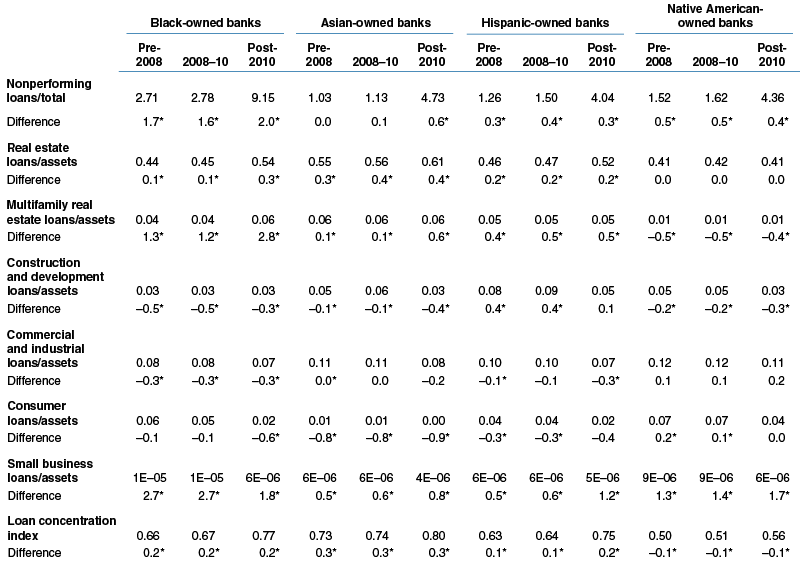

Figure 10 shows the differences in nonperforming loans between MDIs and non-MDIs, within their specific primary local markets, and nationwide, disaggregated by asset size—very small banks (less than $100 million in assets) and larger community banks ($100 million and up to $10 billion in assets). The share of nonperforming loans increased, post-2010, varying by bank asset size and by the type of primary markets served by the banks. Specifically, smaller banks and those in lower-income service areas had larger shares of nonperforming loans, as could be expected. About 2 percent of loans made by very small MDIs in lower-income service areas were nonperforming, while slightly over 1 percent of loans were nonperforming for similar non-MDIs in the same markets. Post-2010, more than 7 percent of loans on average were nonperforming for MDIs compared with close to 2 percent for non-MDIs in low- to-moderate income service areas. For larger banks (between $100 million and $10 billion in assets), prior to 2010, less than 2 percent of loans were nonperforming for MDIs, while less than 1 percent of loans were nonperforming for non-MDI peers in same markets. Post-2010, more than 5 percent of loans on average were nonperforming for MDIs compared with about 3 percent for non-MDIs within similar service areas. When we account for similarity in location (figure 10), differences in nonperforming loans between MDIs and non-MDIs remain more or less the same, and MDIs continue to show a significantly higher percentage of nonperforming loans than their peers. Furthermore, post-2010 up to 2013, if we constrain the primary service area in question to be lower income, the differences in loan performance are magnified, suggesting that the differences between MDIs and non-MDIs are not fully due to locational differences. Table 6, which shows additional statistics on loan concentration, composition, and performance by ethnic ownership designation, provides insights into some of the factors behind differences in loan performance within similar locations. Between 2005 and 2013, non-MDIs had more diversified loan portfolios. In general, they had significantly more construction and development loans, commercial and industrial loans, and consumer loans than most MDI groups. By contrast, MDIs of all groups (with the exception of Native Americans) tended to have higher loan concentrations in real estate than non-MDIs in their service areas. This is especially true in the case of loans for multifamily housing units. These types of housing units were not only disproportionately affected by steep price declines and foreclosures in many areas (Shilling, 2010), they were also more likely to remain on banks’ balance sheets because they had less access to the private and agency-backed secondary mortgage markets than other real estate loans. Smaller affordable properties located in relatively high-minority and low-income areas, which MDIs tended to issue, had even more limited access to these markets (Segal and Szymanoski, 1997; DiPasquale and Cummings, 1992; Thallam 2012; and Nothaft and Freund, 2003). Similarly, although loans to small businesses generally comprised a small portion of total assets for banks, these loans made up a much larger share of portfolios of MDIs than of non-MDIs in their primary service areas. Economic fluctuations affecting small businesses in low-income areas, therefore, had balance sheet consequences for these loans as well, and this is especially true given the relative lack of efficient secondary market also for small business loans (Berger, Rosen, and Udell, 2007; and Congressional Budget Office et al., 1994). Thus the differences in bank lending performance reflect differences in the composition of the loan portfolios at different banks, and the exposure of these loans to local housing market shocks, disproportionate price drops in multifamily housing units in addition to deteriorating conditions for small businesses in lower-income markets.26Figure 10. Nonperforming loans

Sources: Call Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Table 6. Portfolio performance and composition of minority-owned versus nonminority-owned banks in similar local service areas

