2022

President's Letter

January 2023

Taking office as the Federal Reserve Bank of Chicago’s tenth President, I share this review of 2022 at a time of economic challenge. I look forward to supporting your ongoing commitment to the Federal Reserve Bank of Chicago in 2023 and beyond. We will continue to serve the public by promoting a healthy, stable, and inclusive economy and financial system in which all have an opportunity to thrive.

The Economy

First, I would like to thank and honor my predecessor as Chicago Fed President, Charles Evans, for his service to and leadership of the Federal Reserve Bank of Chicago. He had an illustrious career at the Chicago Fed over three decades and will be missed.

Before retiring, President Evans described 2022 as defined by change and challenge. The year began with global supply chains still in disarray; after a rapid recovery from the most extreme pandemic-related disruptions, overall growth stalled in the first half of the year. Yet with consumers resuming travel and other activities delayed by the pandemic, the economy continued to add jobs at a breakneck pace, bringing the unemployment rate back to the very low levels seen prior to the pandemic. Worryingly, though, inflation, which had initially been concentrated in items that were especially sensitive to the pandemic, continued to rise and become more widespread. Russia’s invasion of Ukraine and ongoing Covid-related shutdowns abroad delivered further jolts to the economy, adding to already strong inflationary pressures and an uncertain economic climate.

With inflation running far above the Federal Open Market Committee’s 2 percent target, the FOMC began in March 2022 to remove the extraordinary degree of monetary policy accommodation that had been in place since the early days of the pandemic. By the end of the year, the FOMC had increased the federal funds rate range by 4-1/4 percentage points to a moderately restrictive setting. Additionally, the Fed began in June to reduce the size of its balance sheet, tightening monetary policy further.

The Fed remains focused on reducing inflation. As is always the case, the exact path for monetary policy will depend on economic developments. And policy always aims to support the Federal Reserve’s dual mandate objectives of maximum inclusive employment and price stability—goals that, in the longer run, go hand in hand. I look forward to helping the Federal Reserve achieve our dual mandate goals and create an economic environment in which all can prosper.

At the Federal Reserve Bank of Chicago

Across the Bank in 2022, work evolved to support monetary policymaking at the highest levels as the demands of the U.S. economy changed. Bank employees prioritized pathbreaking economic research, careful management of payments systems, a workplace ethic fostering diversity and inclusion, diligent bank supervision, forward-pushing technology, a return to pre-pandemic outreach and engagement, and continued excellence in cash operations and employee support.

I invite you to learn more about the work of the Bank over the past year in the following sections.

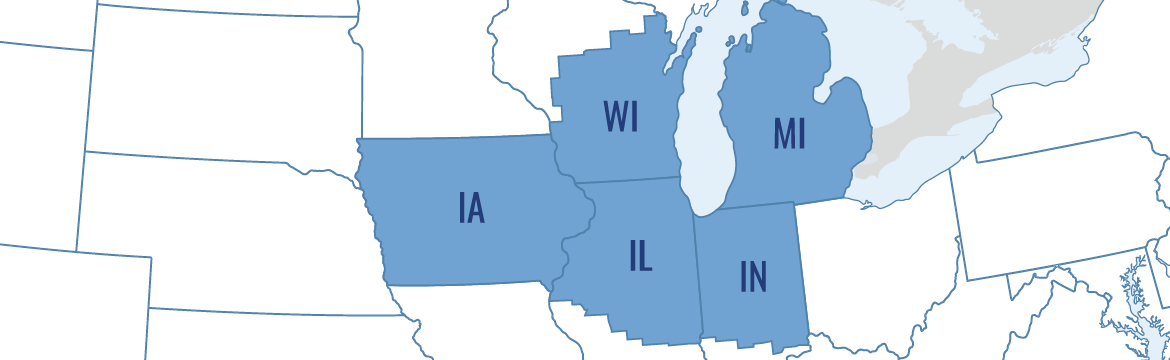

Chicago Board of Directors: Identifying a New Seventh District Leader

In 2022 the Board of Directors formed a Presidential Search Committee of eligible Class B and C directors.1 As part of the search process, the committee sought input from a wide range of external and internal audiences. This included a series of focus groups across the Seventh Federal Reserve District, with attendees representing small business, economic development, agriculture, and labor organizations. The committee hosted a public town hall and conducted a digital outreach campaign that sought nominations from the public and feedback on the needs of the District and what the committee should look for in the Chicago Fed’s next president.