Sources: Call Reports; Federal Deposit Insurance Corporation Summary of Deposits; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

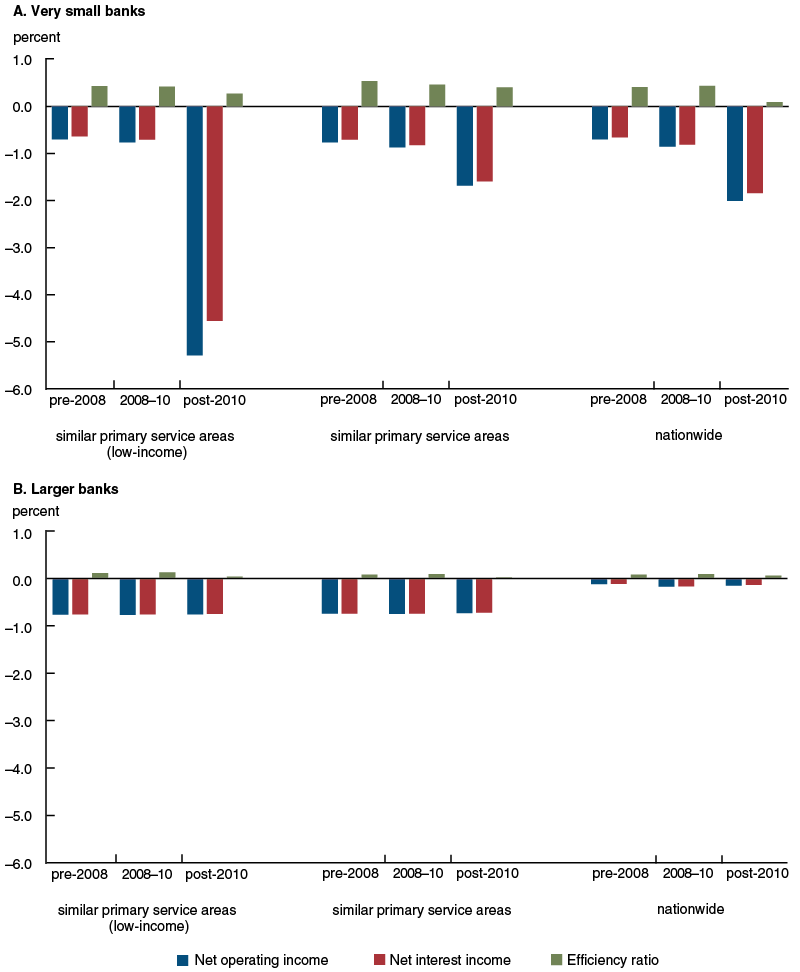

Income, sources of liquidity

The loan portfolio composition and higher incidence of nonperforming (real estate) loans among MDIs translate into these institutions having lower income relative to expenses than non-MDIs, adversely affecting their efficiency ratios. Figure 11 (panels A and B) shows three measures—net interest income, net operating income, and the efficiency ratio. The efficiency ratio is the ratio of non-interest expenses to net operating income, and therefore a higher ratio indicates higher expenses relative to income. The difference in these measures is more obvious for very small MDIs relative to non-MDIs (those with assets less than $100 million), even in the same primary local service areas, suggesting that the very small MDIs may have found it particularly challenging to operate in their primary local services areas, in terms of generating yields sufficient to cover expenses, during and subsequent to the peak period of the financial crisis and housing market shock.

The relatively lower yields (interest and fee income) reflect not only the increase in nonperforming loans, but also the decline in core deposits among MDIs after 2010. Core deposits are deposits typically made by local customers. Figure 12 shows trends in the core deposits normalized by assets for MDIs and non-MDIs and by location. The gap in core deposit shares between MDIs and non-MDIs doubled after 2010, and this was true regardless of the size of the banks and whether they operated in the same primary service areas. These results suggest that the deposit base of MDIs could be more volatile and susceptible to financial shocks; as table 7 (p. 22) reports, this seems to be particularly true for black-owned MDIs. As core deposits declined from 60 percent of assets pre-financial crisis to 50 percent of assets post-financial crisis, depending on the ownership category, brokered deposits increased from 2 percent of assets to 5 percent of assets.27 Other sources of liquidity, such as Treasury securities and mortgage-backed securities (MBS) increased between 7 percent and 15 percent, depending on the group. A decreased base of core deposits, along with nonperforming loans, combined to depress the net interest margins of MDIs,28 a result that is particularly apparent for black-owned banks and Native American banks.