The committee identified a broad, highly qualified, and diverse candidate pool from a variety of backgrounds, professions, and regions of the country. Committee members conducted multiple rounds of interviews with candidates before identifying a final candidate. The selection was then approved by the Board of Governors of the Federal Reserve System. On December 1, 2022, economist Austan D. Goolsbee was announced as the tenth president and CEO of the Federal Reserve Bank of Chicago.

Supervision and Regulation: Ensuring Banking and Credit Soundness for All

The Supervision and Regulation Department (S&R) focused on ensuring the safety and soundness of more than 750 supervised banks and financial institutions.

In 2022, S&R successfully returned to on-site examinations while advancing supervisory programs tailored to the size, complexity, and risk of firms. As part of a consortium with other Reserve Banks, it joined in launching a National Cyber Resource Program for the Federal Reserve System. S&R leads the efforts to bolster the security of the banking system through the control, data, reporting, and scheduling of cyber supervision. S&R continued to provide System leadership to other critical supervisory programs, such as the Wholesale Credit Risk Center and Shared National Credit Reserve Bank Partner program, in addition to the National Stress Testing program.

S&R collaborated with colleagues throughout the Bank to contribute to the interagency Community Reinvestment Act proposal, which would overhaul how banks do business with underserved people and communities. S&R, together with other Bank staff, gathered input from Seventh District communities, considered feedback from lenders and mission-driven financial institutions, and conducted research analysis that informed the policy’s design.

Federal Reserve Financial Services: Driving Payments Innovation

In 2022, the Federal Reserve payments product and support office structure, including the Chicago Fed’s Customer Relations and Support Office, transitioned to an enterprise model for Federal Reserve Financial Services (FRFS). Chicago Fed staff made significant contributions to the FRFS enterprise, beginning with selections to serve in key leadership roles across the enterprise and executive leadership roles in technology, product, and relationship management and in diversity, equity, and inclusion.

Concurrently, Chicago staff, through FRFS, continued to lead efforts in support of the FedNow Service, the instant payments service targeted for release in mid-2023. In October 2022, FRFS worked with the Chicago Fed to host its 22nd annual Chicago Payments Symposium, with a focus on building customer-centered and adaptive networks.

Economic Research: Advancing Economics and Supporting Monetary Policymaking

The Economic Research Department provided valuable expertise across the Federal Reserve System throughout 2022. The department had 32 papers accepted for publication, including at some of the top refereed academic journals in economics and finance. In addition, a record 55 original research papers were added to the Chicago Fed working paper series, covering topics including the growth in university-level online learning and redlining in the 1930s. In addition to recurring policy memos, Economic Research staff prepared 33 special memos and briefings to support the president in his monetary policymaking role. These briefings covered the projection of growth and inflation and longer-term monetary policy strategies, among other topics. Additional briefings for the Chicago Fed and Detroit Branch boards of directors, as well as the Board of Governors of the Federal Reserve System, were prepared by Economic Research staff. These included a briefing on the financial stability risks in insurance and another one on the stresses in commodity markets due to Russia’s invasion of Ukraine.

Economic Research celebrated a successful launch of the Economic Mobility Project, which is amplifying the voices of Chicago Fed researchers in policy conversations. The department also resumed hosting large-scale in-person events, including the annual Midwest Agriculture Conference and Economic Outlook Symposium.

Community Development and Policy Studies: Strengthening Economic Mobility and Resilience

Community Development and Policy Studies (CDPS) worked to promote economic mobility and resilience among low- and moderate-income and historically underserved people and places across the Seventh District.