Bank size and capitalization

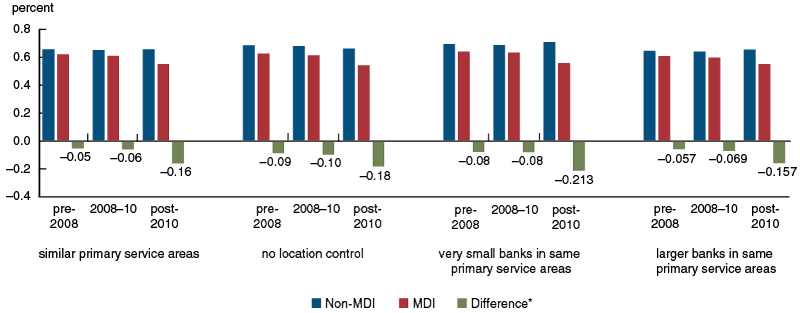

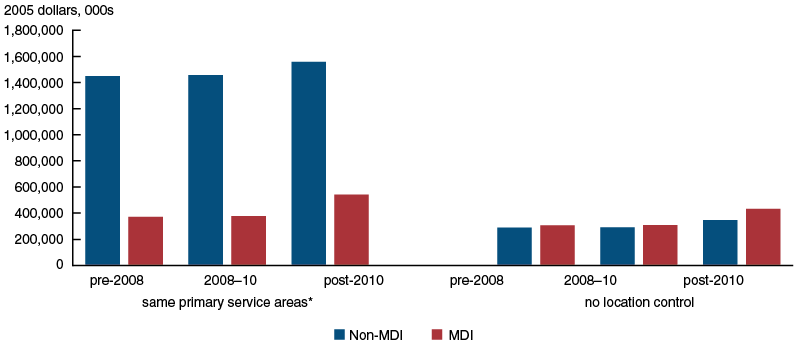

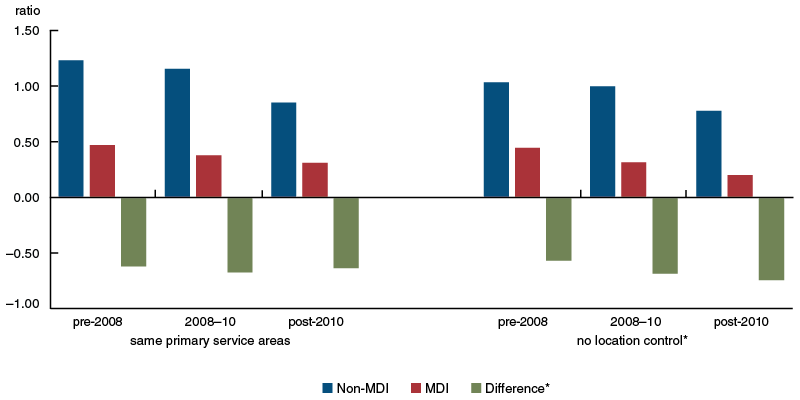

Most previous studies of MDI performance have compared MDIs in terms of asset size and capitalization. We too analyze these measures, but the results underscore the importance of comparing MDIs and non-MDIs within locations that approximate the same service areas (as opposed to comparing MDIs with all non-MDIs nationwide). Figures 13 and 14 show that MDIs are significantly smaller and have significantly less capital than competitors that operate branches in the same primary service areas. The difference is not obvious or significant if we do not control for location.

Figure 11. Income, yields, and expenses

Sources: Call Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Figure 12. Core deposits, normalized by assets

Sources: Call Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Figure 13. Average value of assets

Sources: Call Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Figure 14. Average value of capital

Sources: Call Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Figure 15. Performance (return on assets)

Sources: Call Reports; Federal Deposit Insurance Corporation; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Table 7. Funding sources for minority-owned banks versus nonminority-owned community banks

Sources: Call Reports; Federal Deposit Insurance Corporation Summary of Deposits; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

Table 8. Size, capitalization, and performance of minority-owned versus nonminority-owned banks

Sources: Call Reports; Federal Deposit Insurance Corporation Summary of Deposits; Office of the Comptroller of the Currency; Office of Thrift Supervision; Board of Governors of the Federal Reserve System, Minority-Owned Depository Institutions, statistical release; and authors' calculations.

One of the most common measures of performance is return on assets (ROA). ROA is considered an indicator of how management uses its assets or resources to generate income. As a rule of thumb, ROA levels should be closer to 1 percent for banks to cover their cost of capital. The results in figure 15 show that MDIs significantly underperformed their peers in similar markets in ROA terms, suggesting that at least some of the difference in MDI profitability is not the result of operating in different primary markets.

Table 8 reports additional measures and ratios of performance by ownership status. The results show significant heterogeneity by minority ownership status, in terms of bank size, capital adequacy, and overall financial health. Black-owned banks had on average lower capital (assets minus liabilities) and lower capital normalized by assets compared with nonminority-owned institutions, especially post-2010. The average ROA for MDIs was negative and lower than for non-MDI peers during that period.

Finally, table 8 reports the tier 1 leverage core capital ratio of banks. The tier 1 leverage core capital ratio is a measure of a bank's overall financial health. Under the FDIC Improvement Act definition for prompt corrective action by bank regulators, a bank is well capitalized if the ratio of tier 1 capital to total assets is at least 5 percent. The results suggest that the MDI sector overall had adequate capital to meet regulatory requirements, although the analysis of this metric shows heterogeneity by bank ethnic ownership status.29 While we find no statistically significant differences in Asian, Hispanic, and Native American banks compared with non-MDIs in similar markets, black-owned banks had significantly less core capital leverage during the period of analysis. The difference in the leverage core capital ratio of black-owned banks and non-MDIs is smaller in black local market service areas, suggesting that overall capital health is also reflective of the locations black-owned banks serve. This result is also consistent with the fact that these locations were disproportionately affected by economic shocks during the crisis. The opposite is true for Asian banks. They had tier 1 leverage capital ratios comparable to or higher than non-MDIs peers in their primary local service areas. These results are consistent also with previous research findings (for example, Lawrence, 1997).

Conclusion

Our analysis offers some new insights into the differences in performance between minority-owned and nonminority-owned banks. We also define the markets primarily served by these institutions and provide what we hope is a more fitting basis for comparing and assessing their performance relative to their immediate competitors. We confirm that even with changes in banking structure, minority-owned banks continue to play a special role in some markets that appear to be underserved by other institutions. Evidence of expansion in bank branches and extension into new markets, even as some MDI banks have gone through mergers and acquisitions (in many instances by other minority-owned banks), implies long-term viability of the MDI sector. We find that challenges related to diminished funding sources and capital remain, especially for MDIs, which have been particularly affected by relatively large shares of nonperforming real estate/multifamily loans as well as small business loans.

In addition, our analysis offers strategic implications for minority bank managers and practitioners by illustrating how performance in times of stress is connected to the local market areas served by these institutions, loan portfolio concentration, and size of banks. For policymakers, we hope these findings can help inform policies and initiatives aimed at supporting mission-oriented minority depository institutions. This could mean supporting capital-access or capital-injection programs, technical assistance, and deposit programs. This could also mean better understanding ways to enhance investor relationships with key community-based banking institutions, as well as understanding how various risk-sharing initiatives and public/private partnerships could help mitigate risks (Segal and Szymanoski, 1997). An important goal of community development is to encourage bank investment in affordable housing and small businesses, including from mission-oriented community banks that specialize in relationship lending (Orlebeke, 2000). To the extent that mission-oriented MDIs help address community reinvestment needs and play a particularly meaningful role in improving access to financial services in some places, including for housing and small business development, policies and initiatives to help these institutions hedge against local economic shocks should remain under consideration.

NOTES

1 Urban Partnership Bank is owned by two large financial institutions, Goldman Sachs and J.P. Morgan, with equity holders including Citigroup, Bank of America, Wells Fargo, the Chicago-based Northern Trust, and the commercial finance arm of General Electric. It is also nonetheless classified as a minority-owned bank by virtue of its majority-minority board of directors. Urban Partnership also has the designation of community development financial institution (see Daniels, 2013, 2017).

2 For a timeline of major events in minority depository institutions history, see https://www.fedpartnership.gov/minority-banking-timeline/milestones.

3 Beginning June 30, 2015, depository institutions that participate in the FDIC’s Minority Depository Institutions Program have been added to depository institutions defined by the Treasury. See Federal Reserve Partnership for Progress website, https://www.federalreserve.gov/releases/mob/.

4 Based on banks that appear on FDIC, Federal Reserve, or OCC lists. Hereafter, referred to as African American- or black-owned banks.

5 In 1962, Los Angeles-based Cathay Bank became the first bank recognized as Asian American. In 1969 Centinel Bank of Taos, New Mexico, became the first U.S. mainland-based Hispanic bank. (Banco Popular de Puerto Rico, headquartered in San Juan, is more than 100 years old.) See http://www.nationalbankers.org/history.htm.

6 See the U.S Department of the Treasury, Bureau of the Fiscal Service, https://www.fiscal.treasury.gov/fsservices/gov/rvnColl/mnrtyBankDep/rvnColl_mbdp.htm. In 1970 when the program was announced, the aim was to increase government deposits at minority banks by $100 million. The effects of the program could then be seen in bank balance sheets in 1971. Government deposits rose to 10 percent of total deposits, a 10 percent increase of total deposits in minority-owned banks, while these deposits represented only 2 percent of total deposits at nonminority-owned banks (Clair, 1988).

7 Researchers have noted that holding government deposits distorts balance sheets in several ways. U.S. government deposits are a significantly larger proportion of total liabilities at minority-owned banks. And, being short-term and volatile, these deposits are not appropriate for funding long-term illiquid assets (Clair, 1988).