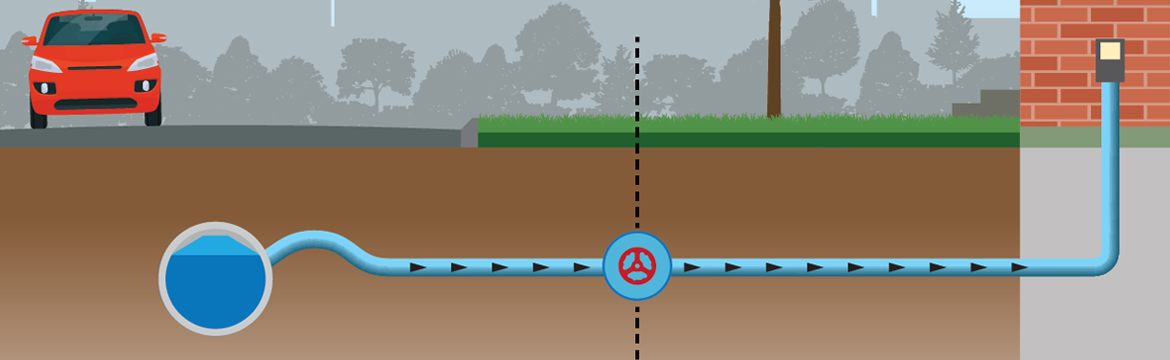

Working with Public Affairs and the Financial Markets Group, CDPS was a leader of the Chicago Fed’s Lead Service Line Replacement work, an initiative to help rapidly accelerate the replacement of municipal lead pipes that deliver water into homes. By publishing articles and convening diverse stakeholders, staff enhanced awareness of the need for private capital markets in financing lead service line replacement and the importance of equitable financing solutions.

Staff in CDPS supported federal rulemaking efforts on the Community Reinvestment Act and led the development of the National Interagency Community Reinvestment Conference—a U.S.-wide conference that explored the role of community development in shaping a more resilient economy. Staff also worked to increase the diversity of participants in the Beige Book survey, which informs monetary policymaking, and to raise awareness of the barriers to economic inclusion through research and outreach. This research included analyzing evidence of racial discrimination in the $1.4 trillion auto loan market and exploring why millions of dollars in tax refunds are going unclaimed by low-income families.

Diversity, Equity, and Inclusion: Taking Action and Making Progress

In 2022, the Bank continued to advance its three-year DEI strategy, leading to meaningful gains in officer representation and in the Bank-wide percentage of employees of color.

The Bank worked to build a diverse pipeline of talent by supporting early career workers via the Year Up Chicago program and the Corporate Work Study Program. The culture of inclusion was strengthened through active participation in Employee Support Network Groups, the launch of an extensive DEI learning curriculum, and the creation of new leadership development opportunities.

The Bank aspires to buy supplies from a diverse vendor group. Spending continued to increase for the fourth consecutive year: 21 percent of the budget was spent with minority- and women-owned businesses. Moreover, the ninth annual Business Smart Week was hosted by the Bank to support diverse and small businesses and was attended by over 220 participants.

Administrative Services: Reimagining Workflow and Collaboration

Administrative Services continued to adjust offerings to enable the business of the Seventh District. In response to the pandemic, Facilities Management introduced a new dedicated coworking space that is self-service and incorporates innovative technology and collaborative areas. Hospitality Management reinvented their service model to support hybrid meetings in the Conference Center as well as large events hosted on site. Law Enforcement continued to make progress on a multiyear investment in the Law Enforcement Training Suite.

People and Culture: Rapidly Shifting Benefits

Workforce benefits needs have rapidly shifted amid a prolonged global pandemic, heightened commitment to DEI, and a competitive job market. Throughout 2022, the Chicago Benefits Team developed a new vision to attract and retain talent, offering enhanced benefits such as an improved personal time off policy and tuition reimbursement plan. Further changes designed to provide more financial support, greater flexibility, and additional enhanced benefits to Chicago Fed employees are planned.