8 In interviews with journalists, numerous community bankers have substantiated the idea that black customers have taken their business to mainstream banks as mainstream banks have sought entry into minority communities (Walker, 2003).

9 In August 2015, the Community Development Financial Institutions Fund (CDFI Fund) selected the National Community Investment Fund as a contractor to provide group training and individual technical assistance to certified community development entities (CDEs) that meet the CDFI Fund’s definition of a minority CDE. The training will inform minority CDEs on how they can participate in the New Markets Tax Credit Program (NMTC Program).

10 The Capital Purchase Program was a TARP subprogram in which Treasury injected certain banks with capital, mainly through the purchase of preferred stock and warrants thereof. Most financial institutions participating in the CPP paid Treasury a 5 percent dividend on preferred shares for the first five years and a 9 percent rate thereafter. See http://www.treasury.gov/initiatives/financial-stability/TARP-Programs/bank-investment-programs/cap/Pages/overview.aspx. However, the CDFIs that participated in CPP and were in good standing were eligible to exchange those investments into the CDCI program, which had an initial dividend or interest rate of 2 percent. The dividend or interest rate increases to 9 percent after eight years under CDCI, compared with five years under CPP. See http://www.gao.gov/assets/670/663892.pdf.

11 See Supervision and Regulation (SR) Letter 13-15/Consumer Affairs (CA) Letter 13-11, “Federal Reserve resources for minority depository institutions,” https://communitybankingconnections.org/articles/2014/q3-q4/promoting-an-inclusive-financial-system.

12 GAO (2006) provides an analysis of survey results reflecting views of the effectiveness of earlier technical training and outreach efforts on specific performance outcomes for MDIs.

13 The FDIC launched the Investor Match Program in 2011 to encourage the participation of small, minority, and women-owned investors in FDIC asset sales programs. See https://www.fdic.gov/news/news/press/2011/pr11148.html.

14 The most common method of failed bank resolution is purchase and assumption (P&A), whereby a healthy bank purchases some or all of the assets of the failed bank and assumes some or all of the liabilities. When bidder interest is not strong, the FDIC allows for “modified whole bank P&A with or without optional shared-loss agreements.” Under loss-sharing agreements, the FDIC agrees to share in a portion of future asset losses and recoveries for a specific amount of time with the acquiring institution. See http://www.fdicoig.gov/reports13%5C13-004EV.pdf and http://www.gao.gov/assets/660/651154.pdf (see GAO, 2013).

15 Similar arguments were expressed in interviews we conducted with business owners, officers, and clients in communities where MDI banks have been closed and acquired. One business owner noted that the closing bank had “taken a chance” on him by lending him money when “no other banks would have.” A number of business owners also followed their lender from the closed minority CDFI bank to a different bank when the original lender was hired at that new institution, even though the lender’s new bank was outside of his community. We were also told that a minority designation does not necessarily mean that the acquirer will have similar lending behavior as the acquired bank, particularly if the acquirer has a different business model than the closed bank.

Minority depository institutions: Structure, performance, and social impact,” https://fdic.gov/bank/analytical/quarterly/2014_vol8_3/mdi_study.pdf.

Consistent with previous research, we use census tracts as a proxy for banks’ service areas (Ergungor, 2010; Nguyen, 2014). Although MSAs have been used in banking/finance research to understand the local market power of banks, this unit of geography may be too broad in the context of mission-oriented banks. Census tracts are small, relatively permanent statistical subdivisions of a county. They usually have between 2,500 and 8,000 people, and when first delineated, are designed to be homogeneous with respect to population characteristics, economic status, and living conditions. The spatial size of census tracts varies widely depending on the density of settlement. Census-tract boundaries are delineated with the intention of being maintained over a long time, so that statistical comparisons can be made from census to census. However, physical changes in street patterns caused by highway construction, new development, and so on, may require occasional revisions; census tracts occasionally are split due to large population growth or combined as a result of substantial population decline. See https://www2.census.gov/geo/pdfs/education/CensusTracts.pdf.

18 Low-income census tracts have a median family income less than 50 percent of the metropolitan area median income; moderate-income geographies have a median family income of at least 50 percent and less than 80 percent of the area median income; middle-income geographies have a median family income of at least 80 percent and less than 120 percent of the area median income; and high-income geographies have a median family income of 120 percent or more of the area median income (see http://www2.fdic.gov/crapes/peterms.asp).

19 The passage of the Riegle–Neal Interstate Banking and Branching Efficiency Act in 1994, allowing nationwide (interstate) branching as of June 1997, set off a wave of mergers and acquisitions.

20 The Federal Reserve System, the Office of the Comptroller of the Currency (OCC), and the FDIC each use different definitions to identify what constitutes a community bank. The OCC and the Federal Reserve define community banks by asset size. The OCC asset cutoff is $1 billion and the Federal Reserve asset cutoff is $10 billion (see https://www.federalreserve.gov/boarddocs/supmanual/supervision_cbem.htm).The FDIC has developed a functional definition of community banks outlined in the 2012 FDIC Community Banking Study that aggregates the assets of banks under a single holding company charter; excludes banks where more than 50 percent of assets are held in specialty charters like credit cards or industrial loan companies; and includes banks with certain minimum loan-to-deposit ratios and core deposit ratios.

21 This is consistent with the fact that regulators have articulated a commitment to preserving the character of MDIs in cases of mergers or acquisitions. See https://www.fdic.gov/news/news/press/2011/pr11148.html.

22 One of these African American-owned banks was acquired by a nonminority CDFI. We count seven instances in which an MDI bank had no acquirer. We also count nine instances of banks that continued operations but either opted out of MDI status or no longer met the MDI qualifications.

23 The Hispanic population constitutes the largest minority in the United States, and their appeal to financial institutions has been growing. This could explain in part why we see a broader mix of acquirers. Both Spanish banks that already had a strong presence in Latin America and U.S. banks have been trying to take advantage of the growing Hispanic market (see http://knowledge.wharton.upenn.edu/article/hispanic-banking-the-race-is-on/).

24 This was in part because Asian-owned banks added over 130 branches over the 2008–15 period and in part because nearly 70 percent of branches acquired from closed or failed Asian-owned banks remained under MDI ownership.

25 To determine the significance of these variables based on t statistics, we do the following steps. First, the variables in question are calculated for each bank. Then the unweighted mean and variance are calculated for each MDI type as a group and for non-MDIs. The variances are also tested for significance of differences, based on an F test. If the variances are significantly different, the t statistics and the degrees of freedom are adjusted to account for the violation of equal variances. We report the results for the pooled sample for three different periods, before, during, and after the financial crisis. The mean difference by year would be more desirable than one using pooled years data, which assumes that the mean and variances of variables do not vary over those periods. However, the sample size of MDIs by ethnic ownership may be too small not to use pooled years data. Our concerns are, however, minimized by subdividing over three distinct periods, before, during, and after the 2008–10 financial crisis, which have clearly divergent trends.

26 We do not assess other specifics of underwriting criteria, risk profiles, and managerial experience of banks that may be at play, as noted in studies based on surveys or anecdotal reports (for example, GAO, 2006).

27 Brokered deposits are a wholesale funding method, obtained directly or indirectly through a deposit broker. The broker pools large-denomination deposits from many small investors and markets the pooled deposits to financial institutions, usually in blocks nearing $100,000, and negotiates a higher rate for the pooled certificates of deposit. In contrast, core deposits are largely derived from a bank’s regular customer base and are typically less costly with lower interest rates. Once a bank is not well capitalized, federal law prohibits banks from renewing or accepting brokered deposits (GAO, 2006).

28 The net interest margin is the difference between the interest income generated by the bank and the amount of interest paid out to its lenders, relative to the amount of its interest-earning assets.

29 This result reflects some survivors’ bias, since banks that failed are not included in the calculations.

REFERENCES

Acharya, Viral V., and Rangarajan K. Sundaram, 2009, “The financial sector bailout: Sowing the seeds of the next crisis,” in Restoring Financial Stability: How to Repair a Failed System, Viral V. Acharya and Matthew Richardson (eds.), Hoboken, NJ: John Wiley & Sons, pp. 327–339.

Bates, Timothy, and William Bradford, 1980, “An analysis of the portfolio behavior of black-owned commercial banks,” Journal of Finance, Vol. 35, No. 3, June, pp. 753–768.

Berger, Allen N., Lawrence G. Goldberg, and Lawrence J. White, 2001, “The effects of dynamic change in bank competition on the supply of small business credit,” Review of Finance, Vol. 5, No. 1–2, pp. 115–139.

Berger, Allen N., Richard J. Rosen, and Gregory F. Udell, 2007, “Does market size structure affect competition? The case of small business lending,” Journal of Banking & Finance, Vol. 31, No. 1, January, pp. 11–33.

Black, Harold, 1979, “Black financial institutions and urban revitalization,” Review of Black Political Economy, Vol. 10, No. 1, September, pp. 44–58. Black, Harold A., M. Cary Collins, and Ken B. Cyree, 1997, “Do black-owned banks discriminate against black borrowers?,” Journal of Financial Services Research, Vol. 11, Nos. 1–2, February, pp. 189–204.

Bodurian, Nicholas, 2011, “Bailouts and bank risk: The association between bank specific risk measurements and TARP participation,” College of the Holy Cross, Department of Economics and Accounting, economics honors thesis, December.

Boorman, John T., 1974, “The prospects for minority-owned commercial banks: A comparative performance analysis,” Journal of Bank Research, Vol. 4, No. 4, Winter, pp. 263–279.