Information Technology & the Innovation Office: Supporting the Bank’s Digital Transformation

Information Technology and the Innovation Office continued to partner to support the Bank’s Digital Transformation strategic initiative. As one part of digital transformation, the Bank-wide focus on the transition to the cloud will enable a wealth of new features and functionality, allowing Bank departments to operate effectively and efficiently in a hybrid environment and accelerate their adoption of automation to improve business processes.

The Human Rights Campaign Corporate Quality Index recognized the Bank as one of the nation’s Best Places to Work for LGBTQ+ Equality in 2022.

Board of Directors

Chicago Board of Directors

Detroit Board of Directors

Directors who joined the Board during 2022:

Chicago

Lisa D. Cook, Professor of Economics and International Relations, Michigan State University, East Lansing, Michigan was elected as a Class B (nonbanker) director to serve a three-year term. She was elected by Group 1 banks, which have a capital and surplus level of $460 million and over. [Effective January 1, 2022] Cook resigned her position upon her appointment to the Board of Governors later in the year.

Jennifer F. Scanlon, President and Chief Executive Officer, UL Solutions, Northbrook, Illinois, was appointed by the Board of Governors of the Federal Reserve System to serve two remaining years of an unexpired three-year term. [Effective January 1, 2022]

Juan Salgado, Chancellor, City Colleges of Chicago, Chicago, Illinois, was appointed by the Board of Governors of the Federal Reserve System to serve as a Class C director. [Effective June 9, 2022]

Linda P. Hubbard, President and Chief Operating Officer, Carhartt, Inc., Dearborn, Michigan, was elected as a Class B (nonbanker) director to serve the remaining years of an unexpired three-year term, from October 25, 2022, through 2024. She was elected by Group 1 banks, which have a capital and surplus level of $460 million and over.

Detroit

Dr. M. Roy Wilson, President, Wayne State University, Detroit, Michigan, was appointed by the Board of Governors of the Federal Reserve System to serve two remaining years of an unexpired three-year term. [Effective January 10, 2022]

Anika Goss, Chief Executive Officer, Detroit Future City, Detroit, Michigan, was appointed by the board of directors of the Federal Reserve Bank of Chicago to serve a three-year term. [Effective January 1, 2022]

Kevin Nowlan, Chief Financial Officer, BorgWarner, Auburn Hills, Michigan, was appointed by the board of directors of the Federal Reserve Bank of Chicago to serve two remaining years of an unexpired three-year term. [Effective January 1, 2022]

Auditor Independence

The Federal Reserve Board engaged KPMG to audit the 2022 combined and individual financial statements of the Reserve Banks and the financial statements of the three limited liability companies (LLCs) that are associated with the Board of Governors’ actions to address the coronavirus pandemic, of which two LLCs are consolidated in the statements of the Federal Reserve Bank of New York and one LLC is consolidated in the statements of the Federal Reserve Bank of Boston.2

In 2022, KPMG also conducted audits of internal controls over financial reporting for each of the Reserve Banks. Fees for KPMG services totaled $9.2 million, of which approximately $1.5 million were for the audits of the LLCs.3 To ensure auditor independence, the Board of Governors requires that KPMG be independent in all matters relating to the audits. Specifically, KPMG may not perform services for the Reserve Banks or affiliated entities that would place it in a position of auditing its own work, making management decisions on behalf of the Reserve Banks, or in any other way impairing its audit independence. In 2022, the Bank did not engage KPMG for any non-audit services.

1 The Federal Reserve System’s Board of Governors appoints Class C directors, while Class B directors are nominated and elected by the member banks in a Reserve Bank district.

2 In addition, KPMG audited the Office of Employee Benefits of the Federal Reserve System (OEB), the Retirement Plan for Employees of the Federal Reserve System (System Plan), and the Thrift Plan for Employees of the Federal Reserve System (Thrift Plan). The System Plan and the Thrift Plan provide retirement benefits to employees of the Board, the Federal Reserve Banks, the OEB, and the Consumer Financial Protection Bureau.

3 Each LLC will reimburse the Board of Governors for the fees related to the audit of its financial statements from the entity’s available assets.