Bostic, Raphael W., 2003, “A test of cultural affinity in home mortgage lending,” Journal of Financial Services Research, Vol. 23, No. 2, April, pp. 89–112.

Bradford, William D., 1974, “Minority financial institutions, inner city economic development, and the hunt commission report,” Review of Black Political Economy, Vol. 4, No. 3, June, pp. 47–62.

Brimmer, Andrew F., 1971, “The black banks: An assessment of performance and prospects,” Journal of Finance, Vol. 26, No. 2, May, pp. 379–405. Clair, Robert T., 1988, “The performance of black-owned banks in their primary market areas,” Economic and Financial Policy Review, Federal Reserve Bank of Dallas, November, pp. 11–20.

Cole, John A., Alfred L. Edwards, Earl G. Hamilton, and Lucy J. Reuben, 1985, “Black banks: A survey and analysis of the literature,” Review of Black Political Economy, Vol. 14, No. 1, June, pp. 29–50.

Congressional Budget Office, U.S. Department of Treasury, Securities and Exchange Commission, and Small Business Administration, 1994, Developing a Secondary Market for Small Business Loans: An Interagency Report, Washington, DC, August.

Daniels, Steve, 2017, “Seaway Bank buyer rolls dice on African-American acceptance,” Crain’s Chicago Business, February 4.

__________, 2013, “Wall Street-owned Urban Partnership Bank officially a minority bank,” Crain’s Chicago Business, June 11.

DiPasquale, Denise, and Jean L. Cummings, 1992, “Financing multifamily rental housing: The changing role of lenders and investors,” Housing Policy Debate, Vol. 3, No. 1, pp. 77–116.

Duke, Elizabeth A., 2009, “Federal Reserve’s initiatives to support minority-owned institutions,” speech given at the Interagency Minority Depository Institutions National Conference, A Bridge to Community Stabilization, Chicago, Illinois, July 9, https://www.federalreserve.gov/newsevents/speech/duke20090709a.htm.

Elyasiani, Elyas, and Seyed Mehdian, 1992, “Productive efficiency performance of minority and nonminority-owned banks: A nonparametric approach,” Journal of Banking and Finance, Vol. 16, No. 5, September, pp. 933–948.

Emeka, Maurius L., 1973, “Some common problems of black banks in 1972,” Review of Black Political Economy, Vol. 3, No. 3, June, pp. 100–114.

Ergungor, Ozgur Emre, 2010, “Bank branch presence and access to credit in low- to moderate-income neighborhoods,” Journal of Money, Credit and Banking, Vol. 42, No. 7, pp. 1321–1349.

Federal Deposit Insurance Corporation, Division of Insurance and Research, 2014, “Minority depository institutions: Structure, performance, and social impact,” FDIC Quarterly, Vol. 8, No. 3, pp. 33–63, https://fdic.gov/bank/analytical/quarterly/2014_vol8_3/mdi_study.pdf.

Federal Deposit Insurance Corporation, Office of Audits and Evaluations, 2013, “The FDIC’s resolution planning process,” report, No. EVAL-13-004, Washington, DC, September.

Gerena, Charles, 2007, “Opening the vault,” Region Focus, Federal Reserve Bank of Richmond, Vol. 11, No. 2, Spring, pp. 46–49, http://www.ebony.com/wp-content/uploads/2016/08/economic_history.pdf.

Greenstone, Michael, Alexandre Mas, and Hoai-Luu Nguyen, 2014, “Do credit market shocks affect the real economy? Quasi-experimental evidence from the Great Recession and ‘normal’ economic times,” Princeton University, Department of Economics, Industrial Relations Section, working paper, No. 584, November.

Hasan, Iftekhar, and William C. Hunter, 1996, “Management efficiency in minority- and women-owned banks,” Economic Perspectives, Federal Reserve Bank of Chicago, Vol. 20, No. 2, March, pp. 20–28, https://www.chicagofed.org/publications/economic-perspectives/1996/04epmar96b.

Hays, Fred H., and Stephen A. DeLurgio, 2003, “Minority banks: A search for identity,” RMA Journal, Vol. 86.

Iqbal, Zahid, Kizhanathan V. Ramaswamy, and Aigbe Akhigbe, 1999, “The output efficiency of minority-owned banks in the United States,” International Review of Economics and Finance, Vol. 8, No. 1, January, pp. 105–114.

Irons, Edward D., 1971, “Black banking—problems and prospects,” Journal of Finance, Vol. 26, No. 2, May, pp. 407–425.

Isyuk, Varvara, 2013, The Role of the Banking Sector Performance in the Crisis of 2007, Université Paris 1 Panthéon-Sorbonne, Economics Department, doctoral thesis, September, https://hal.archives-ouvertes.fr/tel-00984299/document.

Justiniano, Alejandro, Giorgio E. Primiceri, and Andrea Tambalotti, 2016, “A simple model of subprime borrowers and credit growth,” American Economic Review, Vol. 106, No. 5, May, pp. 543–547.

Kashian, Russ, Richard McGregory, Jr., and Neil Lockwood, 2014, “Do minority-owned banks pay higher interest rates on CDs?,” Review of Black Political Economy, Vol. 41, No. 1, March, pp. 13–24.

Kashian, Russell D., Richard McGregory, and Derrek Grunfelder McCrank, 2014,” Whom do black-owned banks serve?,” Communities & Banking, Federal Reserve Bank of Boston, Summer, pp. 29–31.

Kwast, Myron L., and Harold A. Black, 1983, “An analysis of the behavior of mature black-owned commercial banks,” Journal of Economics and Business, Vol. 35, No. 1, February, pp. 41–54.

Ladd, Helen F., 1998, “Evidence on discrimination in mortgage lending,” Journal of Economic Perspectives, Vol. 12, No. 2, Spring, pp. 41–62.

Lawrence Edward C., 1997, “The viability of minority-owned banks,” Quarterly Review of Economics and Finance, Vol. 37, No. 1, Spring, pp. 1–21.

Mian, Atif, and Amir Sufi, 2009, “The consequences of mortgage credit expansion: Evidence from the U.S. mortgage default crisis,” Quarterly Journal of Economics, Vol. 124, No. 4, November, pp. 1449–1496.

Nguyen, Hoai-Luu Q., 2014, “Do bank branches still matter? The effect of closings on local economic outcomes,” Massachusetts Institute of Technology, Department of Economics, working paper, December, http://economics.mit.edu/files/10143.

Nothaft, Frank E., and James L. Freund, 2003, “The evolution of securitization in multifamily mortgage markets and its effect on lending rates,” Journal of Real Estate Research, Vol. 25, No. 2, April, pp. 91–112.

Office of the Comptroller of the Currency, 2016, “Appendix 2. Policy statement on minority national banks and federal savings associations,” in 2015 Annual Report: Preservation and Promotion of Minority-Owned National Banks and Federal Savings Associations, report to Congress, Washington, DC, https://www.occ.treas.gov/topics/bank-management/minority-depository-institutions/2015-firrea-report-to-congress.pdf.

Okonkwo, Valentine, 2003, “Analysis of the portfolio behavior of black-owned commercial banks,” Journal of Academy of Business and Economics, Vol. 1, No. 1, January.

Orlebeke, Charles J., 2000, “The evolution of low-income housing policy, 1949 to 1999,” Housing Policy Debate, Vol. 11, No. 2, pp. 489–520.

Phillips, Sandra, 2010, “The subprime crisis and African Americans,” Review of Black Political Economy, Vol. 37, Nos. 3–4, September, pp. 223–229.

Price, Douglas A., 1990, “Minority-owned banks: History and trends,” Economic Commentary, Federal Reserve Bank of Cleveland, July 1.

Reuben, Lucy, 2010, “Response to ‘The subprime crisis and African Americans by Sandra Phillips,’” Review of Black Political Economy, Vol. 37, Nos. 3–4, September, pp. 237–240.

Rugh, Jacob S., and Douglas S. Massey, 2010, “Racial segregation and the American foreclosure crisis,” American Sociological Review, Vol. 75, No. 5, October, pp. 629–651.

Segal, William, and Edward J. Szymanoski, 1997, “The multifamily secondary mortgage market: The role of government-sponsored enterprises,” Housing Finance Working Paper Series, U.S. Department of Housing and Urban Development, Office of Policy Development and Research, No. HF-002, March, https://www.huduser.gov/publications/pdf/mf_002wp.pdf.

Shilling, James D., 2010, “The multifamily housing market and value-at-risk implications for multifamily lending,” DePaul University, Institute for Housing Studies, working paper, April.

Thallam, Satya, 2012, “Understanding the multifamily mortgage market,” American Action Forum, report, August, https://www.americanactionforum.org/wp-content/uploads/sites/default/files/Multifamily%20Mortgage%20Market.pdf.

Toussaint-Comeau, Maude, and Robin Newberger, 2017, “Mission-oriented bank closings and small business credit availability in low-income and minority neighborhoods,” Federal Reserve Bank of Chicago, Community Development and Policy Studies, white paper, forthcoming.

U.S. Government Accountability Office, 2013, Financial Institutions: Causes and Consequences of Recent Bank Failures, report, No. GAO-13-71, Washington, DC, January 3.

__________, 2006, “Minority banks: Regulators need to better assess effectiveness of support efforts,” report, No. GAO-07-6, Washington, DC, October 4.

Walker, Andrea K., 2003, “Black-owned banks struggle against times,” Baltimore Sun, June 29.